July 2025

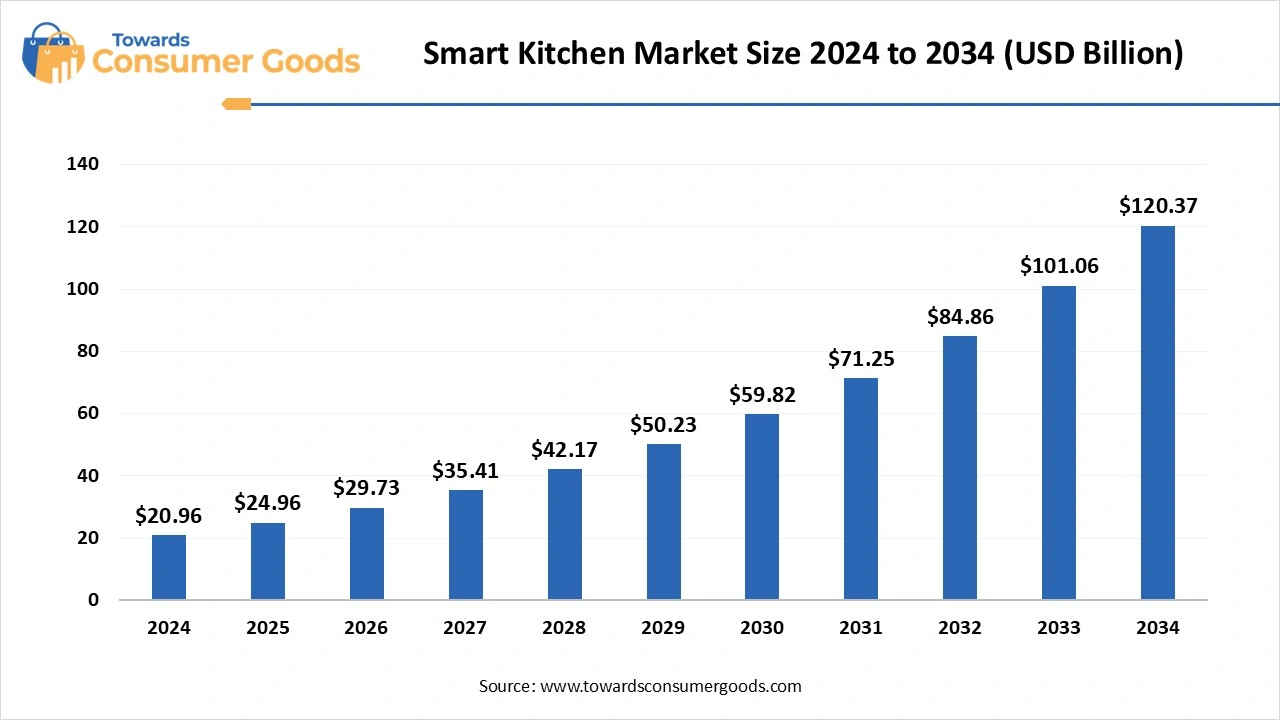

The global smart kitchen market size was valued at USD 20.96 billion in 2024 and is estimated to reach around USD 120.37 billion by 2034, exhibiting a compound annual growth rate (CAGR) of 19.10% during the forecast period 2025 to 2034. Rising demand for the convenience, technological developments like AI and IoT, rising number of smart houses and increasing purchase of the kitchen appliance by online platform significantly driving the market.

In recent times, the idea of smart kitchens has advanced from a visionary concept to an actual reality, transforming how we prepare meals, store groceries, and handle domestic tasks. Incorporating technology into contemporary kitchen design improves functionality while also converting the kitchen into a more efficient, enjoyable, and potentially sustainable area. These kitchens utilize IoT sensors, automation, and cloud software to boost efficiency, minimize waste, and enhance food safety compliance. The growing adoption of smart home technology is significantly influencing the broad acceptance of smart kitchen.

As users increasingly adopt interconnected ecosystems in their residences, the need for appliances that easily integrate with other smart home gadgets grows. With consumers increasingly becoming tech-savvy and looking for convenience in everyday activities, the need for smart kitchen is anticipated to keep growing in the near future and boosting the smart kitchen market. After using the smart refrigerator, food waste has been reduced by 25%. Smart kitchen appliances have reduced energy usage by up to 50% and reduced cooking time by 20%.

| Report Attributes | Details |

| Market Size in 2025 | USD 24.96 Billion |

| Expected Size by 2034 | USD 120.37 Billion |

| Growth Rate from 2025 to 2034 | CAGR 19.10% |

| Base Year of Estimation | 2024 |

| Forecast Period | 2025 - 2034 |

| High Impact Region | North America |

| Segment Covered | By Product, By Technology, By End User, By Region |

| Key Companies Profiled | Electrolux, Haier Group Corporation, Whirlpool Corporation, LG Electronics, Samsung, Panasonic Corporation, BSH Hausgeräte GmbH, Breville Group Ltd, Midea Group, Miele, General Electric, Koninklijke Philips NV, Hitachi Ltd, Robert Bosch GmbH, Bosch, June, Sharp Corporation, SIEMENS AG, Smarter APPLICATIONS ltd, TOSHIBA CORPORATION,XIAOMI Corporation |

Rapid urbanization and busy lifestyle are leading to the demand for time saving smart home solutions like smart kitchen. Furthermore, rising popularity of smart home solution is driving the demand for the smart kitchen. This increasing demand for the smart kitchen creating the opportunities for manufacturers to develop newer solution for smart kitchen along with integration of technology to meet consumer demand.

Smart kitchen appliances are not widely available due to their high initial cost, particularly for consumers who are price conscious. It is difficult for the market to break through middle- and lower-income groups because of this cost barrier as well as additional costs for installation, upkeep, and updates.

North America led the smart kitchen market in 2024. Growth of the market is driven by rising integration of technologically advanced kitchen appliances in both commercial and residential sector. Rising work hours and time spent in travel resulting in lesser time available for cooking and related activities and therefore consumer demand convenience and automation and due to this market is expanding. The impact of social media has also intensified as consumer share their cooking results and experiences online, developing a consumer around smart kitchen. Sustainability has become emerging trend, with evolving technologies focusing on lowering waste and enhancing the recyclability of materials.

The United States Smart Kitchen Market

United States smart kitchen market experienced robust expansion. Growth of the market is mainly fostered the rising popularity of smart homes and the surging adoption of smart home technology. Furthermore, the increasing spending on home renovations and the spurred number of millennials buying homes across the nation are also prominent factors contributing to the expansion of market. Smart kitchens with Integration of IoT, AI, and cloud computing enabling smarter cooking and monitoring and complete the consumer demand for convenience. The key players in the United States Market section are driving innovation, competitive strategies and partnerships for portfolio expansion.

Asia Pacific expects the significant growth in the market during the forecast period. The swift urbanization across various countries of this region and the rising living standard of the consumer in Asia Pacific are fostering the of the smart kitchen market. In recent times, various developing nations in Asia Pacific have experienced the growth in the adoption of smart kitchen appliances, which is mainly contributed to continuous development in the internet of things. Developing internet infrastructure further boosting the adoption of smart kitchen. Cultures in the Asia Pacific region often strongly emphasize cooking and communal dining. The adoption of smart home technologies extends to the kitchen, with consumers seeking connected and intelligent appliances in Asia Pacific.

Growth of Smart Kitchen Market in China

Consumers of China are progressively seeking convenience and efficiency in their daily routines, and smart kitchens provide exactly that. Due to swift urbanization and hectic lifestyles in China, consumers are looking for appliances that assist in saving time and simplifying their lives. Increasing consumer interest in contemporary living standards is fueling the need for innovative kitchen gadgets that provide enhanced features and energy efficiency. The growing urbanization and an expanding middle-class demographic are also driving the market's growth, as more households aim to enhance their cooking spaces with modern technology and chic designs. The fast speed of technological progress and funding in research and development are anticipated to boost market growth even more. China’s vast e-commerce platform offers significant prospects for market penetration and growth. Global investors are especially focused on areas such as smart kitchen technology, which is anticipated to experience significant expansion.

Aden facilitated the creation of the digital twin kitchen by strengthening collaboration with Rational AG, a worldwide frontrunner in intelligent kitchen technology. Aden’s digital twin kitchen utilized the complete capabilities of Rational’s iVario XS and iCombi Pro appliances. Their intelligent interfaces offered unparalleled control and responsiveness for a more secure working environment. (Source: adenservices )

Which Product Type Segment Dominated the Smart Kitchen Market in 2024?

Smart refrigerators segment dominated the market with the largest share in 2024. The growth of the market is linked to the rising consumer demand for convenience and connected devices, along with a heightened focus on health and food freshness. Technological innovations introducing new features, increasing disposable incomes driving premium product acquisitions, and an enhanced emphasis on energy efficiency and sustainability are additionally propelling market expansion. Intelligent refrigerators boast advanced features like a hands-free door, touchscreen controls, integrated sensors, and typically come at a higher price than standard models. Major players in the smart refrigerators sector consist of Samsung Electronics, Haier, LG Electronics, AB Electrolux, Whirlpool, Panasonic Corporation, Siemens AG, Bosch Group, and others.

The smart cookware and cooktop segment is observed to grow at the fastest rate during the forecast period, propelled by the growing use of innovative cooking methods. The ease of controlling appliances through mobile applications, efficient energy use in cooking, and the growing popularity of smart connected homes are driving the segment’s growth. Cooktops are a vital part of contemporary kitchens, and their development indicates a larger movement towards convenient and energy-saving cooking options. The rise of AI-enhanced smart cooktops has fundamentally transformed our food preparation methods. In addition to enhanced comfort and cooking performance, these cooktops offer better safety, customization, and energy efficiency.

Why Did the Wi-Fi Enabled Appliances Segment Dominate the Smart Kitchen Market in 2024?

Wi-Fi enabled appliances dominated the market with the largest share in 2024. Producers of smart kitchen gadgets are progressively incorporating Wi-Fi-enabled connectivity technology, enabling users to control and oversee their cooking devices from afar. Smart cooking appliances with Wi-Fi capability assist the user in managing and overseeing two key factors such as temperature and time. These advantages have led residential and commercial consumers to acquire smart kitchen devices featuring

Sensor-based appliances segment is seen to grow at a notable rate during the predicted timeframe. A key driver of growth for the sensor-based appliances is the increasing demand for smart home products. The growth of the Internet of Things has resulted in the incorporation of sophisticated sensors in household devices that can now interact with one another and the user. This has improved the usability and features of appliances like refrigerators, ovens and dishwasher, thus boosting the market. Sensors are often placed in positions to gauge conditions in difficult environments. For instance, A sensor can measure the temperature and humidity in a dishwasher. Such integration of sensors in the smart kitchen appealing the consumers and therefore fostering the market.

Which End-use Segment Held the Dominating Share of the Smart kitchen market In 2024?

Residential/home users held the dominating share of the smart kitchen market in 2024. With the expansion of smart home technology and rising focus on connected living, residential consumers are significantly investing in smart kitchen appliances to smooth cooking process, cooking tips, access recipes and develop gourmet meals with simplicity. As smart devices emerging as the efficient alternative to the traditional devices in home kitchens, the millennial demographics and also creates interest in cooking.

Commercial segment expects the significant growth in the market during the forecast period. This segment is attributed to grow due to the increasing foodservice sector, such as cloud kitchens and restaurants. increasing demand for energy-efficient, smart kitchen appliances and rising investments in advanced cooking and refrigeration solutions are boosting the market growth.

As per the survey conducted in 2023, 67% of restaurant owners stated that smart kitchen devices lowered operational expenditure by 20% or more. Hotels are also focusing on this trend, utilizing smart appliances to enhance room service effectiveness and smooth buffet preparation. Survey also showed that kitchens with the IoT-enabled devices lower energy consumption by up to 25% and 15% reduction in operational downtime. (Source: hospitalitytech )

Thermomix®

Geek

Qu

By Product Type

By Technology

By End-User

By Region

July 2025

July 2025

July 2025

July 2025