June 2025

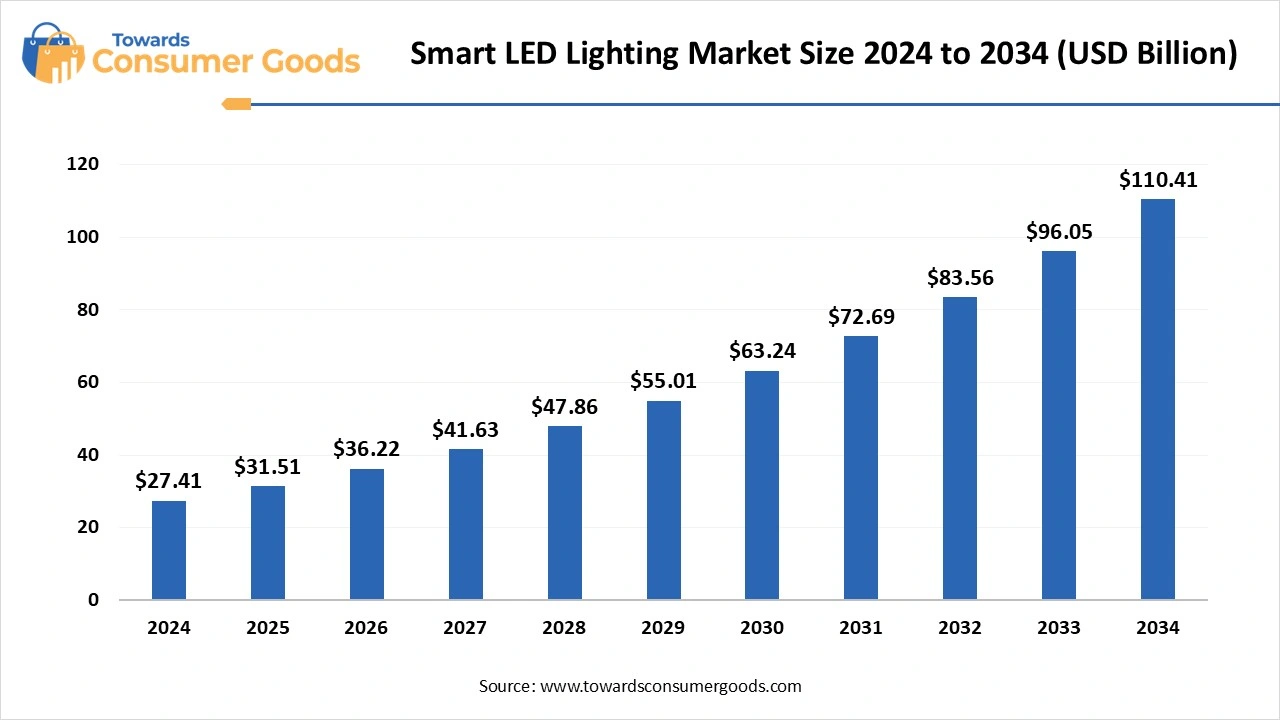

The global smart LED lighting market accounted for USD 27.41 billion in 2024 and is expected to reach around USD 110.41 billion by 2034, with a CAGR of 14.95% from 2025 to 2034. The demand for smart LED lighting is increasing due to rising focus on energy-efficient solutions that help consumers manage their electricity bills.

Smart LED lighting refers to light-emitting diodes (LEDs) that are integrated with advanced technology with automated and remote-based controls. These lights can be adjusted to different brightness and temperature levels according to the consumer's preferences. There are various components, like bulbs, which are being designed effectively, unlike the traditional fixtures. The popularity of this lighting is significantly increasing due to higher requirements, which can cost savings for individuals.

The rising government policies and regulations are one of the major drivers that are promoting these products for energy conservation in their laws. The smart LED lighting market is expanding rapidly due to the rising energy labelling programs like BEE ratings in India and Energy Star in the United States. The European countries have also imposed a ban on halogen bulbs, which is creating a significant business ground for smart LED lighting in these regions. Some of the governments are also investing in large-scale projects through large-scale projects. These regulatory bodies are also launching campaigns which aim to reduce carbon emissions.

| Report Attributes | Details |

| Market Size in 2025 | USD 31.51 Billion |

| Expected Size in 2034 | USD 110.41 Billion |

| Growth Rate from 2025 to 2034 | CAGR of 14.95% |

| Base Year of Estimation | 2024 |

| Forecast Period | 2025-2034 |

| Dominant Region | North America |

| Segment Covered | By Product, By technology, By Distribution Channel, By Region |

| Key Companies Profiled | Cree Lighting USA LLC, Eaton, Koninklijke Philips N.V., ABB, Wipro, Syska, Bridgelux, Inc, ams-OSRAM AG, TVILIGHT Projects B.V., SiteWorx Software, ACUITY BRANDS, INC. |

Rising Adoption of Smart Building Systems

The rising adoption of technology in recent years has been playing a transformative role by promoting automation and energy management in residential and commercial projects. Regulatory bodies are also keen to invest in these technologies, aligning with sustainable initiatives that manage energy consumption.

The smart LED lighting market is anticipated to expand rapidly as new projects implement this lighting in their Building Management Systems (BMS), centralising control of the lighting and energy usage for enhanced security. This integration allows users to manage the lighting through mobile applications and Artificial intelligence (AI)-based voice assistants. The commercial startups in the developed areas are also implementing these policies, which might help them manage their costs in the long run.

Higher Initial Costs

The smart technology integration has been gaining significant popularity in many developed regions due to higher investment capabilities. The smart LED lighting market may face certain challenges in the cost-sensitive sector, as the hardware components of these products are higher in cost, which require higher investments as compared to the traditional lighting systems. The commercial and residential projects in the underdeveloped region may witness certain barriers as it requires higher costs for wiring, connectivity and installation. The process also requires a longer time, which may also increase the labor costs in some projects.

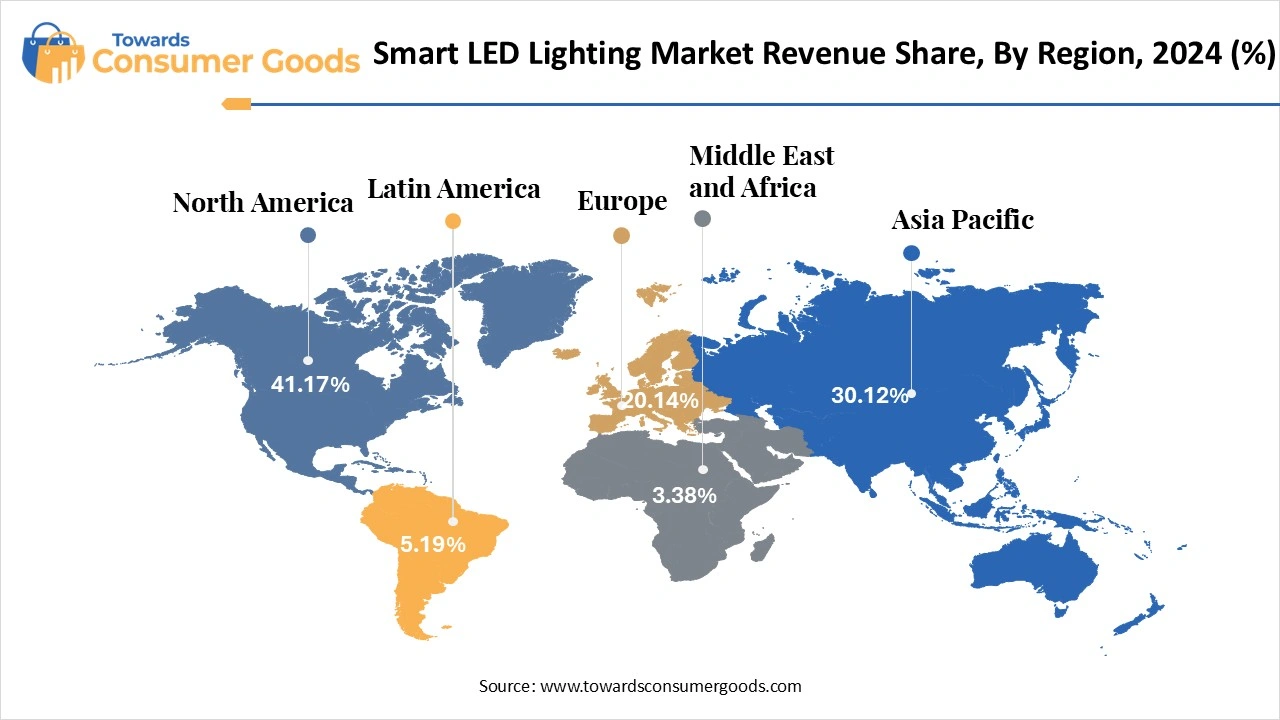

The North America smart LED lighting market size was valued at USD 11.28 billion in 2024 and is expected to be worth around USD 45.52 billion by 2034, growing at a compound annual growth rate (CAGR) of 14.97% over the forecast period 2025 to 2034. North America held the dominant position in the market by generating the largest revenue share in 2024. The dominance of the region is attributed to the technological infrastructure in countries like the United States and Canada, which act as trend setters in many sectors. The growing awareness regarding energy consumption and energy efficient alternative with the advanced technologies boosts the demand for the smart LED lightings. Additionally, the rise in the construction industry in the regional countries and adaptation of smart technologies in the commercial and residential buildings further increasing the growth of the smart LED lighting market.

The United States stands as a major player in the smart LED lighting market due to the higher number of smart homes in the region, which are equipped with this lighting in their homes. Additionally, the constant support from the US government is playing an influential role in attracting more consumers through state-level incentives. Companies like Philips Hue, GE, and many more also have an upper hand in the majority of the sectors that help them dominate the market. Additionally, the corporate office and public infrastructure are expanding at a commendable rate, which will play a significant role in the upcoming years.

Asia Pacific anticipated to rise at the highest CAGR from 2025 to 2034. The growth of the region is attributed to the rapid urbanization in countries like India and China, which are experiencing higher electricity demand for various industrial and commercial applications. Countries like Singapore, India and China have adopted a smart city initiative that is attracting investments for smart LED lighting in public infrastructures. The rising construction projects in the rural areas are anticipated to attract many manufacturing hubs for companies in the coming years.

China stands as a prominent player in the Asian market due to higher investments of governments in various projects like urban planning. These initiatives have also helped the local manufacturers to boost production capabilities. Additionally, the global companies are also keen on investing in the country due to lower manufacturing costs as compared to developed countries. Additionally, China is expanding significantly in the corporate sector, which would mandate the adoption of energy-efficient lighting solutions.

The wired segment generated the largest revenue share in 2024. The dominance of the segment is attributed to the due to its established setups in many commercial and residential infrastructures. These systems are largely popular due to their stability, which helps in high-scale operations. These products usually respond quickly compared to others, which helps towards the growth of the smart LED lighting market. Many companies are investing heavily in wired lighting systems as a long-term investment that helps them in easy maintenance and upgrades.

The wireless segment is anticipated to grow at the fastest CAGR from 2025 to 2034. The growth of the segment is attributed to the easy installation process of these products that eliminate the need for extensive wiring procedures. The residential spaces are mainly attracting this smart LED lighting due to rising automation in other home-based appliances, too. The market is anticipated to expand more rapidly as companies are advancing in smart assistants like Alexa, Google, and many more.

The hybrid segment generated the largest revenue share in 2024. The dominance of the segment is attributed to the availability of both wired and wireless options in these offerings. The majority of the demand is generated from large commercial and industrial settings, as they have an established base for wired technology, and they are also investing in new energy-efficient solutions. The smart LED lighting market is anticipated to gain more popularity as the new startups are bound to invest in the hybrid technology for longer sustainability. Additionally, the advancements in the hybrid technology are expected to help in more complex management systems.

The Zigbee segment is observed to emerge at the fastest CAGR over the projected period. The growth of the segment is attributed to the rising preference for low-power consumption-based lighting solutions. As a result, both commercial and residential settings are adopting these solutions to manage their costs effectively. The government is also supporting these technologies as they help in managing energy conservation smoothly. The smart home expansion in developing countries is anticipated to boost the demand for the technology in the future.

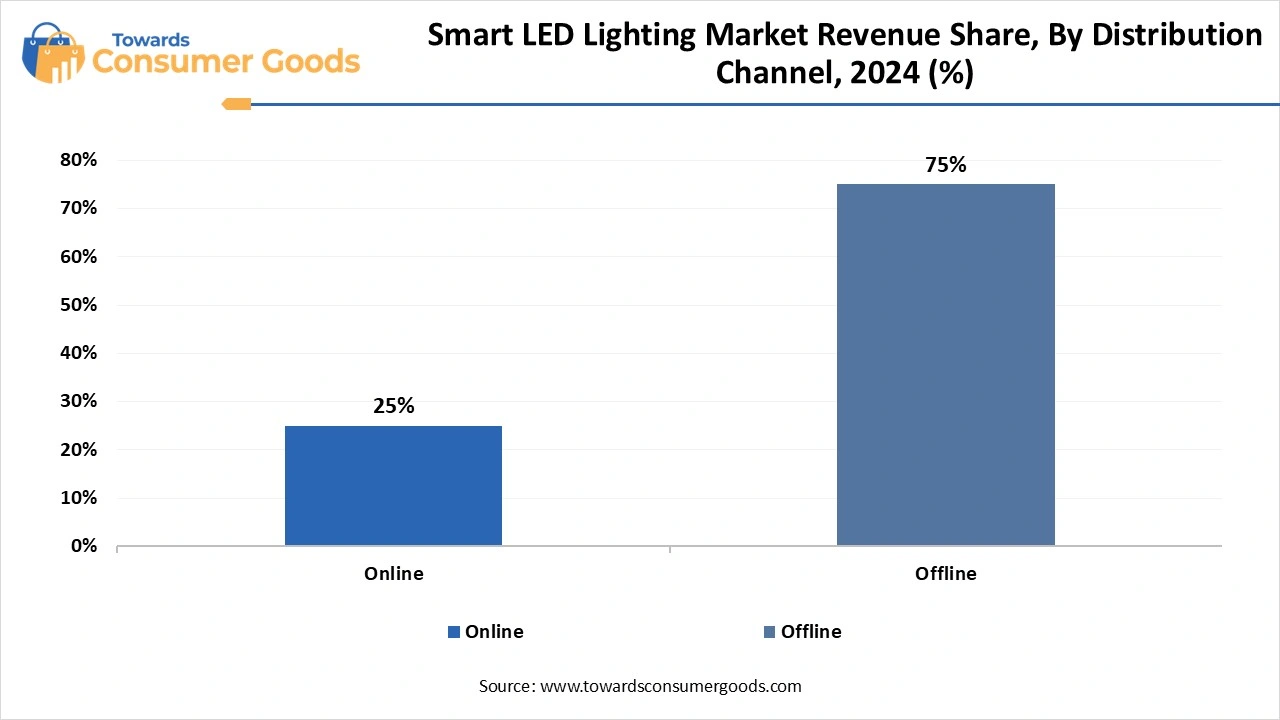

The offline segment dominated the market in 2024. The dominance of the segment is attributed to the higher presence of retail chains like showrooms, electronic dealers and many more. The market is anticipated to advance more rapidly as these channels are offering personalized services like consultation and expert advice on various products, which plays an important role in attracting a significant consumer base. The industrial and other commercial orders are mainly attracted by these channels, which also increases partnerships and deals within these organizations.

The online segment is expected to rise at the highest CAGR from 2025 to 2034. The changing lifestyles have been significantly helping attract a significant consumer base due to wider product accessibility and convenient shopping options from e-commerce. The smart LED lighting market is anticipated to expand at a rapid pace as the internet penetration is increasing in the developing economies, which is leading towards a growing consumer base. Additionally, these platforms are giving additional discounts and offers to consumers due to the D2C medium, which also helps the companies to increase their profit margins.

Installation: In February 2025, Ranchi Smart Corporation (India) installing 300 sensor-based LED streetlights with adaptive brightness controls under their smart city mission. (Source: timesofindia)

Launch: In February 2025, Signify launched Odisha’s (India) largest Philips Smart Light Hub in Bhubaneshwar that features 450 SKUs and showcases connected smart lighting innovations. (Source: architectandinteriorsindia)

According to market insights prediction, the global wipe market size accounted for USD 24.52 billion in 2025 and is forecasted to hit around USD 40.56...

According to market projection,The global sanitary ware market size was estimated at USD 14.18 billion in 2024 and is predicted to increase from USD 1...

Industry forecasts suggest that, the global botanical supplements market industry will increase from USD 38.24 billion in 2024 to USD 98.73 billion by...

Market insights predict, the workplace wellness market size was valued at USD 53.94 billion in 2024 and is expected to hit around USD 89.55 billion by...

June 2025

June 2025

June 2025

June 2025