July 2025

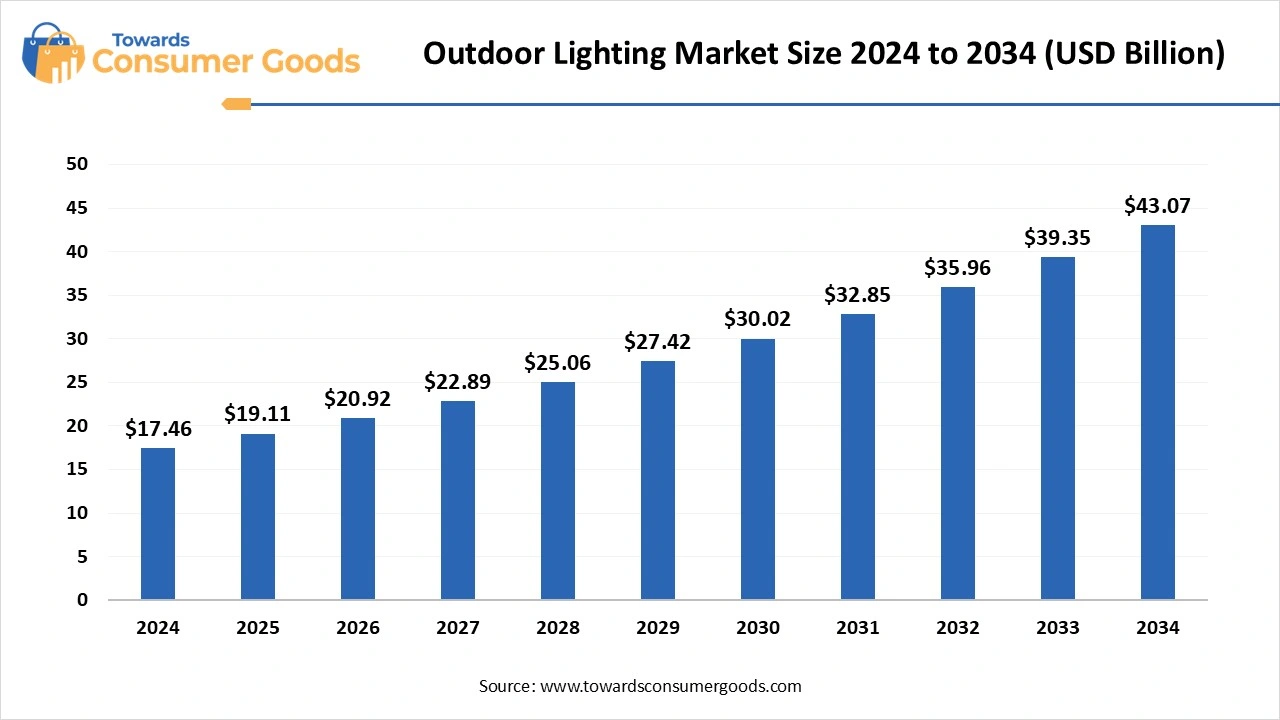

The global outdoor lighting market size accounted for USD 17.46 billion in 2024, grew to USD 19.11 billion in 2025, and is expected to be worth around USD 43.07 billion by 2034, poised to grow at a CAGR of 9.45% between 2025 and 2034. This market is growing due to rapid urbanization, government smart city programming, and the shift towards energy-efficient luminaires.

The outdoor lighting market is witnessing steady growth, fueled by growing awareness of environmental sustainability and energy efficiency in smart city initiatives and urbanization. The use of LED and solar-powered lighting solutions for public infrastructure, including parks, stadiums, highways, and streets, is growing among governments and municipalities. Furthermore, outdoor lighting is becoming a crucial part of intelligent urban infrastructure thanks to the incorporation of smart technologies like motion sensors, wireless controls, and Internet of Things-based monitoring. In both developed and developing regions, growing investments in outdoor aesthetics for homes and businesses, as well as worries about safety and security, are driving up market demand.

Smart technology is reshaping the outdoor lighting market by enabling greater energy efficiency, real-time control, and automated operation. In addition to improving public safety, smart lighting systems lower maintenance costs and electricity consumption with features like motion detection, adaptive brightness and remote brightness and remote monitoring. These developments are particularly helpful for facility managers and city planners who want to create responsive and sustainable urban environments. Smart outdoor lighting has become a wise investment for both commercial and municipal spaces due to the movement toward smart cities and digital infrastructure.

| Report Attributes | Details |

| Market Size in 2025 | USD 19.11 Billion |

| Expected Size by 2034 | USD 43.07 Billion |

| Growth Rate from 2025 to 2034 | CAGR 9.45 % |

| Base Year of Estimation | 2024 |

| Forecast Period | 2025 - 2034 |

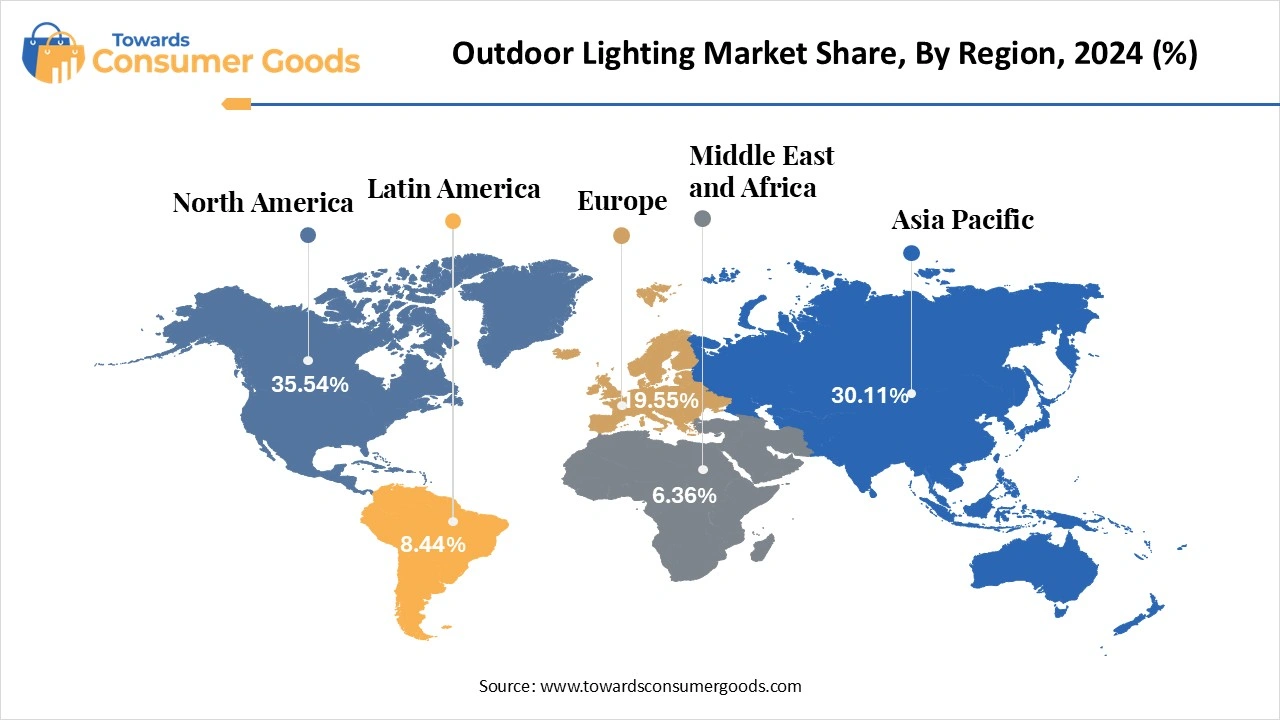

| Dominant Region | North America |

| Segment Covered | By Source, By Application, By Distribution Channel, By Geography |

| Key Companies Profiled | Signify Holding, ACUITY BRANDS, INC., Hubbell, Zumtobel Group, ams-OSRAM AG, Outdoor Lighting Perspectives, Savant Systems Inc (GE Lighting), Cree LED, SYSKA, Virtual Extension |

How is smart lighting technology opening new opportunities in the outdoor lighting market?

With the ability to optimize energy and provide real-time control, smart lighting systems with motion sensors, IoT, and adaptive brightness features open a world of possibilities. By using automated dimming failure detection and traffic-responsive lighting, these technologies lower maintenance costs while enhancing public safety. Smart city initiatives are causing municipalities to invest in intelligent infrastructure. Manufacturers of outdoor lighting are being encouraged by this change to create networked sensor-integrated solutions. Smart lighting is becoming an important urban investment due to the increased emphasis on digital transformation.

Restraint

Modern lighting systems with automation and sensors might be thought of as more difficult to maintain than conventional fixtures. Contractors and local government agencies may lack the knowledge or skilled personnel necessary to effectively administer such systems. Reluctance to abandon traditional lighting may result from this perception. In places with limited resources, the requirement for remote monitoring, specialized components, or software updates may further discourage adoption. Improving market penetration requires making maintenance easier.

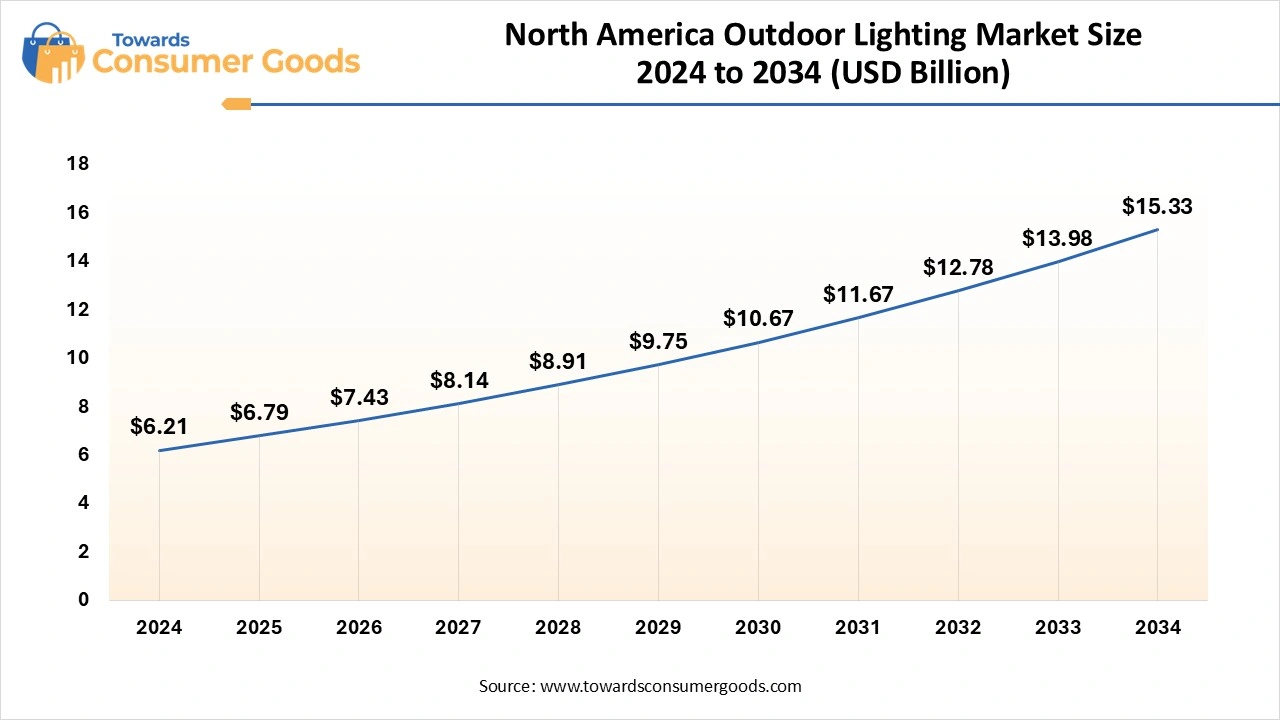

Why is North America dominating the outdoor lighting market?

The North America outdoor lighting market is expected to increase from USD 6.79 billion in 2025 to USD 15.33 billion by 2034, growing at a CAGR of 9.46% throughout the forecast period from 2025 to 2034. North America dominates the outdoor lighting market, driven by sophisticated infrastructure, smart city initiatives, and stringent laws encouraging energy conservation. Well-known manufacturers' cutting-edge public lighting systems and large government investments in smart technologies all benefit the area. Connected lighting systems are being actively adopted by urban municipalities for public areas, parking lots, and streets. The region's leadership is further cemented by its high level of sustainability awareness and advanced digital readiness.

Asia Pacific is fastest fastest-growing market due to government-led electrification initiatives, growing urban and rural construction, and fast urbanization. To achieve energy-saving objectives, nations in this region are progressively implementing solar and LED lighting. The demand for outdoor lighting is being driven by infrastructure development, particularly in the real estate and transportation sectors. Adoption is accelerating across a range of applications thanks to supportive policies of subsidies and investments in smart cities.

Europe holds a notable position in the outdoor lighting market because of strict environmental regulations, the extensive use of LED technology, and aggressive climate targets. Early adopters of sustainable lighting are still pushing for the replacement of outdated systems with more energy-efficient ones. Innovative smart lighting controls and public-private partnerships are prevalent in European cities. Market expansion is also aided by EU e-waste reduction regulations and green building standards.

Why are LED lights dominating the outdoor lighting market?

LED lights dominate the market, driven by their energy efficiency, long lifespan, and cost-effectiveness. These lights consume significantly less power compared to traditional lighting sources and require minimal maintenance, making them ideal for public spaces. Government regulations banning inefficient bulbs have further accelerated LED adoption. Their ability to integrate with smart systems adds to their appeal in modern lighting infrastructure.

Plasma lights are the fastest growing lighting source due to their durability, high intensity brightness, and capacity to illuminate expansive outdoor spaces such as highways and stadiums. These lamps provide consistent illumination over long distances and superior color rendering. They are appealing for some commercial and industrial projects because of their long-term lower operating costs and adaptability to harsh weather conditions. Their adoption is anticipated to increase in specialized high-demand applications as technology advances.

Why is commercial demand dominating the outdoor lighting market?

Commercial segment dominates the market driven by, driven by the requirement for extensive lighting in public spaces such as parking lots, office parks, and streets. Smart lighting systems in commercial zones are being adopted as a result of corporate and municipal investments in energy-efficient solutions. Other important considerations are security, aesthetics, and adherence to environmental regulations. Commercial customers are important clients for outdoor lighting suppliers because they value durable and economical solutions.

Residential outdoor lighting demand is growing rapidly due to increasing interest in home improvement, safety, and aesthetics. Smart home trends and DIY lighting solutions are making outdoor setups more accessible to homeowners. Consumers are investing in garden lights, security lighting, and solar-powered options for energy savings. The rise of connected lighting systems that can be controlled via apps or voice assistants is also fueling this segment’s expansion.

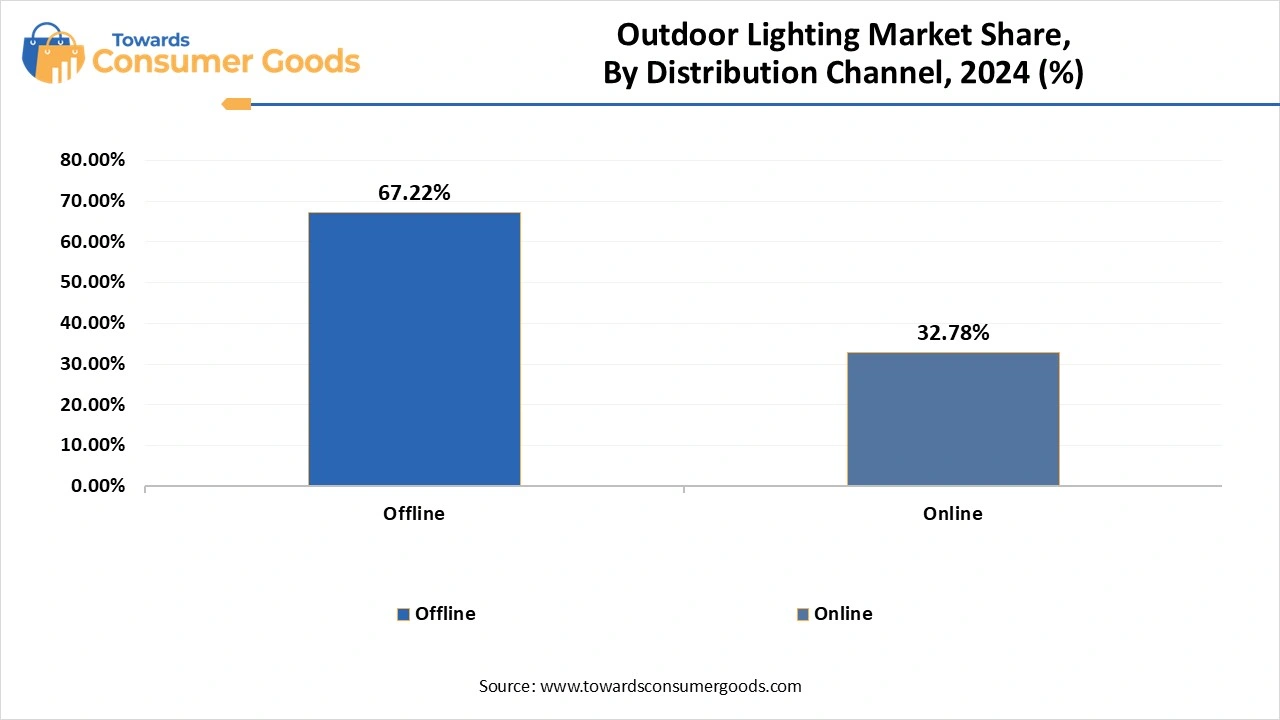

Why are offline channels dominating distribution in the outdoor lighting market?

Offline channels dominate because they can provide individualized consultations, large-scale project procurement, and direct vendor relationships. For quality control, city planners, architects, and lighting designers frequently favor in-person product evaluations. Specialty distributors and physical showrooms are still essential for commercial and institutional projects. Technical assistance, on-site installation, and product demos are also offered through these channels.

Online channels are growing the fastest due to rising e-commerce penetration, ease of price comparison, and wider product availability. Retailers and manufacturers are expanding their digital presence to cater to DIY consumers and small-scale buyers. The convenience of home delivery, bundled warranties, and increasing consumer trust in online platforms contribute to this growth. Online channels are especially attractive for residential buyers and small contractors seeking flexible ordering options.

By Source

By Application

By Distribution Channel

By Geography

July 2025

July 2025

July 2025

July 2025