July 2025

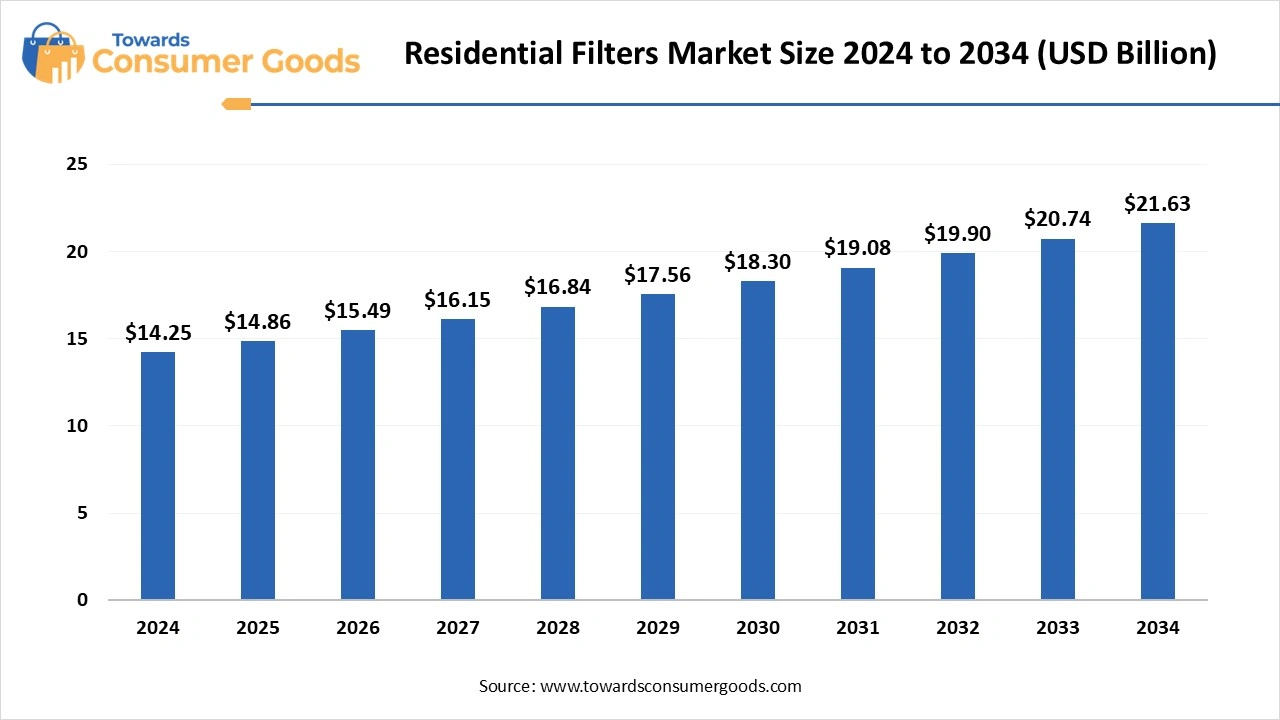

The residential filters market size was calculated at USD 14.25 billion in 2024 and is projected to hit around USD 21.63 billion by 2034 with a CAGR of 4.25%. The growing awareness among consumers regarding waterborne diseases, rapid growth in urban population, and technological advancements in residential filters have driven the market growth.

The residential filters market, which encompasses both water and air filtration systems, is experiencing robust growth driven by an increasing public consciousness regarding health, heightened concerns about the quality of air and water, and the alarming rise in instances of waterborne diseases and air pollution. This market expansion is further bolstered by stringent government regulations aimed at ensuring water safety, remarkable advancements in filtration technologies, and a rising demand for energy-efficient and environmentally sustainable filtration solutions.

Consumers are becoming increasingly aware of potential contaminants, such as heavy metals, chemicals, and microorganisms, in municipal water supplies, prompting a higher demand for reliable and effective water filtration systems to guarantee safe drinking water. On the air quality front, an escalating fear surrounding indoor air pollution, driven by allergens, dust, and various pollutants, is significantly boosting the demand for air purifiers and filtration systems. The underlying anxiety over the potential health repercussions of waterborne diseases is a substantial incentive for more households to adopt water filtration technologies.

The residential filters market is witnessing considerable upward momentum, primarily driven by a surge in awareness surrounding the health hazards associated with subpar air and water quality. This rise is also propelled by increasing urbanization and governmental policies that advocate for cleaner air and water standards. Moreover, advancements in filtration technology, such as High-Efficiency Particulate Air (HEPA) filters and smart filtration mechanisms, are contributing to the market's growth trajectory.

A growing public understanding of the long-term health ramifications of air and water pollution is compelling consumers to seek out effective filtration solutions. This heightened awareness is being further intensified by the rising prevalence of respiratory diseases and other health complications linked to poor environmental conditions. As urban areas expand, pollution levels in both air and water continue to rise, underscoring the critical need for effective filtration systems.

| Report Attributes | Details |

| Market Size in 2025 | USD 14.86 Billion |

| Expected Size in 2034 | USD 21.63 Billion |

| Growth Rate | CAGR of 4.25% |

| Base Year in Estimation | 2024 |

| Forecast Period | 2025-2034 |

| Dominant Region | North America |

| Segment Covered | By Type, By Filter Media, By Efficiency, By Application, Distribution Channel, By Region |

| Key Companies Profiled | 3M, AAF International, Air King, Blueair, Brita, Coway, Dyson, Filtrete,Greenway, Honeywell, Lennox International, Puronics, Trane, Vornado, Whirlpool |

The residential filters market, which covers both air and water filtration systems, presents substantial growth potential. This is primarily fueled by a heightened awareness surrounding health and environmental issues, especially in urban areas facing pollution challenges. The increase in residential construction activities is further driving demand for effective filtration solutions, highlighting the growing significance of maintaining indoor air quality.

Consumers are becoming increasingly aware of the adverse health impacts associated with poor air and water quality, which in turn is propelling demand for innovative filtration systems. Moreover, the rising acknowledgment of indoor air pollutants and allergens is significantly boosting the adoption of air purifiers. Exciting advancements in air quality monitoring technologies, including more compact devices and solutions harnessing nanotechnology, are also paving the way for new innovations in the market.

Conversely, several factors pose challenges to the growth of the residential air filters market. High costs associated with initial purchases, replacements, and ongoing maintenance hinder widespread adoption. The presence of cheaper, lower-quality filter options in the market further complicates consumer choices. Additionally, the emergence of alternative technologies, such as electrostatic precipitators and UV air filters, presents competition.

The intricate nature of indoor pollutants, coupled with a generally low level of consumer awareness regarding their potential health effects, can also impede market expansion. For consumers, the significant initial investment required, particularly for electronic air filters, along with the continuous operational costs tied to their use, can deter potential buyers. Furthermore, the regular replacement expenses, necessitated by frequent filter changes every few months, can strain household budgets.

The HVAC filter segment currently leads the residential filters market. This dominance can be attributed to several converging factors, including the burgeoning demand for effective HVAC systems, an increasing awareness regarding the importance of indoor air quality, and the enforcement of government regulations that advocate for efficient filtration solutions. As more households integrate HVAC systems, the requirement for efficient filtration to enhance system performance and indoor air quality becomes critical, thereby augmenting the demand for HVAC filters.

On the other hand, the water filter segment is recognized as the fastest-growing category in the residential filters market. Consumers are gaining insights into the health risks associated with consuming contaminated water, resulting in a surge in demand for effective water filtration solutions that can ensure safety and promote well-being.

The fiberglass segment is a dominant force in the residential filters market, mainly due to its economic advantages, widespread application in thermal insulation, and its outstanding performance characteristics. This material aligns with the growing focus on energy efficiency regulations, especially in regions like North America and Europe, where there is an increasing demand for fiberglass in both newly built homes and retrofitting existing structures. The affordability of fiberglass filters compared to other types makes them an accessible choice for a diverse array of consumers across different building categories.

In contrast, the activated carbon segment is witnessing a significant surge in growth within the residential filters market. The rise in consumer awareness regarding air and water quality issues, coupled with stricter environmental regulations, has further stimulated the demand for activated carbon solutions. Its multifunctional adaptability enables it to be effectively utilized in various applications, enhancing its market presence.

Filters rated MERV 1-4 currently hold the leading position in the residential filters market. These filters are celebrated for their affordability and efficiency in capturing larger particles, such as dust and pollen, common air quality concerns for many households. MERV 1-4 filters are typically the most budget-friendly choice, catering to a wide demographic of homeowners seeking cost-effective solutions.

Conversely, the MERV 6-10 segment is rapidly expanding within the residential filters market as it strikes an ideal balance between filtration efficiency and cost. MERV 8-10 filters, in particular, are often recommended for general home use due to their effective filtration capabilities while maintaining unrestricted airflow.

The air filtration segment leads the residential filters market, driven by a heightened awareness of indoor air quality challenges and the unparalleled efficiency of HEPA (High-Efficiency Particulate Air) filters in capturing airborne particles. The combined effects of urbanization, industrialization, growing population densities, and rising disposable incomes are collectively propelling the demand for effective air purification solutions.

Meanwhile, the water filtration segment is currently the fastest-growing area in the residential filters market. This rapid growth can be attributed to escalating health concerns related to unsafe drinking water, an increase in awareness regarding waterborne diseases, and a strong desire for clean and safe drinking water. Additionally, government initiatives aimed at improving public health, combined with rising consumer spending in developing nations, are also fueling the expansion of this segment. With consumers becoming more educated on the health risks posed by contaminated water, there is a growing demand for reliable and effective water purification solutions.

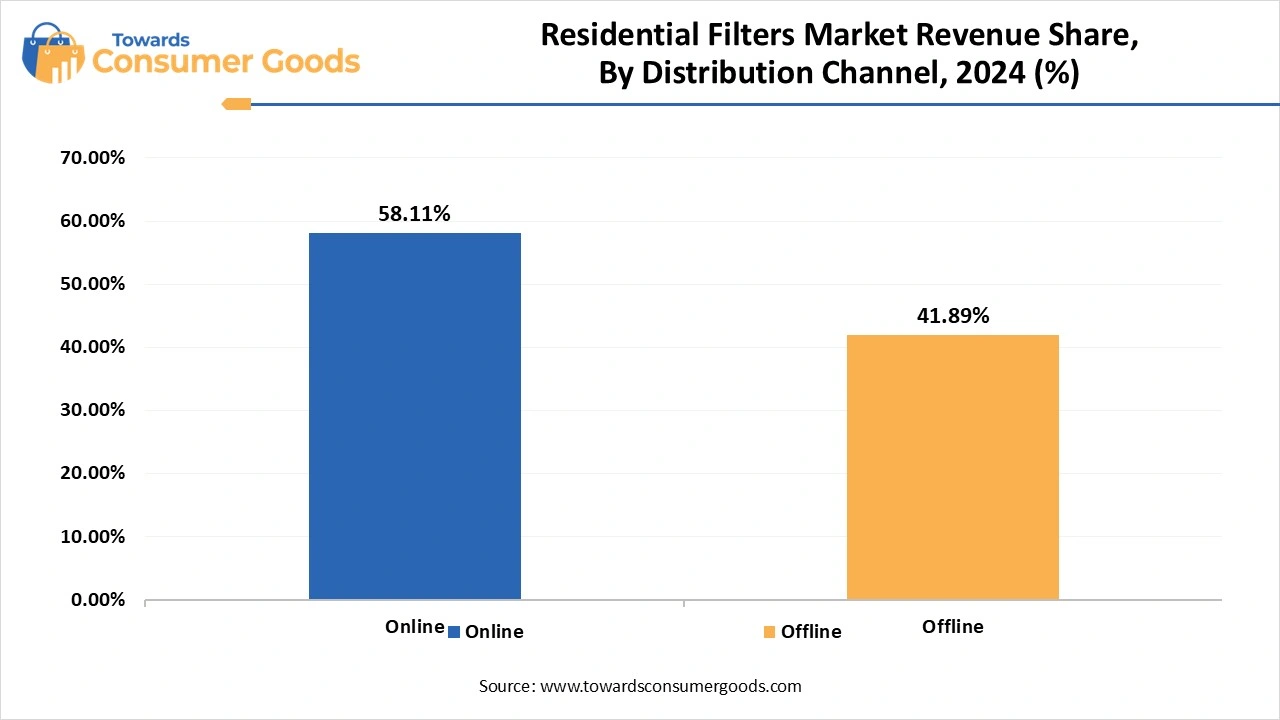

In terms of distribution channels, the offline segment remains the dominant force within the residential filter market. Many consumers favor physically inspecting and assessing water purifiers before making a purchasing decision, prioritizing the opportunity to evaluate quality, features, and the ability to compare different models in-person. Additionally, physical retail environments often provide advantages such as discounts, installation support, and after-sales customer service, which can significantly influence purchasing decisions.

Conversely, the online segment is emerging as the fastest-growing channel in the residential filters market. Factors driving this trend include increased consumer convenience, a wider array of product options, competitive pricing, home delivery capabilities, and the influence of favorable online reviews. The ability to compare various products, read reviews, and make purchases at any hour eliminates the necessity for in-person retail visits.

Geographically, North America leads the residential filters market, primarily due to the robust economic environment in the United States, with Canada also contributing significantly. Specifically, in Canada, factors such as rising air pollution in metropolitan areas, increased public awareness of health risks associated with inadequate indoor air quality, and the growing adoption of advanced filtration technologies—like HEPA and activated carbon filters—are pivotal. The combined growth in the automotive and healthcare sectors across the U.S., Canada, and Mexico further amplifies the demand for filtration systems as consumers become more informed about the health benefits of clean air.

In contrast, the Asia Pacific region is emerging as the fastest-growing area in the residential filters market. This rapid growth is fueled by a combination of factors, including swift urbanization, industrial expansion, and increasing environmental concerns. The ongoing urbanization and industrial growth in countries like India and China lead to elevated pollution levels, creating an urgent need for improved air and water filtration systems within residential environments.

Innovation- In a notable advancement in April 2025, Xiaomi announced the introduction of new Mijia water purifiers as part of its innovative smart home ecosystem. The new Mijia Water Purifier Pro will be available in two versions—Dual-Outlet 1200G and 1600G—as part of its new Dual-Effect Water Purifier Pro portfolio, promising enhanced filtration capabilities for consumers.

Announcement- In March 2025, Philips unveiled a cutting-edge range of water filtration products that incorporate technology tested by both NASA and the European Space Agency (ESA). These advanced products are designed to significantly reduce harmful contaminants present in tap water in Australia, enhancing public health through improved water safety.

In April 2025, CLEANR launched an innovative washing machine filter designed to address environmental concerns related to microplastics. This groundbreaking filter aims to capture an impressive 90% of microplastics, marking its launch in alignment with Earth Day to promote awareness and action against plastic pollution honor of Earth Day.

Based on comprehensive market projections, the global wellness real estate market size is calculated at USD 463.54 billion in 2024, grew to USD 522.18...

The global mattress and mattress component market size was estimated at USD 77.41 billion in 2024 and is predicted to increase from USD 81.16 billion ...

The global lip care products market size was estimated at USD 2.66 billion in 2024 and is predicted to increase from USD 2.82 billion in 2025 to appro...

July 2025

July 2025

July 2025

July 2025