July 2025

The global nicotine pouches market size accounted for USD 5.49 billion in 2024 and is predicted to increase from USD 7.12 billion in 2025 to approximately USD 73.67 billion by 2034, expanding at a CAGR of 29.65% from 2025 to 2034. This market is growing due to rising demand for smoke-free and tobacco-free alternatives among health-conscious consumers.

The nicotine pouches market is experiencing robust growth as consumers increasingly shift toward tobacco-free and smoke-free nicotine delivery alternatives. Both new users and those attempting to quit smoking have taken to these pouches because they provide discreet use and lower health risks than traditional smoking or chewing tobacco. Adoption is also being accelerated by the introduction of flavored and low-dose varieties of regulatory support in some areas and increased public awareness of the dangers of combustible tobacco. To gain a greater portion of this new market, big tobacco companies are also making significant investments in nicotine pouch brands extending their product lines and setting up shops in new regions.

One important factor is their odorless discrete and convenient design which enables use without social stigma or the requirement for designated smoking areas. The range of tastes and nicotine levels enables a personalized experience to appeal to a lot younger users. Additionally, Gen Z and millennial consumers who are more tech-savvy and health-conscious are drawn to marketing that highlights contemporary clean lifestyles. These patterns imply that in emerging markets nicotine pouches are a lifestyle product as well as a smoking cessation aid.

| Report Attributes | Details |

| Market Size in 2025 | USD 7.12 Billion |

| Expected Size by 2034 | USD 73.67 Billion |

| Growth Rate from 2025 to 2034 | CAGR 29.65% |

| Base Year of Estimation | 2024 |

| Forecast Period | 2025 - 2034 |

| Dominant Region | North America |

| Segment Covered | By Product, By Strength, By Distribution Channel, By Geography |

| Key Companies Profiled | British American Tobacco PLCO, Altria Group, Inc., NIQO Co. (Swedish Match AB), Nicopods ehf., SnusCentral, Japan Tobacco International, Swisher, GN Tobacco Sweden AB, Skruf Snus AB, Tobacco Concept Factory |

By using synthetic nicotine which is produced in a lab rather than from tobacco leaves, brands can differentiate themselves. Because of this, they can advertise that their products are completely tobacco-free, which makes them seem cleaner and more contemporary, especially to consumers who are health-conscious. Additionally, synthetic nicotine aids businesses in navigating regulatory gaps in areas where tobacco-based nicotine is severely restricted. Brands that use synthetic nicotine can gain the trust and loyalty of consumers searching for safer alternatives by highlighting purity, consistent quality, and a diminished association with traditional tobacco. Due to the perception that synthetic options are more sophisticated or inventive, it also creates opportunities for premium pricing.

Nicotine pouches are promoted as safer substitutes for smoking cigarettes. There is currently little scientific data regarding their long-term health impacts. Health officials issue warnings about the dangers of nicotine addiction particularly for non-smokers or those who use it frequently. Concerns exist regarding the effects on oral health including lesions or irritation of the gums. Healthcare professionals and potential patients are hesitant because of this uncertainty. Market expansion may be impeded by negative media coverage which can further erode consumer confidence.

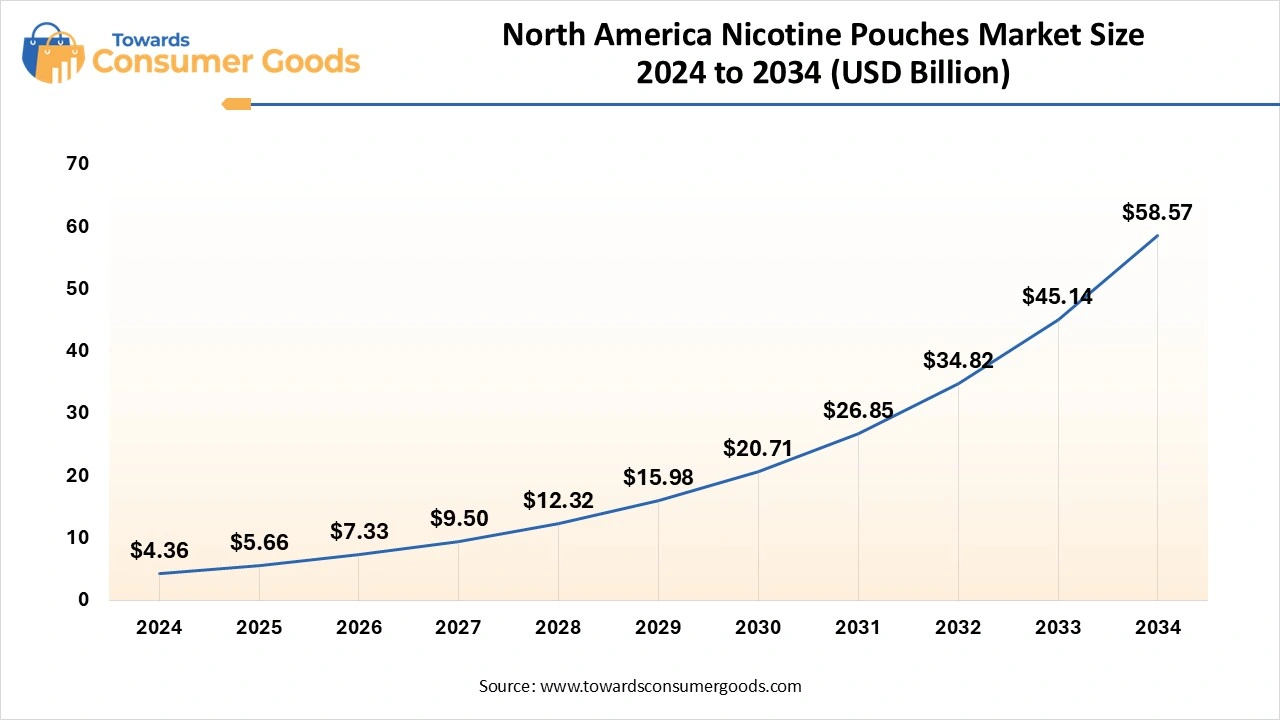

The North America nicotine pouches market is expected to increase from USD 5.66 billion in 2025 to USD 58.57 billion by 2034, growing at a CAGR of 29.66% throughout the forecast period from 2025 to 2034. North America dominated the nicotine pouches market due to high consumer awareness, strong acceptance of alternative nicotine products, and advanced regulatory frameworks that support product innovation and market entry. The presence of major manufacturers and extensive distribution networks further strengthens this region’s market leadership. Consumers in North America are also more open to adopting new nicotine delivery formats, supported by widespread harm reduction campaigns. Additionally, investments in research and development in this region accelerate product variety and quality improvements.

Asia Pacific is fastest growing fueled by rising smoking rates, increasing disposable incomes, and growing awareness of harm-reduction products. Rapid urbanization and expanding e-commerce infrastructure accelerate adoption in countries. Increasing government support for tobacco alternatives and a youthful population further drive growth. Companies are actively targeting this region with localized marketing and product innovations to capture new users.

Europe held a significant share of the nicotine pouches market in 2024, with a growing regulatory focus on nicotine alternatives and increasing consumer interest in tobacco harm reduction. However, varied regulations across countries moderate growth rates. The region is witnessing steady product launches and increased availability in retail, but fragmented policies pose challenges. Consumer preferences also vary widely, requiring tailored strategies for different markets within Europe.

Why is the tobacco-derived segment dominating the market?

Tobacco-derived nicotine segment remains dominant due to its well-established supply chains for consumer familiarity and broad regulatory acceptance in numerous areas. Due to its perceived authenticity and steady potency, many consumers favor products that contain traditional nicotine extracted from tobacco. Furthermore, large-scale production is supported by the current manufacturing infrastructure increasing the accessibility and affordability of products derived from tobacco. Strong brand loyalty and wide distribution networks are further benefits of tobacco companies' longstanding presence in this market. Regulatory agencies in certain nations also have more precise rules for products made from tobacco, which makes it easier for producers to comply with regulations.

Synthetic nicotine segment is the fastest growing driven by the growing demand from consumers for tobacco-free substitutes and the benefits of regulations. By avoiding the limitations associated with tobacco, synthetic nicotine gives brands marketing flexibility and appeals to health-conscious consumers looking for cleaner products. This quick expansion indicates that the market is moving toward innovation and diversification. Manufacturers are making significant investments in synthetic nicotine in order to take advantage of new markets and regulatory advantages. Furthermore, consumers are increasingly choosing synthetic options as a perceived safer substitute for tobacco due to increased awareness of the negative effects of tobacco.

Why do flavored nicotine pouches dominate the market?

Flavored nicotine pouches dominate due to their highly appealing to a wide range of people including those quitting smoking or vaping. Offering a variety of flavors mint fruit and herbal improves user experience, promotes experimentation, and helps distinguish brands. Additionally, flavors lessen the harshness of nicotine making these products more palatable, particularly for first-time users. To appeal to younger and inexperienced consumers, marketing campaigns frequently emphasize flavor variety as a key selling point. Concerns about youth uptake however have also drawn regulatory attention to this flavor appeal.

Original/unflavored fastest growing since a portion of customers prefer a simpler, more natural nicotine experience free of extra flavors. A maturing market where some consumers value nicotine delivery over flavor and favor products that more closely resemble traditional tobacco is reflected in this growth. Users who are trying to quit smoking or who are health-conscious might prefer unflavored pouches because they think they are less artificial. Additionally, the trend shows that there is a growing need for authenticity and simplicity in the category.

Why does the strong 4-6 mg/pouch segment dominate?

The strong 4-6 mg/pouch segment dominates the market because it offers a balanced experience strong enough to satisfy regular smokers while avoiding excessive nicotine that can cause discomfort. This range caters to the majority of users seeking effective craving relief, making it the most popular choice across demographics. It provides sufficient nicotine without overwhelming new users, thereby serving as a middle ground. Additionally, this segment benefits from wide availability and is heavily promoted by manufacturers as the standard option.

Normal 3mg/pouch segment is the fastest growing as more users, especially beginners and those reducing nicotine intake, opt for lower-strength options. This trend aligns with increased health awareness and gradual nicotine tapering strategies, supporting sustained market expansion by attracting new users. The availability of low-dose pouches helps smokers transition away from cigarettes, encouraging harm reduction. This segment’s growth also reflects a shift towards personalized nicotine consumption and a cautious approach to intake.

Why is the offline segment dominating nicotine pouch sales?

The offline segment dominated the nicotine pouch sales due to physical retail establishments such as pharmacies, tobacco shops, and convenience stores providing quick access and shopping, especially for regular customers. Offline purchasing is more feasible in many areas due to payment and legal restrictions. Direct marketing and consumer education are also made possible by in-person interactions. Stable sales are a result of the fact that many customers have greater faith in physical retail locations than in Internet stores. Additionally preserving offline dominance is greatly aided by point-of-sale visibility and solid retailer relationships.

Online segment is the fastest-growing market due to its convenience and the growing use of digital technology. Younger and tech-savvy customers are drawn to e-commerce platforms and subscription services because they offer discreet buying options, a wider range of products, and home delivery. Additionally, brands can swiftly enter new markets without significant retail investments thanks to the growth in online sales. Online customer engagement is increased by tailored offers and improved digital marketing techniques. Rapid growth in this channel is also supported by better logistics and an increase in smartphone penetration

By Product Type

By Strength

By Distribution Channel

By Geography

Based on comprehensive market projections, the global online home decor market size is calculated at USD 190.11 billion in 2024, grew to USD 204.67 bi...

According to Consulting experts, the U.S. luxury candle market size is calculated at USD 166.49 million in 2024, grew to USD 185.72 million in 20...

According to market projections, the personalized/customized skin care market industry is expected to grow from USD 25.35 billion in 2024 to USD 56.53...

July 2025

July 2025

July 2025

July 2025