July 2025

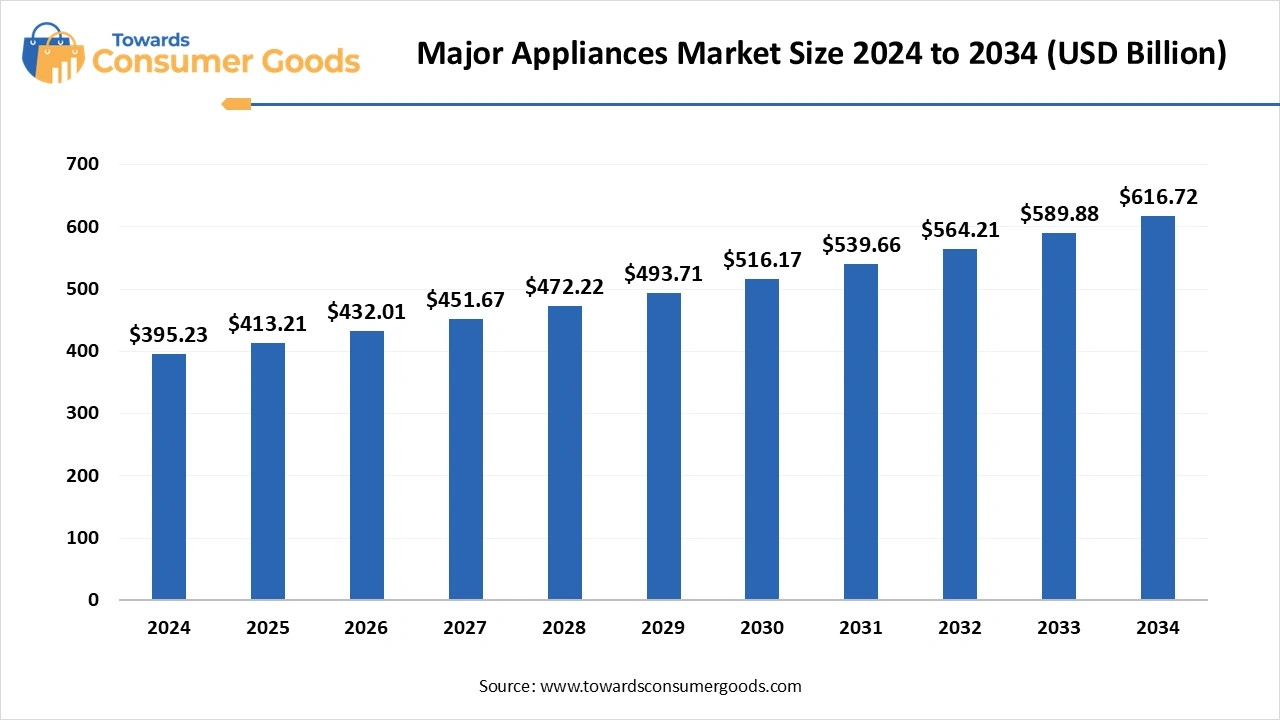

The major appliances market was calculated at USD 395.23 billion in 2024 and is projected to hit around USD 616.72 billion by 2034 with a CAGR of 4.55%. The rapid adaptation of digital technology and convenience offered by appliances have driven the market growth.

Day-to-day Demand for Appliances Drives the Market

The major appliances market represents a critical segment of consumer goods, focusing on the sale of indispensable household devices, which include refrigerators, washing machines, dishwashers, cookers, and air conditioners. This market is significantly driven by various interconnected factors, such as the continuous rise in population, rapid urbanization, advancements in technology, particularly the incorporation of smart appliances and evolving lifestyle preferences among consumers.

As households grow and urban areas expand, people are increasingly seeking convenience, efficiency, and sustainability when selecting appliances. Economic conditions like disposable income levels and overall consumer spending also play a crucial role in shaping market dynamics. The surge in urban migration has led to a higher demand for essential appliances; items such as refrigerators, washing machines, and air conditioners have become staples in modern homes, as they significantly enhance the quality of residential life.

Moreover, the market is witnessing a notable trend towards the adoption of smart and connected appliances, bolstered by advancements in artificial intelligence (AI) and the Internet of Things (IoT). These innovations simplify daily tasks, making appliances more user-friendly and efficient. With increasingly busy lifestyles, consumers are inclined to invest in appliances that streamline their routines, such as technologically advanced dishwashers and intuitive kitchen gadgets. Additionally, a growing consciousness regarding environmental impacts prompts many consumers to prioritize energy efficiency and sustainability, leading to an uptick in the demand for eco-friendly appliances. This trend is supported by governmental initiatives promoting energy-efficient technology, which further align with the consumer shift towards sustainable living.

| Report Attributes | Details |

| Market Size in 2025 | USD 413.21 Billion |

| Expected Size by 2034 | USD 616.72 Billion |

| Growth Rate | CAGR of 4.55% |

| Base Year in Estimation | 2024 |

| Forecast Period | 2025-2034 |

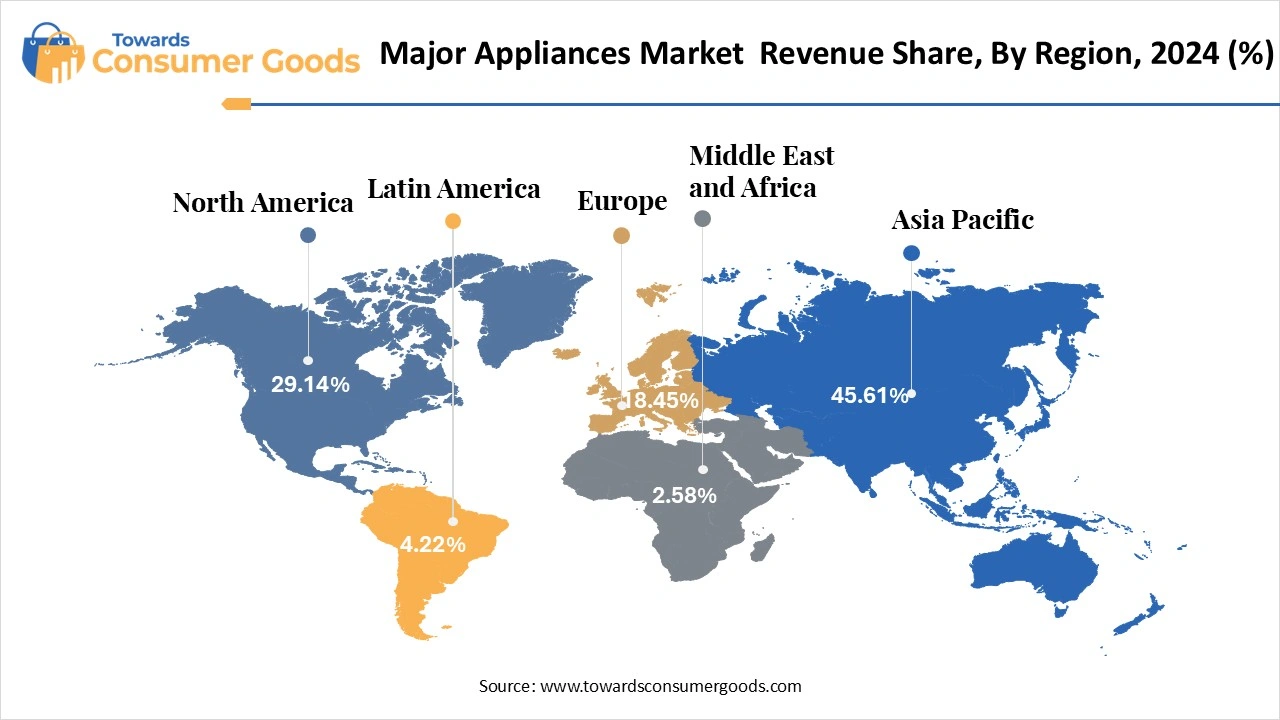

| Dominant Region | Asia Pacific |

| Segment Covered | By Product, By Type, By Distribution Channel, By Region |

| Key Companies Profiled | Whirlpool Corporation, Electrolux AB, Samsung Electronics Co., Ltd., LG Electronics Inc., Haier Smart Home Co., Ltd., Panasonic Corporation, Miele & Cie. KG, Bosch (BSH Hausgeräte), Daikin Industries Ltd., Sharp Corporation, iRobot Corporation Midea Group, Gree Electric Appliances Inc. |

Integration of the Smart Home Appliance

Looking forward, the major appliances market is ripe with opportunities, particularly in domains such as smart home integration, energy-saving innovations, and the expansion into emerging markets. The combination of rising disposable incomes and increasing urbanization continues to catalyze demand, especially for smart devices that enhance connectivity and convenience in everyday living. Consumers are showing a marked interest in appliances that facilitate remote control, provide actionable data insights, and seamlessly integrate within broader smart home ecosystems.

Furthermore, the need for eco-friendly, energy-efficient appliances is expanding as individuals strive to minimize their carbon footprints while simultaneously seeking to lower their energy expenses. Emerging markets like India present substantial growth potential, driven by urbanization trends and rising disposable incomes. There is also an opportunity to develop appliances specifically designed to be user-friendly for the elderly and those with disabilities, catering to a vital segment of the population.

Shortage of Raw Materials

This thriving major appliances market is not without its challenges. Key restraints, including shortages of raw materials such as metals, plastics, and electronic components, can hinder production processes, raise manufacturing costs, and ultimately inflate consumer prices. Additionally, the high costs associated with advanced kitchen appliances especially those equipped with smart technology pose barriers for budget-sensitive consumers. Price sensitivity remains a significant factor, as buyers often compare products and prices across multiple brands, intensifying competitive pressures and limiting profit margins for manufacturers and retailers alike.

Refrigerators segment have firmly established themselves as a dominant force in the major appliances market in 2024, particularly in developed regions such as North America and Europe. They play an essential role in modern living, revolutionizing how consumers approach food storage and preservation. However, this significant shift has birthed notable challenges; notably, the rise in food waste at the household level, coupled with pressing environmental issues arising from the use of hydrofluorocarbons (HFCs) in cooling systems.

As nations advance their cold chain infrastructure, the importance of refrigerators remains unwavering. Not only are they indispensable household items, but they are also focal points for innovation aimed at reducing their environmental footprint. Consumers increasingly value convenience, which is reflected in their preferences for appliances that support bulk buying, facilitate meal prepping, and ultimately lessen the frequency of shopping trips a necessity in today’s fast-paced lifestyles.

The air conditioning segment is predicted to experience substantial growth in the major appliances market during the forecast period. With record-high temperatures now the norm, HVAC contractors are inundated with an influx of requests for air conditioning replacements and urgent repairs. Unfortunately, many contractors face supply chain challenges and are compelled to extend their working hours to keep up with the demand. The ongoing push for energy-efficient cooling solutions and impending Environmental Protection Agency (EPA) regulations are also fueling this growth trajectory, particularly as consumers anticipate longer and hotter summers.

Technological advancements, such as inverter technology that enhances energy efficiency and air purification capabilities, further contribute to the expanding market. Higher disposable incomes mean that more consumers can invest in air conditioning units, while the pandemic has underscored the value of maintaining comfortable indoor environments, thereby driving demand further.

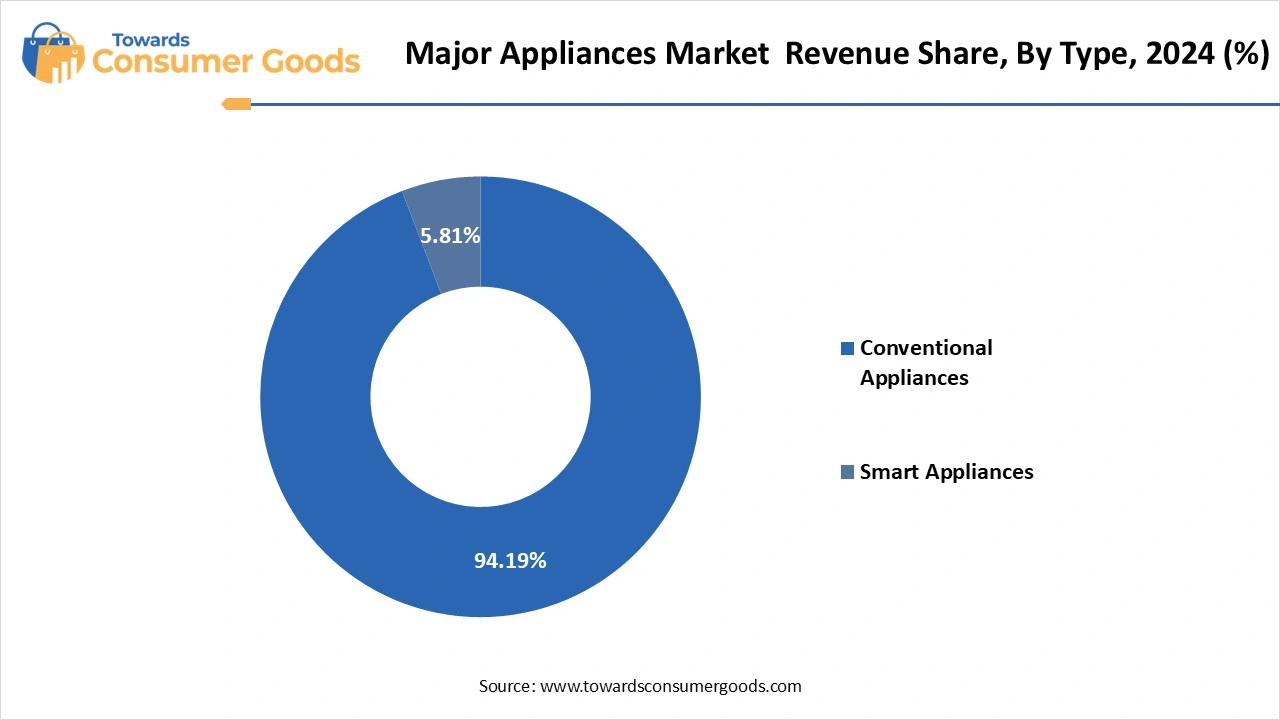

Conventional appliances led the major appliances market in 2024, primarily due to their affordability, simplicity, and reliability. These appliances typically feature straightforward functionality, devoid of the additional costs or complications associated with smart technology. The familiarity of conventional appliances combined with their dependable performance, ensures consumer confidence as they navigate their everyday needs.

The smart appliances segment expects the significant growth in the major appliances market during the forecast period. Today's consumers are becoming more technically adept and are increasingly inclined to embrace appliances that enhance their daily lives with features designed for integration with smart home ecosystems. Smart appliances offer a range of conveniences, from remote control capabilities to automated functions and detailed data tracking factors that strongly appeal to those seeking to streamline their household management.

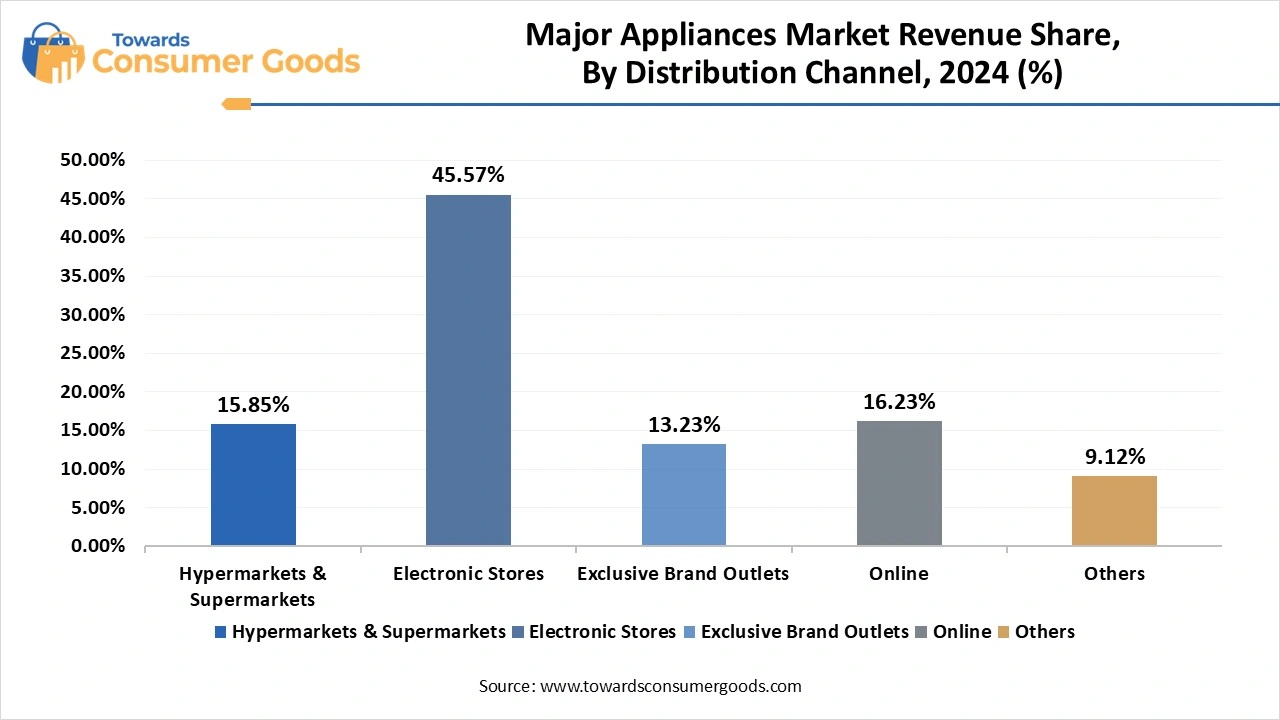

Electronics stores segment dominated the major appliances market in 2024. They merge the strengths of traditional retail with cutting-edge technology, creating a comprehensive shopping experience that caters to diverse consumer needs. In these physical locations, customers can engage directly with various products, enjoying hands-on interactions that allow them to assess size and quality.

Moreover, electronics stores distinguish themselves by offering knowledgeable staff who provide personalized assistance and expert recommendations, ensuring that consumers make informed choices when selecting their appliances. This approach fosters a strong sense of trust and loyalty among customers. As the demand for smart appliances and home automation technology continues to grow, these stores are poised to play a crucial role in educating consumers about the benefits and features of smart products, further enhancing the shopping experience.

The online sales channel segment is rapidly emerging in the major appliances market during the forecast period, driven by expanding internet accessibility and the rise of smartphones. This digital shift offers unparalleled convenience and allows consumers to browse and purchase appliances from the comfort of their homes.

Asia Pacific dominated the market in 2024. The growth of the market in the region owing to the growing population and the rising disposable income in the people of the countries like China, India, Japan, and South Korea. The greater demand results in the innovation in the appliances technology, such as integration of artificial intelligence, automation, IoT, and others. The availability of the leading technology and consumer electronics provider in the regional country is also contributing in the growth of the major appliances market in the region.

North America expected to hold the significant growth in the market during the forecast period, influenced by a variety of significant factors. The area benefits from a robust economy and a high level of consumer spending power, particularly observed in the United States and Canada. As urbanization continues to rise, there is a notable demand for innovative, smart, and energy-efficient appliances that cater to modern lifestyles. Consumers here are progressively favouring appliances that not only conserve energy but also incorporate sustainable practices, reflecting a growing awareness of environmental impact.

Europe expects the rapid growth in the market during the forecast period. spurred by an increasing consumer appetite for energy-efficient, smart, and environmentally friendly solutions. Additionally, soaring urbanization rates, higher disposable incomes, and evolving lifestyle choices coupled with the growth of online retail platforms are propelling the market forward. Consumers are actively seeking appliances that not only offer convenience but also significantly enhance their living environments, fueled by a rising consciousness about smart home technologies.

Innovation- In a notable product launch in May 2025, Xiaomi introduced the Mijia 256L Three-Door Refrigerator. This smart appliance, priced at 1,499 yuan (approximately $208), is designed to meet the needs of compact living spaces, offering a blend of contemporary aesthetics and practical functionality. The refrigerator features a sleek, vertical silhouette, finished in a sophisticated Ice Feather White matte texture, which complements minimalist home interiors while ensuring intelligent connectivity.

Innovation- In February 2025, Samsung, recognized as India’s premier consumer electronics brand, unveiled its Bespoke AI Refrigerator series, available in 330L and 350L capacity options. This innovative range combines cutting-edge AI-powered features, such as AI Home Care and AI Energy Mode with elegant design elements and wider storage solutions, enhancing both functionality and style in the kitchen.

Innovation- In January 2025, Samsung launched its highly anticipated 2025 lineup of BESPOKE AI WindFree™ Air Conditioners. This collection integrates state-of-the-art AI technology with luxurious design aesthetics. Catering specifically to the evolving needs of Indian consumers, this new range comprises 19 distinct models focused on delivering intelligent cooling, exceptional energy efficiency, and a seamless connected living experience.

According to market projections, the global body shapewear market size was estimated at USD 2.81 billion in 2024 and is predicted to increase from USD...

According to market projections, the global turbo trainers market size accounted for USD 491.97 million in 2024, grow to USD 519.03 million in 2025, a...

The global bath linen and accessories market size was valued at USD 12.31 billion in 2024 and is projected to grow from USD 13.13 billion in 2025 to U...

July 2025

July 2025

July 2025

July 2025