July 2025

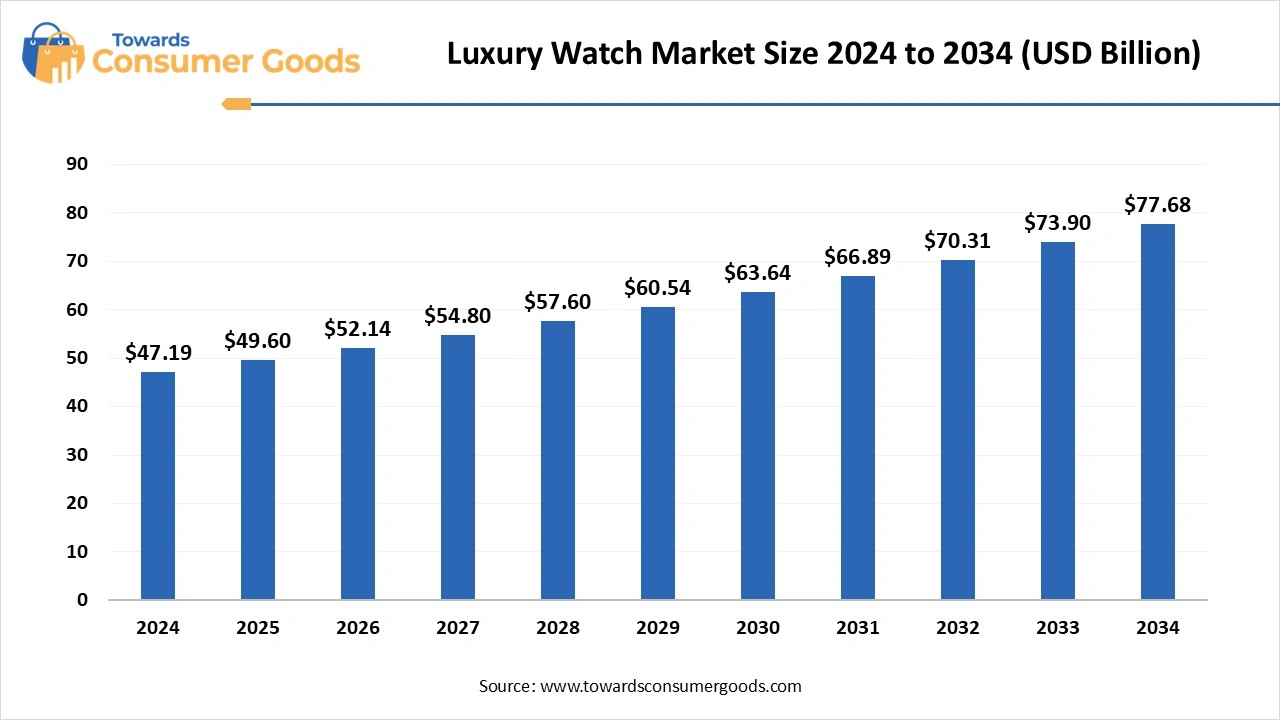

The global luxury watch market size accounted for USD 47.19 billion in 2024 and is predicted to increase from USD 49.6 billion in 2025 to approximately USD 77.68 billion by 2034, expanding at a CAGR of 5.11% from 2025 to 2034. This market is growing due to increasing global wealth and rising demand for status symbols and investment-grade timepieces.

The global luxury watch market is experiencing steady growth, driven by a rise in demand from emerging markets, especially in Asia Pacific, the desire for high-end craftsmanship, and rising disposable incomes. Luxury watches increase sales in both the primary and secondary markets because consumers see them as long-term investments in addition to status symbols.

The industry is also changing because of digitization and e-commerce, which enable brands to reach new consumers while preserving exclusivity through brand heritage and limited editions. Innovation and sustainability continue to be major trends as younger consumers look for ethical production as well as authenticity.

Why are luxury watches still thriving in a tech-driven world?

Luxury watches are still thriving in a tech-driven world because they provide heritage craftsmanship and emotional value, things that technology cannot match. Luxury watches are regarded as classic art pieces that are frequently handed down through generations, in contrast to smartwatches, which may become outdated in a few years. They are status markers, fashion statements, and frequently long-term investment assets. Authenticity, exclusivity, and traditional artistry have become increasingly popular, especially among younger consumers. This has strengthened their appeal in a time when digital devices are the norm.

| Report Attributes | Details |

| Market Size in 2025 | USD 49.6 Billion |

| Expected Size by 2034 | USD 77.68 Billion |

| Growth Rate from 2025 to 2034 | CAGR 5.11% |

| Base Year of Estimation | 2024 |

| Forecast Period | 2025 - 2034 |

| Dominant Region | Asia Pacific |

| Segment Covered | By Product, By Distribution Channel, By Geographic |

| Key Companies Profiles | Apple Inc., The Swatch Group Ltd, Audemars Piguet Holding S.A., Fossil Group, Inc., Citizen Watch Company of America, Inc., Seiko Watch Corporation, Compagnie Financière Richemont SA, LVMH Moet Hennessy -Louis Vuitton, Movado Group Inc., Ralph Lauren Corp. |

How can luxury watch brands balance traditional and innovative ways to attract modern consumers while preserving their timeless appeal?

Luxury watch brands can balance tradition and innovation by blending classic craftsmanship with modern design, technology, and storytelling. They preserve authenticity and prestige through the preservation of artisanal techniques and aesthetics inspired by heritage. Incorporating modern components such as smart features, limited edition drops, sustainable materials, and captivating digital experiences also helps them remain relevant to younger tech-savvy customers. Working together with tech companies' artists or influencers enables established watchmakers to innovate without compromising their heritage, appealing to both new and devoted collectors.

How can luxury watch brands stay relevant as smartwatches increasingly dominate the wristwear market?

Luxury watch brands can stay relevant amid the rise of smartwatches by doubling down on what sets them apart. Timeless craftsmanship, exclusivity, and emotional value. Luxury timepieces represent heritage artistry and identity qualities that appeal to collectors and status-conscious consumers, while smartwatches concentrate on functionality. Brands can also adopt innovation in a targeted manner, for example, by developing hybrid models or adding subtle smart features without sacrificing mechanical tradition. They can stay relevant while respecting their legacy by involving younger audiences through storytelling, eco-friendly methods and digital methods and digital experiences.

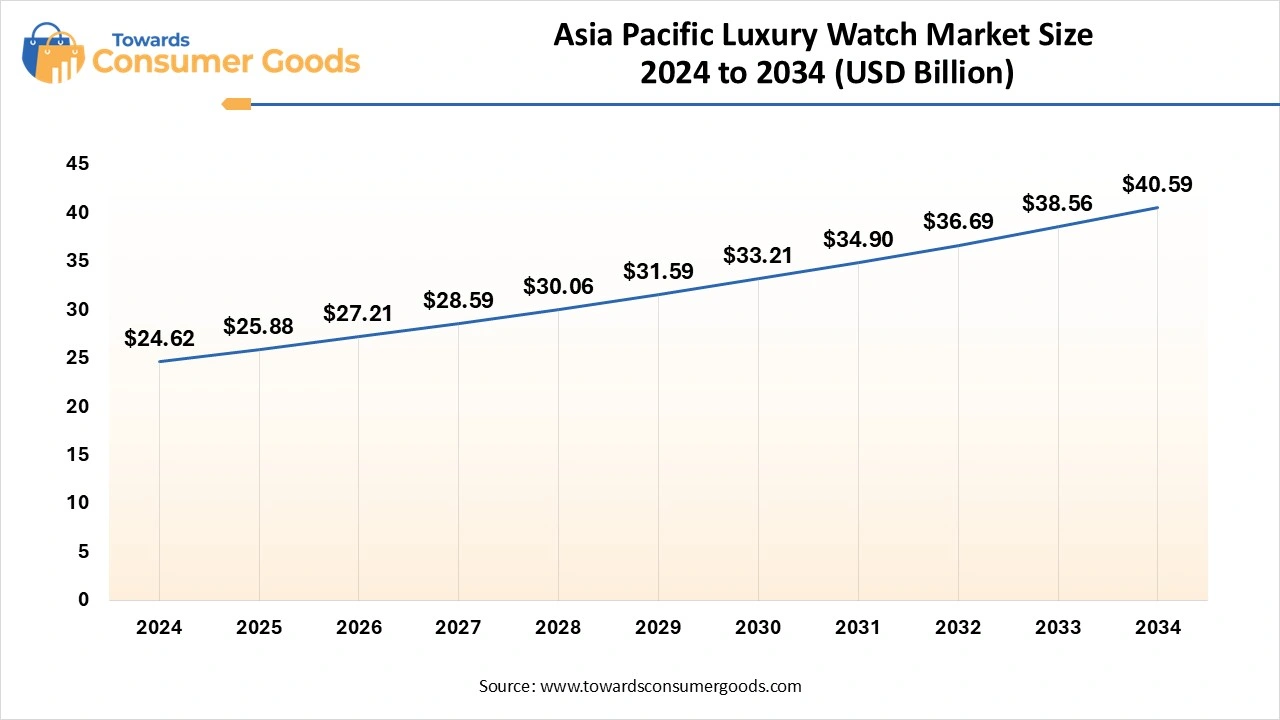

The Asia Pacific luxury watch market is expected to increase from USD 25.88 billion in 2025 to USD 40.59 billion by 2034, growing at a CAGR of 5.13% throughout the forecast period from 2025 to 2034. Asia Pacific remains the dominant region in the luxury watch market, driven by fueled by a deep cultural appreciation for luxury goods, growing numbers of high-net-worth individuals, and robust consumer demand. The region remains the market leader in terms of sales volume and brand recognition, with customers favoring high-end watchmakers and limited-edition collections. Luxury travel, growing retail networks, and digital platforms are all contributing to the expansion. Luxury watchmakers see Asia-Pacific as their most important source of income because consumers in this area place a high value on heritage craftsmanship and brand prestige.

North America is currently the fastest-growing region in the luxury watch market, due to growing consumer interest in luxury timepieces as investment pieces and fashion accessories. The market base is growing as more young, wealthy consumers become interested in vintage and pre-owned timepieces. To increase brand engagement and conversion, luxury brands are also fortifying their physical and digital presence in strategic urban areas. The region's strong sales momentum is still being driven by its appetite for innovation and exclusive releases.

Europe remains a notable and influential player in the luxury watch market, with a rich legacy of watchmaking and a sophisticated consumer base. Known for its deep-rooted connection to traditional horology, the region serves as a hub for luxury craftsmanship and brand heritage. In addition to being home to major watch expos and flagship boutiques, Europe benefits from tourism-driven luxury sales and a high rate of local collector interest. The combination of historical prestige and consumer loyalty keeps the European market consistently relevant.

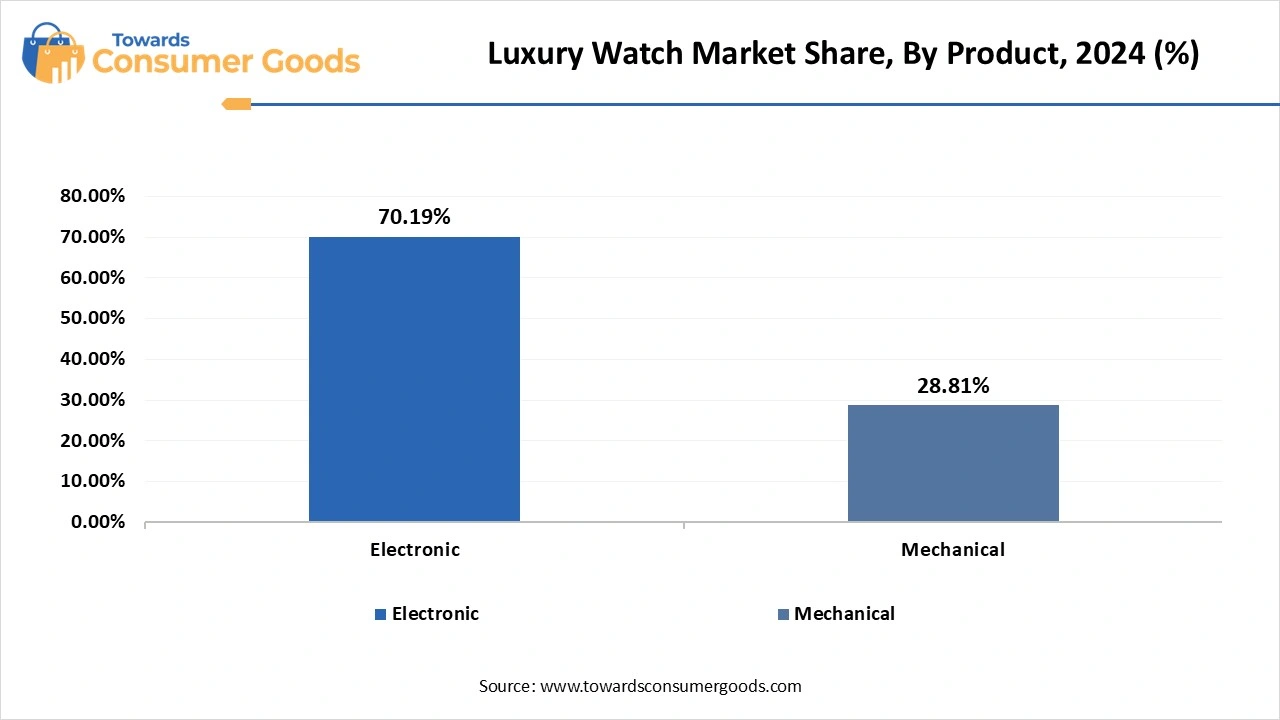

Why do electronic watches currently dominate the luxury watch market?

Electronic luxury watches continue to dominate the market by combining traditional luxury aesthetics with cutting-edge smart technology, with a plethora of digital features like GPS health tracking and smartphone integration. These watches are both incredibly useful and aspirational. Companies like TAG Heuer and Montblanc are taking advantage of this trend by aiming to attract younger tech-savvy luxury consumers. Electronic watches' inventiveness and adaptability enable them to stay ahead of consumer demand as digital lifestyles continue to change.

Mechanical watches are seeing the fastest growth in the luxury segment due to renewed appreciation for heritage, handcrafted precision, and collectible value. Customers increasingly see them as lifestyle statements and long-term investments, particularly limited editions or models associated with heritage watchmakers. Mechanical timepieces are notable for their artistry and technical complexity as consumers look for deeper brand stories and emotional connections. Demand for mechanical watches is also being accelerated by younger consumers joining the market.

What makes online channels the dominant force in luxury watch distribution today?

Online distribution now dominates the luxury watch landscape, driven by growing consumer demand for accessibility, transparency, and ease, as well as increased digital adoption. To replicate the boutique vibe online, luxury brands and retailers have made significant investments in high-end e-commerce platforms and virtual worlds. With features like live consultations, virtual try-ons, and exclusive web-only editions, online shopping has become the preferred method for many high-end consumers. This change is especially noticeable among younger tech-savvy consumers.

Offline channels are experiencing the fastest growth in customer engagement and value. Due to the tactile feel of trying watches, trust, and customer service, luxury buyers still prefer in-person interactions. In addition to sales, flagship stores and brand experience centers provide exclusive product education and personalization. A crucial touchpoint in the high-end watch buyer journey, brick and mortar retail is regaining traction as international travel bricks are particularly in major luxury cities.

By Product

By Distribution Channel

By Geographic

July 2025

July 2025

July 2025

July 2025