July 2025

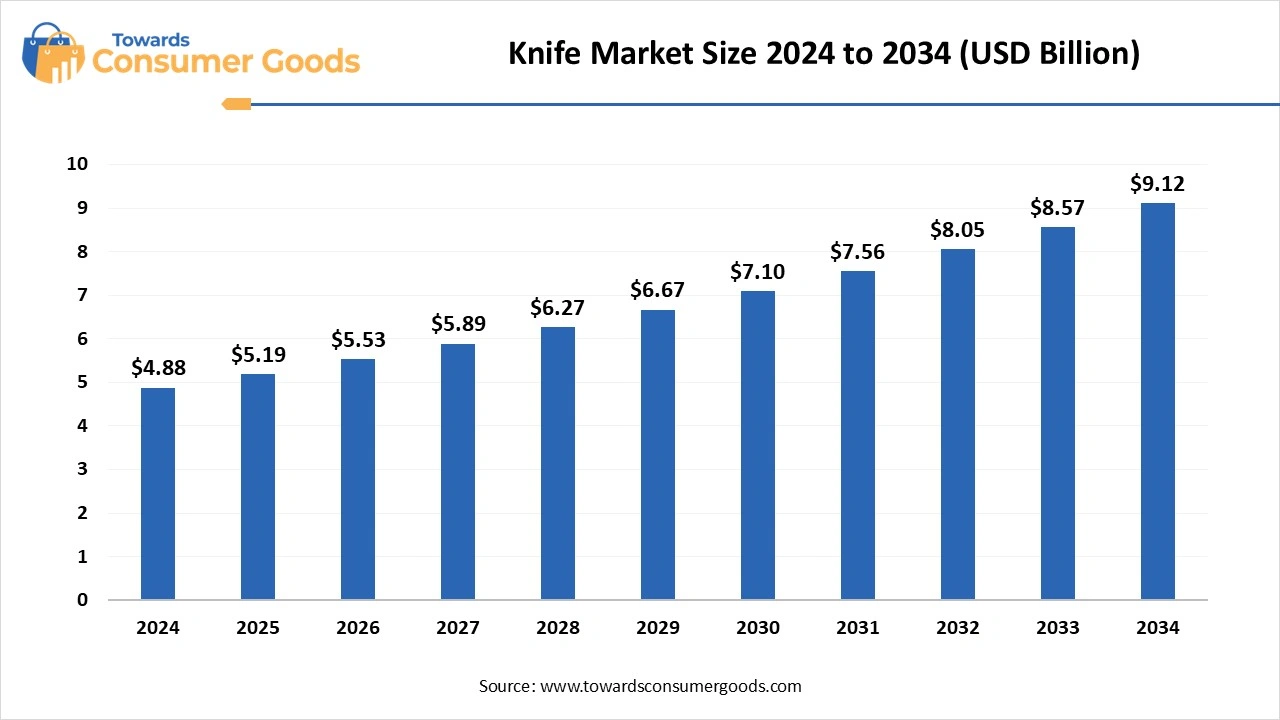

The global knife market size is calculated at USD 4.88 billion in 2024, grew to USD 5.19 billion in 2025, and is projected to reach around USD 9.12 billion by 2034. The market is expanding at a CAGR of 6.45% between 2025 and 2034. The demand for kitchen and military knives has increased, driving the global knife market. Additionally, the growing consumer demand for tactical and survival gear is contributing to the market growth.

The knife is a niche market, providing significant opportunities for the manufacturing companies, distribution channels, as well as supply chain logistics. The market has witnessed transformative growth driven by several factors like rising outdoor activities, demand for kitchen knives, growing DIY and home improvement activities, and expanding commercial sectors. The changing lifestyle and consumer preferences have driven demand for unique, survival or tactical knives, collectible or ceremonial knives, and custom or artisanal knives. The rising consumer concern for safety use has prompted for manufacturing of high-quality and safety-featured knives. The expanding commercial sector has increased demand for high-performance knives. Additionally, growing outdoor activities are increasing the popularity of low-budget, unique, durable, and high-quality knives. The rising trend of aesthetic appeals and sustainability has also contributed to increasing innovations in the knife market.

The growing demand for commercial kitchen knives is the key driver of the global knife market. The expansion of the food service industry, including restaurants, cafeterias, catering services, and fast-food shops, has increased demand for knives. The rising culinary industry is fueling demand for commercial grads. The commercial sector has witnessed significant growth in demand for high-quality, precise, and well-balanced knives for more efficient and safer use. This demand has led to several advancements in knife technologies, including innovative designs, materials, and features to improve knife performance. Ergonomics and durability.

| Report Attributes | Details |

| Market Size in 2025 | USD 5.19 Billion |

| Expected Size by 2034 | USD 9.12 Billion |

| Growth Rate from 2025 to 2034 | CAGR 6.45% |

| Base Year of Estimation | 2024 |

| Forecast Period | 2025 - 2034 |

| Dominant Region | North America |

| Segment Covered | By Product Type, By End Use, By Material, By Distribution Channel, By Region |

| Key Companies Profiled | Victorinox, Wüsthof, Zwilling J.A. Henckels , Global (Yoshikin) , Shun (Kai Corporation), MAC Knife , Dalstrong , Cutco , Mercer Culinary , Dexter-Russell , Messermeister , Furi , Benchmade , Spyderco , Gerber Gear Other Players |

The market is projected to witness transformative growth due to rising consumer appreciation of r quality and craftsmanship. The demand for high-quality, durable, and well-crafted knives has increased. Manufacturers are actively developing knife products with more attention to detail, durability, and unique designs. The competition of maintaining brand reputations, ensuring companies' establishment for high-quality and excellence. Additionally, the growing trend of sustainability and premiumization for kitchen appliances is creating a favorable road map for innovations in the knife market.

The safety concerns are the major restraint for the knife market. The rising activities like home cooking, DIY, and home improvements, outdoor activities, and the growing demand for kitchen knives have increased consumer demands for high safety standard-based knives, which can pose a risk to users. The market competition for low-cost knives among manufacturers is leading to the development of limited safety-concerned knives, impacting product purchasing.

North America Knife Market

North America dominates the global knife market, driven by strong demand for knives in various sectors of the region, including the culinary industry, kitchen knives, outdoor and hunting knives, and military. The growing outdoor activities like camping, hiking, and survivalist practices have also increased the demand for knives in the region. North

America has a well-established knife manufacturing sector.

The U.S. is a major player in the regional market, contributing to market growth due to increased demand for knives in kitchen appliances, outdoor activities, DIY, and home improvement activities. The well-established military & defense industry of the country has prompted major adoption of knives. The high disposable income enables U.S. consumers to invest in premium knives, shaping the market.

Asia Pacific Knife Market

The Asia Pacific is the fastest-growing region in the global market, contributing to growth due to increased demand for kitchen knives and rising outdoor activities. The expanding manufacturing industry, rising disposable income, and government initiatives and support for local manufacturers are contributing to market competitiveness. Cyberknives are gaining traction in the Asian industry. The government initiatives like

“Made in China” and “Make in India” are fostering the adoption of advanced instruments, including knives.

China is a major player in the regional market, driving growth due to large and strong manufacturing giants in the country. China is popular for the cost-effective and unique manufacturing of products, including knives. The expanding food service industry, government initiatives like “Make in China”, and a large consumer base for low-cost knives are fueling the market. The rising manufacturers' focus on developing technologically advanced knives is further supporting the market growth.

For instance, the Air Knives are gaining significant popularity due to energy efficiency and the ability to reduce waste in manufacturing procedures.

Product Type Insights

Which Product Types Dominant the Knife Market?

The kitchen knives segment dominated 57.7% of the market in 2024 due to expanding cooking-at-home trends and the growing food service industry. The rising interest in cooking, growing household and commercial use of knives, and demand for premium products are fueling the segment. Additionally, the expansion of online sales enables easy accessibility and availability, contributing to the segment's growth.

The tactical & combat knives segment is expected to grow fastest over the forecast period, due to increased demand for safe and high-quality knives in major areas like military, outdoor recreation, personal safety, self-defence, and law enforcement. The advancements in materials and designs are enhancing the performance and durability of tactical & combat knives, to support segment expansion.

Which Material Held the Largest Revenue of the Knife Market in 2024?

The blade material segment held 62.12% market revenue in 2024, due to its wide use in knives for high durability, performance, versatility, and overall value. Blade materials include steel, ceramic, alloy blends, and titanium. The steel segment dominates the market due to its high preference among professionals and casual users for easy sharpening.

The handle material segment is expected to grow fastest over the forecast period, driven by increased consumer preference for various weights, costs, and durability of the knives. Handle materials include wood, metal, G10, micarta, carbon fiber, plastic, rubber, bone, and other materials. These materials are highly durable, ergonomic designs that provide great resistance to wear and tear.

What Made the Mid-Range Segment Dominate the Knife Market in 2024?

In 2024, the mid-range segment dominated 57.5% market 2024, driven by a large consumer base for balances price and quality. The demand for budget-friendly and high-end products is high, compared to low-quality and low-cost knives. Companies' initiatives in providing better quality knives at affordable prices in the shaping segment.

Buck, a US-based company, is focusing on expanding its RDC offering in a big way for FY 2025. The company has launched various novel knives with of wide range of prices. The release of the Range Pro and Mini Rage Pro knives featuring with Cross Bar Lock gained top profit in Q1 of 2025.

The premium segment is the second-largest segment, leading the market, due to increased consumer demand for high-quality, high-performance, and durable knives. The adoption of these knives is large in outdoor activities and safety & self-defence activities. The increased availability of disposable income enables access to premium-priced knives.

How Offline Distribution Channel Dominated the Knife Market in 2024?

The offline segment dominated the 57.5% market in 2024, growth driven by large consumer preference for traditional shopping habits. Offline retailers offer expert guidance and advice, making them suitable for consumers to purchase the right knife according to their needs. The Kitchen knives and outdoor knives are mostly purchased by offline channels.

The online segment is expected to lead the market over the forecast period, due to expanding e-commerce platforms and growing consumer seek for convenience, wide accessibility, and competitive pricing products. Online channels provide great transparency and consumer reviews, making them suitable for consumer purchasing decisions.

Which End-use Segment Leads the Knife Market in 2024?

The military & defense segment is the second-largest segment, leading the market, driven by the wide use of knives in military & defense activities like self-defense, safety, and law enforcement. The segment is rapidly encouraging innovations in material, multi-functionality, and ergonomics. The rising geopolitical tension and increased defense budget have increased demand for high-end and premium knives.

US Tariffs implemented in February 2025, issued by President Donald Trump, increased taxes on imports of steel and aluminum, particularly a 50% rise under section 232, significantly impacting on knife industry and manufacturers. Several small American brands with mostly dependent on foreign steel, like Buck, The James brand, and WESN, have faced immediate challenges in the US market.

The implementation of these tariffs has led to increased consumer prices, and companies are increasing the price of their products. These metal tariffs are intended to hit goods.

By Product Type:

By End Use

By Material

By Distribution Channel

By Price Range

By Region

The U.S rum market size was estimated at USD 3.19 billion in 2024 and is predicted to increase from USD 3.35 billion in 2025 to approximately USD 5.17...

July 2025

July 2025

July 2025

July 2025