July 2025

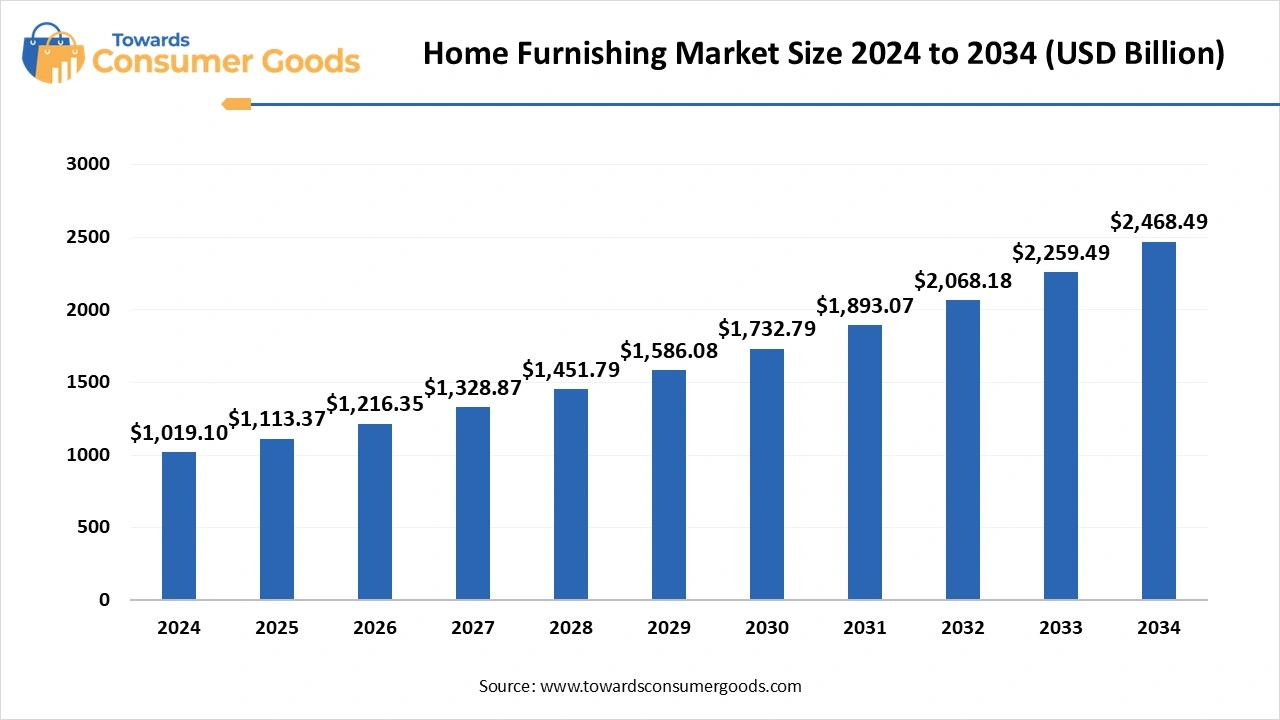

The global home furnishing market size was valued at USD 1019.1 billion in 2024 and is expected to reach around USD 2468.49 billion by 2034, growing at a CAGR of 9.25% from 2025 to 2034. The demand for home furnishing is increasing due to the rising home ownership in the urban areas, demanding constant upgrades in their houses.

Home furnishings are products and items that are used for decorating and enhancing the functionality, aesthetics and comfort of a living space. These items are mainly furniture, textiles like curtains, bed linens, pillow covers and many more. The rising demand for home aesthetics is also leading towards home décor products like paintings, artificial plants, and many more.

Rising residential constructions are one of the major drivers that have been contributing as a major market driver for the home furnishing market. The governments and private real estate are constantly supporting construction growth to manage the living spaces in recent years.

The growing economies like India, China, and Indonesia are witnessing rapid construction due to rising rural immigration. The rising influence of Western homes is also a major factor which is driving a massive consumer base for various aesthetic products. Rising government initiatives in India, like Pradhan Mantri Awas Yojana (PMAY), are helping in building affordable homes for the low-income citizens.

| Report Attributes | Details |

| Market Size in 2025 | USD 1113.37 Billion |

| Expected Size by 2034 | USD 2468.49 Billion |

| Growth Rate from 2025 to 2034 | CAGR 9.25% |

| Base Year of Estimation | 2024 |

| Forecast Period | 2025 - 2034 |

| High Impact Region | North America |

| Segment Covered | By Product, By Distribution Channel, By Region |

| Key Companies Profiled | IKEA, Ashley Furniture Industries Inc., BERCO DESIGNS, Godrej and Boyce Manufacturing, Herman Miller, Stanley Furniture, Heritage Home Group, Nitori Co. Ltd., Williams-Sonoma |

The recent businesses are witnessing rapid consumer shifts, which are aiming to adopt environmentally friendly products. The home furnishing market is growing rapidly as younger consumers are adopting eco-friendly products like furniture and many more. The governments are mandating certifications for these products, which will help the new startups to innovate advanced products in the market. The majority of the brands are investing in these materials to differentiate their brand and also charging a premium.

The developed economies have been a major contributor to the home furnishing market due to higher disposable incomes, but there are still some factors which may affect the growth in some regions. The Lower disposable income in these regions restricts the population from spending on these premium products. Additionally, the constant improvements in materials and products is increasing the overall costing of quality products.

Why did North America dominate the home furnishing market in 2024?

North America marked its dominance by generating the highest revenue share in 2024. The dominance of the segment is attributed to the higher per capita income in countries like the United States and Canada. The real estate sector is also progressing at a rapid pace, which is helping the regional companies to innovate premium and luxurious furnishing options for homeowners. The region is also witnessing rapid advancements through home renovation trends, which are helping the home décor companies to invest in new product lines. The growing immigration rates in the region are expected to increase the growth rate in the coming years.

United States Home Furnishing Market Trends

The United States stands as a prominent player in the North American market due to the presence of leading brands like IKEA, Ashley Furniture and many more. The American population have a higher disposable income, which increases their spending capacities on home comfort and aesthetic products. Moreover, the work culture is mainly shifting towards remote or hybrid work, which is increasing the demand in the home furnishing market. Additionally, the home ownership rates are also increasing rapidly, which is helping in creating a wider business scope for the companies.

Asia Pacific is expected to grow at the fastest CAGR during the projected period of 2025 to 2034. The growth of the segment is attributed to the rising urbanization, which is boosting the urban construction rates. The World Bank data also states that by 2036, cities and towns will be home to 600 million people in India, which accounts for around 40% of the population. Countries like India, China and Japan are also improving digitally, which will create a business base for companies to invest in e-commerce. The western influence in these areas is also increasing due to social media platforms, which are expected to create demand for home aesthetics products.(Source: worldbank)

China Home Furnishing Market Trends

China stands as a dominant country in the home furnishing market due to its stronger furniture production and exports on the global stage. The country had exported around $64.18 billion worth of furniture globally in 2023-24. The Chinese population is also investing in smart and modular living spaces, which is creating a massive business base for domestic companies like Kuka Home and Markor Home Furnishing. The apartment living trend in the country is expected to play a major role in driving many innovations in home décor products.

Europe is also expected to grow at a significant CAGR during the projected period of 2025 to 2034. The growth of the region is attributed to the higher demand for luxury interior design trends that raise sales through luxury furniture and home décor items. Moreover, the stricter regulations in the region are also expected to create a massive business ground for companies aiming to innovate sustainable and eco-friendly products.

The rapid economic growth in Germany is one of the major drivers that is creating many opportunities for global retailers. Additionally, the brands in the country are trying to innovate modern designs and space-efficient products, which will help the market growth in the future.

Why did the bedding and linen segment dominate in 2024?

The bedding and linen segment marked its dominance by generating the largest revenue share in 2024. The dominance of the segment is attributed to the higher use frequency of products like bedsheets, pillows, blankets, mattresses and many more. The home furnishing market is expected to maintain the demand as many house owners and rental living spaces require these products. The replacement is also higher, which depends on the weather and other factors. The companies have a wider business scope due to wider availability. The retail channels are also providing these products with various products. The rising hospitality trend is also expected to help the companies grow more rapidly.

The furniture bathroom linen segment is expected to grow at the fastest CAGR during the projected period of 2025 to 2034. The home furnishing market is growing rapidly due to the increasing work-from-home work culture that drives the demand for various chairs and desks. Consumer preferences are also evolving frequently, which stands as a major growth factor in the growth of minimal types of furniture. The bathroom linen is also experiencing rapid demand, where consumer preferences are driven towards hygiene. The companies are expected to gain popularity due to the rapid shift towards the growth of organic products made from bamboo, cotton and recycled fibers.

What Made Speciality Stores Dominant in 2024?

The speciality stores segment stood as the dominant one by contributing to the highest revenue share in 2024. The dominance of the segment is attributed to the wider product availability with physical in-store experiences. The home furnishing market is marking several advancements, where the companies are prioritizing consumer preferences as they are investing in expert assistance through staff and other technologies.

The online segment is expected to emerge at the fastest CAGR during the projected period of 2025 to 2034. The growth of the segment is mainly attributed to the rising consumer convenience, as they can purchase these products from anywhere. The changing work lifestyles in the urban areas are a major contributor, where companies are focusing on digital expansion, which would increase consumer reliability and trust in these platforms.

Moreover, the e-commerce expansion is also providing multiple options to the consumers, which would increase the consumer base on these platforms. The home furnishing market will continue to grow more rapidly as these online platforms are being integrated with technologies like Artificial Intelligence and Internet of Things (IoT).

IKEA

Nitori

Furnishka

By Product Type

By Distribution Channel

By Region

A new research report, the U.S hair care products market size is calculated at USD 21.19 billion in 2024, grew to USD 22.56 billion in 2025 and is pre...

July 2025

July 2025

July 2025

July 2025