July 2025

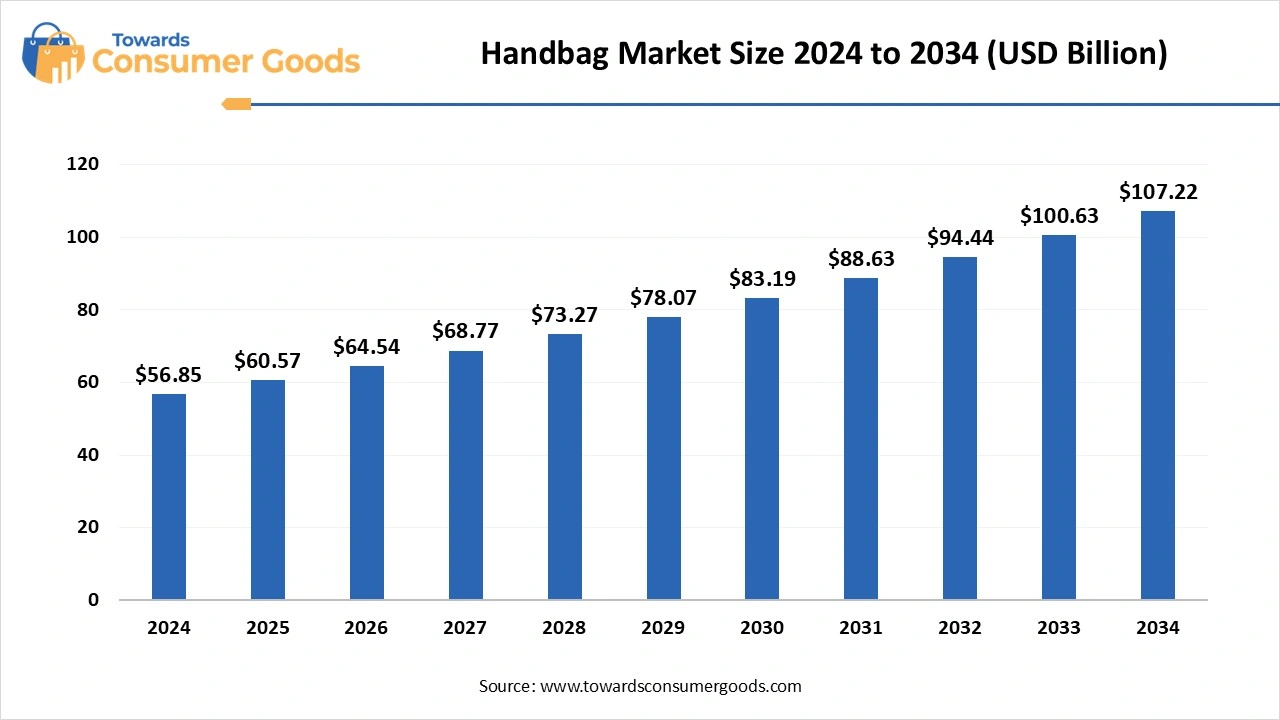

The global handbag market was valued at approximately USD 56.85 billion in 2024 and is projected to grow at a CAGR of 6.55% from 2025 to 2034, reaching a value of USD 107.22 billion by 2034. The global handbag market is flourishing as fashion-conscious consumers increasingly seek functional and stylish accessories that align with their lifestyle. With the rise of social media influence, premiumization trends, and demand for personalized fashion statements, handbags are no longer just utility items but essential expressions of identity and status.

The handbag market is undergoing significant changes driven by key factors such as evolving fashion trends, the rise of urban living, and the growing impact of celebrity and influencer endorsements. Brands are diversifying their offerings, which now include everything from luxury totes and designer crossbody bags to sustainable options and tech-integrated designs. This innovation spans various aspects, including design, materials used, and functionality to meet consumer expectations.

Furthermore, the digital transformation has expedited the growth of e-commerce and direct-to-consumer (D2C) sales channels. Generation Z and millennials are particularly influential in shaping demand, with a clear preference for exclusivity, sustainability, and ethically produced accessories. As various brands strive to achieve a balance between style, affordability, and purposeful production, the market shows strong indications of continuing global growth.

Tariffs tangle the threads of worldwide luxury

| Report Attributes | Details |

| Market Size in 2025 | USD 60.57 Billion |

| Expected Size by 2034 | USD 107.22 Billion |

| Growth Rate from 2025 to 2034 | CAGR 6.55% |

| Base Year of Estimation | 2024 |

| Forecast Period | 2025 - 2034 |

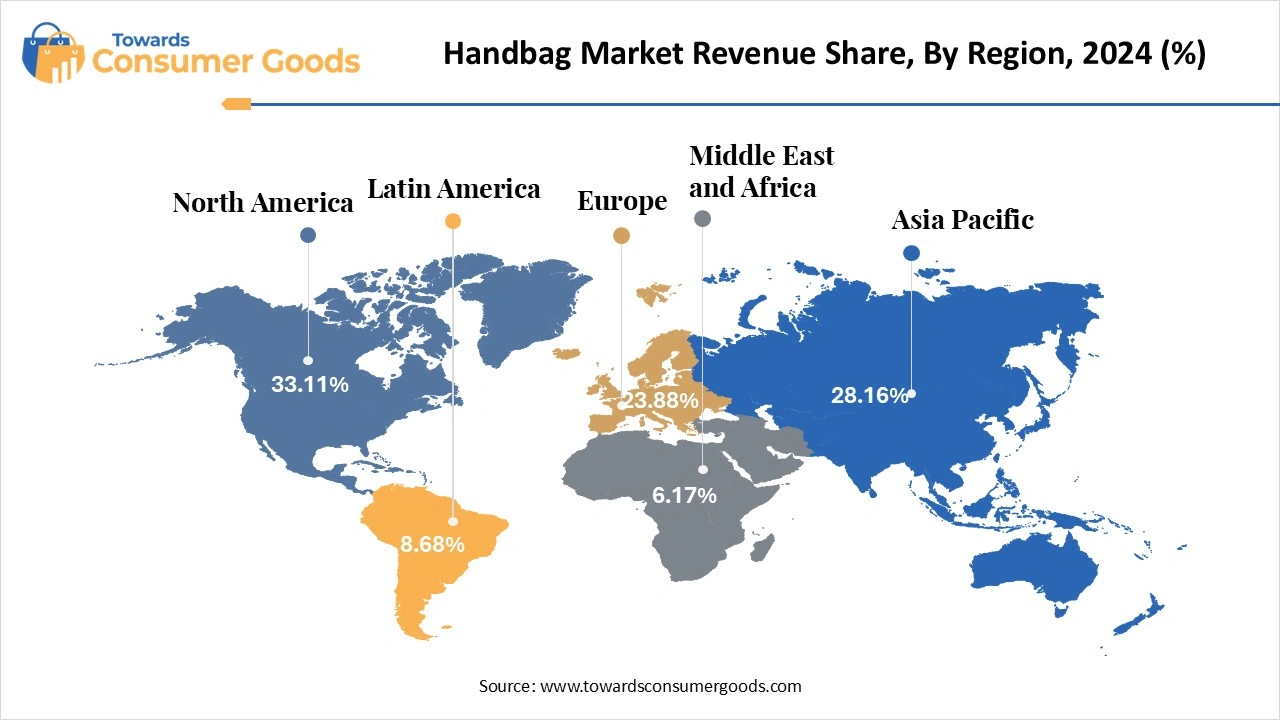

| High Impact Region | North America |

| Segment Covered | By Product, By Distribution Channel |

| Key Companies Profiled | Louis Vuitton, Hermès, Michael Kors, Fossil Group, Guccio Gucci S.p.A., PRADA, Burberry Group Plc, Tapestry, Inc., Chanel, Compagnie Financière Richemont SA |

The global handbag market is riding a wave of transformation, fueled by the rise of conscious consumerism. As sustainability becomes a key purchasing factor, there is immense potential for brands to innovate with eco-friendly materials, transparent supply chains, and ethical production practices. Consumers, especially millennials and Gen Z, are actively seeking products that align with their environmental values, creating a significant opening for brands offering vegan leather, recycled fabrics, and biodegradable alternatives. Additionally, the surge in online retail and luxury resale platforms has expanded market reach, providing new channels to capture diverse demographics and niche preferences.

Counterfeits & Costs: The Twin Challenges to Growth

Despite promising growth, the handbag industry faces serious restraints. A major concern is the increasing presence of counterfeit products, especially in online marketplaces. These fake goods not only damage brand reputation but also erode customer trust. Moreover, the high cost of authentic luxury handbags limits accessibility for a large portion of potential buyers, particularly in developing markets. Inflation and supply chain disruptions have further pushed up production and logistics costs, making price-sensitive consumers hesitant to purchase. Overcoming these challenges will require stricter regulations, innovative pricing models, and digital authentication technologies.

The North America handbag market size was valued at USD 18.82 billion in 2024 and is expected to be worth around USD 35.55 billion by 2034, exhibiting a compound annual growth rate (CAGR) of 6.57% over the forecast period 2025 to 2034. North America continues to lead the global handbag market due to a combination of high disposable incomes, fashion-conscious consumers, and strong demand for premium and luxury brands. The region has a well-established retail infrastructure and a thriving e-commerce sector that supports both domestic and international brands. Frequent collaborations between fashion houses and celebrities, along with innovative digital marketing campaigns, further drive consumer engagement. Additionally, the presence of top global players and increasing preference for sustainable fashion are contributing to steady market expansion.

What Makes Europe the Fastest-Growing Handbag Market?

Europe is witnessing the fastest growth in the handbag industry, fueled by a rich fashion heritage, growing luxury tourism, and rising sustainability trends. Consumers in countries like France, Italy, and Germany are not only inclined towards high-end designer bags but are also embracing sustainable and locally crafted alternatives. The booming second-hand luxury market, supported by circular fashion initiatives, is reshaping consumption patterns. Government regulations promoting eco-friendly production and heightened awareness of ethical sourcing are prompting both established and emerging brands to innovate responsibly.

Is Asia-Pacific the Next Big Hub for Handbags?

Asia-Pacific is rapidly evolving into a high-potential market for handbags, driven by urbanization, rising middle-class income, and an increasing appetite for global fashion trends. Nations like China, India, South Korea, and Indonesia are witnessing a surge in demand, particularly through online channels and mobile shopping platforms. Influencer marketing and celebrity endorsements are playing a pivotal role in brand popularity. The region’s youthful population and tech-savvy consumers are propelling not just volume sales but also premiumization trends, making Asia-Pacific a critical focus for handbag manufacturers

Is the Tote Bag the Undisputed Favorite in the Handbag Market?

Tote bags continue to dominate the handbag market due to their spacious design, versatile usage, and modern appeal. Favored by working professionals, students, and shoppers alike, their practicality allows them to transition seamlessly between casual and formal settings. Brands increasingly focus on sustainable tote options, customization, and eco-friendly materials to cater to environmentally conscious consumers, adding to their market dominance.

On the other hand, the satchel segment is witnessing remarkable growth as consumers increasingly prefer compact yet functional styles that strike a balance between elegance and everyday use. Their structured form, crossbody capability, and appeal across age groups, especially among young professionals and fashion-forward individuals, are propelling their rapid expansion in both luxury and affordable handbag categories.

Brick-and-mortar stores remain a dominant force in the handbag market due to the tactile and experiential nature of the product. Consumers prefer seeing, touching, and trying handbags before purchasing, especially when investing in premium or designer items. Department stores, exclusive brand outlets, and luxury showrooms continue to thrive through personalized service and in-store promotions.

Moreover, the online distribution channel is rapidly expanding, driven by the convenience of shopping from home, the availability of a wide product range, and attractive discounts. With advancements in virtual try-on tools, easy return policies, and influencer-driven digital marketing, online platforms are becoming the preferred choice, especially among tech-savvy and younger consumers seeking quick, trend-driven fashion.

Is Leather Still the Gold Standard in Handbag Material?

Leather handbags remain a symbol of luxury, durability, and timeless style. Consumers favour leather for its premium finish and long-lasting quality, making it the top choice for both luxury and everyday bags. With the growing demand for sustainable alternatives, many brands are also investing in eco-leather and responsibly sourced hides, maintaining leather’s stronghold in the market.

On the other hand, Fabric handbags are gaining popularity for their lightweight, colourful, and affordable options. Ideal for casual use, travel, and seasonal collections, fabric materials allow for experimentation with patterns, textures, and styles. The demand is especially high in urban and youthful demographics, who prefer playful designs and budget-friendly fashion with frequent wardrobe updates.

Product Outlook

Distribution Channel

By Material

By Regional

Based on comprehensive market projections, the global connected apparel market size accounted for USD 2,793.79 billion in 2025 and is forecasted to hi...

The U.S. range cooker market size was valued USD 1.95 billion in 2024 and is projected to grow from USD 2.13 billion in 2025 to USD 4.81 billion by 20...

July 2025

July 2025

July 2025

July 2025