July 2025

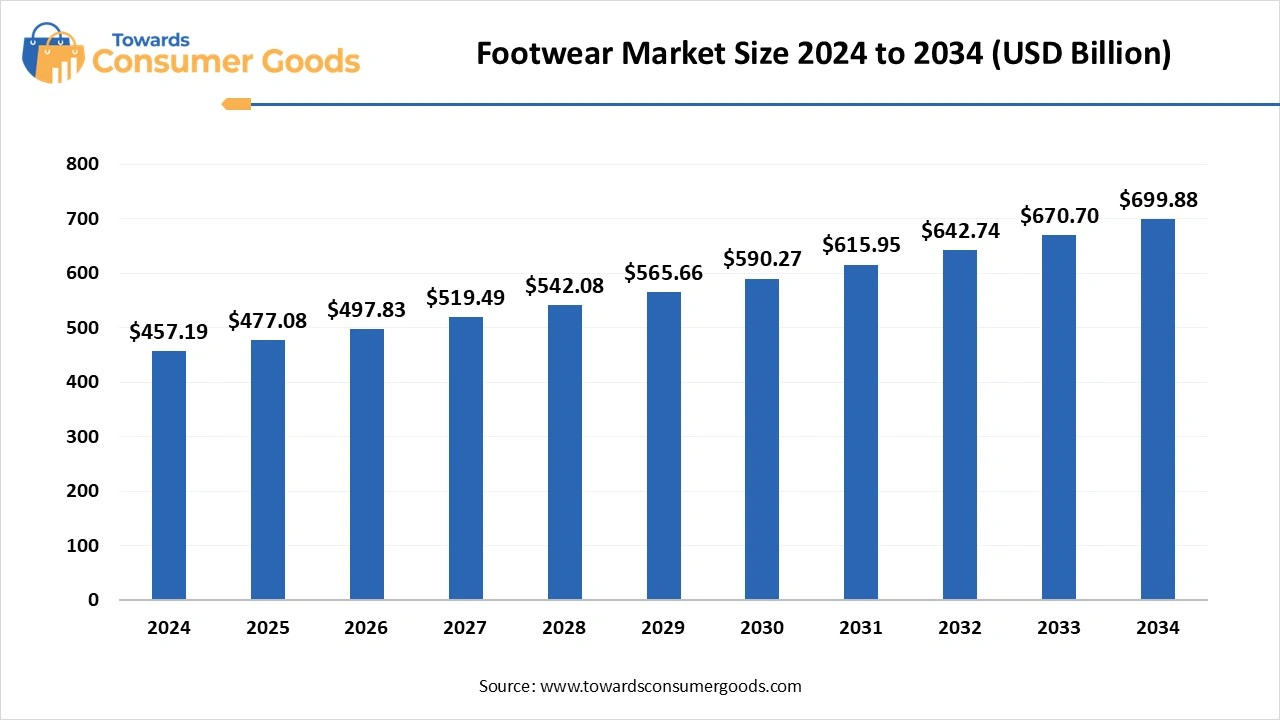

The global footwear market size was valued at USD 457.19 billion in 2024 and is expected to hit around USD 699.88 billion by 2034, growing at a compound annual growth rate (CAGR) of 4.35% over the forecast period 2025 to 2034. The global footwear market is witnessing robust growth, driven by evolving fashion trends, increased health consciousness, and the rising popularity of sports and outdoor activities. Consumers today seek a blend of style, comfort, and functionality, pushing brands to innovate with advanced materials and sustainable designs.

The global footwear market is undergoing a transformative shift, evolving from basic utility to a symbol of lifestyle and personal expression. The increasing demand for athleisure, ergonomic designs, and eco-friendly materials is reshaping consumer preferences. Rapid urbanization, growing disposable income in emerging economies, and the influence of social media and celebrity endorsements are fueling brand loyalty and fashion-conscious purchases.

Technological innovations like 3D-printed shoes, smart footwear with health tracking sensors, and custom-fit insoles are also redefining user expectations. As sustainability becomes a central focus, many manufacturers are adopting recyclable materials and ethical production methods to meet rising eco-conscious consumer demands.

| Report Attributes | Details |

| Market Size in 2025 | USD 477.08 Billion |

| Expected Market by 2034 | USD 699.88 Billion |

| Growth Rate from 2025 to 2034 | CAGR 4.35% |

| Base Year of Estimation | 2024 |

| Forecast Period | 2025 - 2034 |

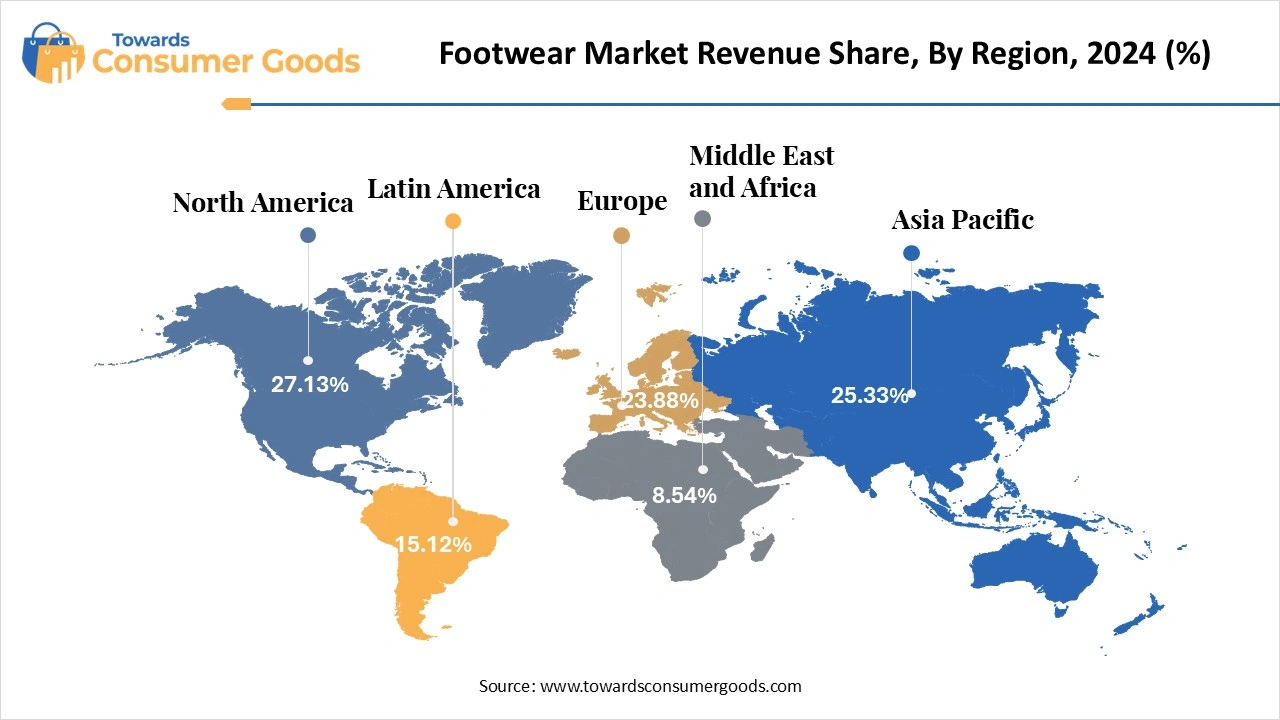

| Dominant Region | North America |

| Segment Covered | Key Product, Key End User |

| Key Companies Profiled | Nike, Inc., Adidas AG, Puma SE, Geox S.p.A, Timberland, Skechers USA, Inc., ECCO Sko A/S, Crocs Retail, LLC, Under Armour, Inc., Wolverine World Wide, Inc. |

The footwear market is brimming with opportunities as consumers increasingly prioritize sustainability, personal comfort, and technological innovation. The surge in demand for eco-friendly materials and biodegradable footwear has opened new avenues for brands focusing on ethical and green manufacturing. Additionally, the rise of smart footwear, integrated with sensors for fitness tracking, health monitoring, and personalized analytics, is capturing interest in health-conscious and tech-savvy demographics. The direct-to-consumer (DTC) model, digital fashion shows, and influencer marketing are empowering even niche brands to reach global audiences. Emerging markets, particularly in Asia and Africa, with growing middle-class populations and fashion awareness, represent untapped potential for long-term expansion.

Despite strong growth, the footwear market faces several challenges that could hinder its full potential. High production costs due to fluctuating raw material prices, especially for sustainable alternatives, continue to affect profit margins. Moreover, global supply chain disruptions and logistic complexities in sourcing and distribution can delay production cycles.

The presence of counterfeit products in developing markets undermines brand reputation and revenue. Additionally, rapidly shifting fashion trends demand constant innovation, leading to short product lifecycles and high design costs. For startups and small manufacturers, entering the competitive market without significant brand value or technological investment can be a major hurdle.

Which Region Dominated the Footwear Market in 2024?

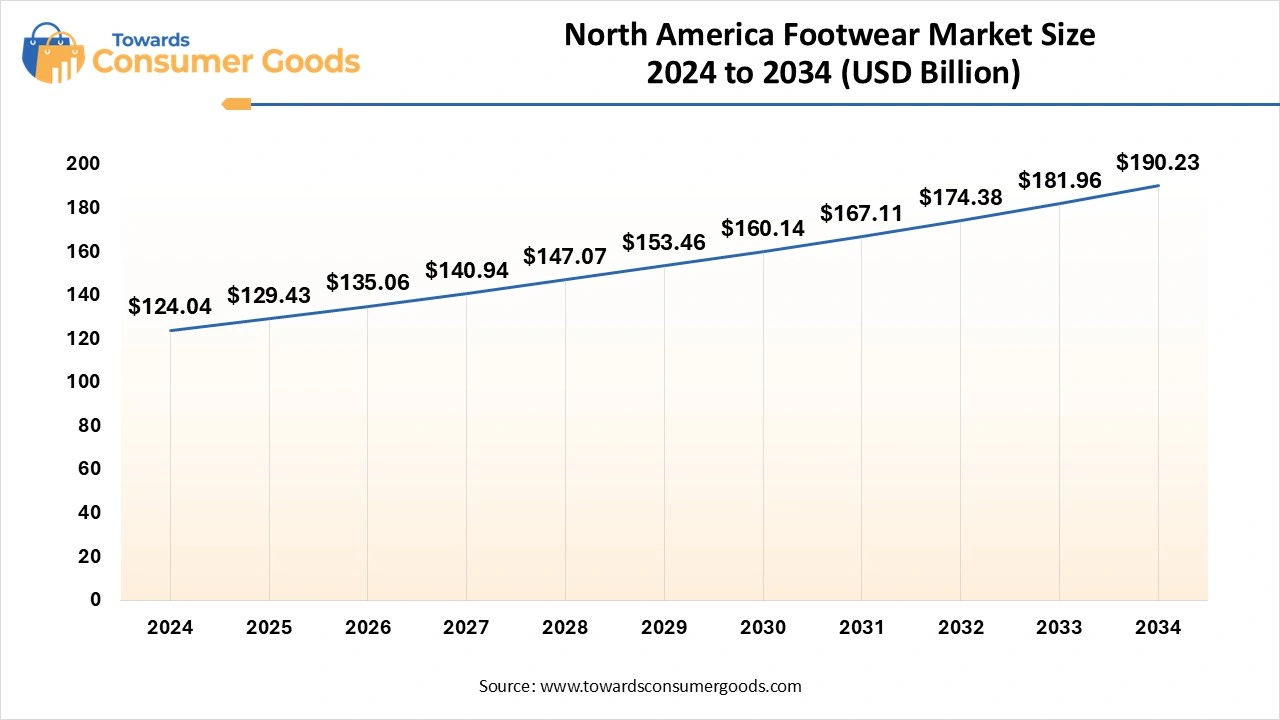

The North America footwear market size was valued at USD 124.04 billion in 2024 and is expected to be worth around USD 190.23 billion by 2034, exhibiting a compound annual growth rate (CAGR) of 4.37% over the forecast period 2025 to 2034. North America dominates the global footwear market, influenced by several key dynamics. A prevalent culture of brand consciousness among consumers, combined with relatively high disposable incomes, creates a strong demand for various footwear options. Moreover, the region exhibits a keen embrace of innovation, where consumers increasingly prefer sustainable, customized, and technologically advanced footwear. The influence of the athleisure trend is notable, as more individuals adopt wellness-focused lifestyles, leading to a steep rise in demand for high-performance sports shoes and comfortable casual wear.

This trend reflects a broader shift in consumer preferences towards functionality and style. Significantly, major footwear brands in the U.S. and Canada have swiftly transitioned to direct-to-consumer business models, enhancing their digital engagement through social media. This strategic shift not only strengthens their connection with consumers but also plays a pivotal role in solidifying their market presence and competitiveness within the evolving landscape of the footwear industry. The combination of these factors positions North America at the forefront of footwear innovation and market leadership, setting trends that may influence the global industry.

How is Europe Merging in Footwear Industry?

Europe is experiencing rapid growth in the footwear market, propelled by strong fashion sensibilities, rising interest in sustainable footwear, and innovation in smart manufacturing. Consumers in countries like Germany, France, and Italy show a preference for artisanal craftsmanship and environmentally responsible products. The increasing popularity of online retail, coupled with support for local brands, has accelerated market growth. Footwear made from vegan leather, cork, and other eco-materials is gaining mainstream attention.

Local footwear brands are responding swiftly by scaling operations, investing in modern design and production technologies, and offering products that reflect both cultural identity and global trends. Meanwhile, international brands are making significant investments in the region, setting up local manufacturing hubs, streamlining supply chains, and tailoring products to suit regional tastes and preferences. These strategic moves are not only enhancing product availability but also contributing to regional economic development.

How is Asia-Pacific rising footsteps?

Asia-Pacific is emerging as a vibrant epicenter of growth and innovation in the global footwear industry, underpinned by rapid socio-economic development and evolving consumer lifestyles. This region, comprising economic powerhouses such as India, China, South Korea, Indonesia, and Vietnam, is experiencing a significant demographic shift marked by a rising middle-class population, expanding urban infrastructure, and increasing disposable incomes. These factors are collectively transforming the footwear market from one focused primarily on utility to one that embraces fashion, comfort, and technological sophistication.

The demand for stylish yet affordable footwear is surging, as consumers, especially millennials and Gen Z, become more fashion-conscious and brand-aware. Urbanization has led to lifestyle changes that prioritize not just the look but also the functionality of footwear, with a growing preference for categories like athleisure, smart shoes, and sustainable alternatives. This shift is not only influencing design trends but also driving product diversification and customization. The digital revolution has further accelerated market growth. E-commerce platforms and mobile shopping apps have made purchasing footwear more convenient, enabling consumers to explore a wide range of domestic and international brands from the comfort of their homes. At the same time, the rise of influencer marketing on platforms like Instagram, TikTok, and YouTube has created a new wave of aspirational buying, where fashion trends are set and spread by digital content creators and celebrities.

The non-athletic footwear segment continues to dominate the global footwear market, primarily due to its widespread usage across formal, casual, and fashion-oriented settings. From office wear to social outings, consumers are seeking stylish, comfortable, and seasonally adaptable footwear that aligns with their lifestyle. This segment includes a diverse range of shoes such as loafers, boots, sandals, heels, and flats, catering to various occasions and fashion sensibilities. The growing influence of fashion trends, especially among urban populations, has led to an increased frequency of footwear purchases, as consumers seek to update their wardrobes regularly. Additionally, collaborations between fashion designers and leading brands have elevated the appeal of non-athletic footwear, making it not just a necessity but a statement of personal style.

On the other hand, Athletic footwear is witnessing the fastest growth rate, fueled by rising health awareness, increased participation in sports and fitness activities, and the global boom in athleisure wear. Consumers today are not only focused on performance but also on the design, comfort, and multifunctionality of their footwear. Products such as running shoes, training shoes, and gym-specific footwear are in high demand among both professionals and amateurs.

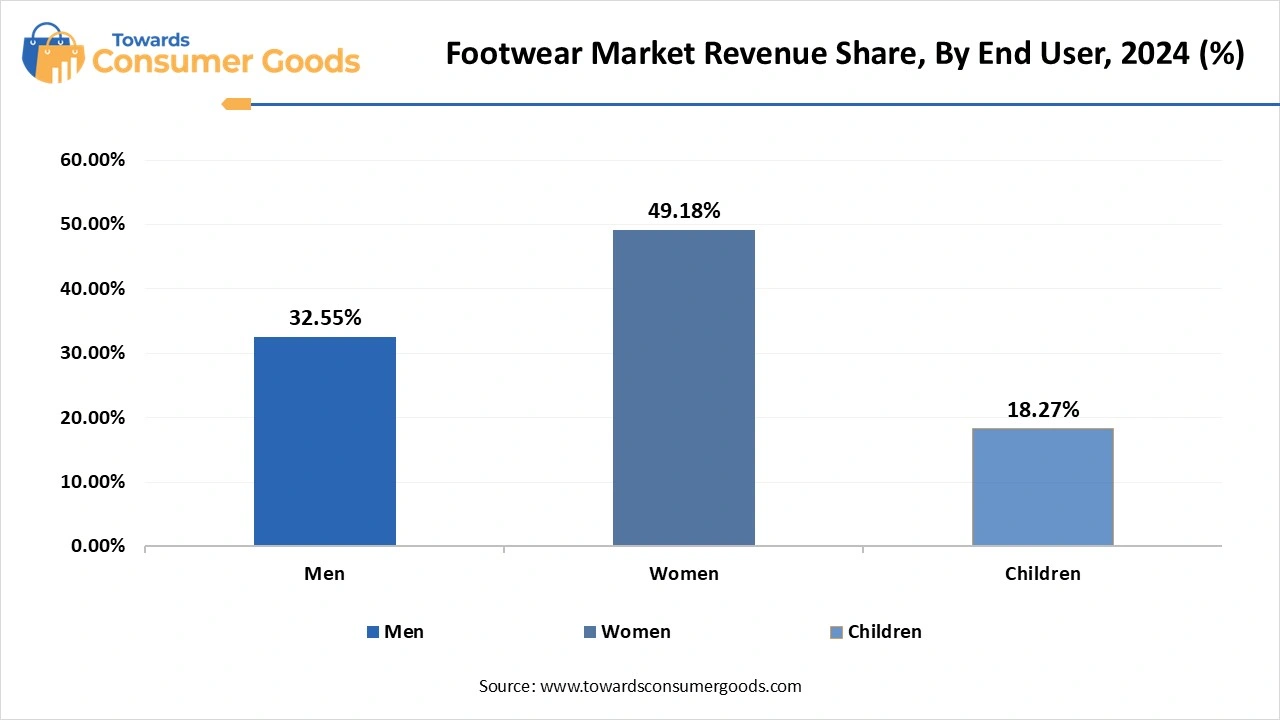

Women remain the largest consumer base in the footwear market, contributing significantly to overall revenue. The dominance of the women’s segment is attributed to their broader variety of footwear needs, ranging from formal and ethnic to luxury and fitness categories. Fashion consciousness, frequent wardrobe changes, and social media influence play key roles in boosting this segment. Furthermore, women are increasingly embracing work-life balance and wellness, leading to demand across both non-athletic and athletic footwear categories. Brands are continuously innovating in terms of design, comfort, and customisation to cater to women’s preferences, including eco-friendly options and extended sizing.

Moreover, men is the fastest-growing segment in the market, which includes smart shoes embedded with sensors for tracking movement, posture correction, and even health diagnostics. Consumers, especially in urban and fitness-focused demographics, are showing growing interest in footwear that integrates with mobile apps for real-time feedback and performance monitoring. In addition to health tech, innovations in material science, such as self-healing fabrics, water-repellent textiles, and breathable membranes, are appealing to tech-savvy users who demand more from their footwear. The blending of functionality, fashion, and technology is creating a new, fast-growing niche in the market that promises to revolutionise how consumers interact with their footwear.

By product

By End user

By Regional

July 2025

July 2025

July 2025

July 2025