July 2025

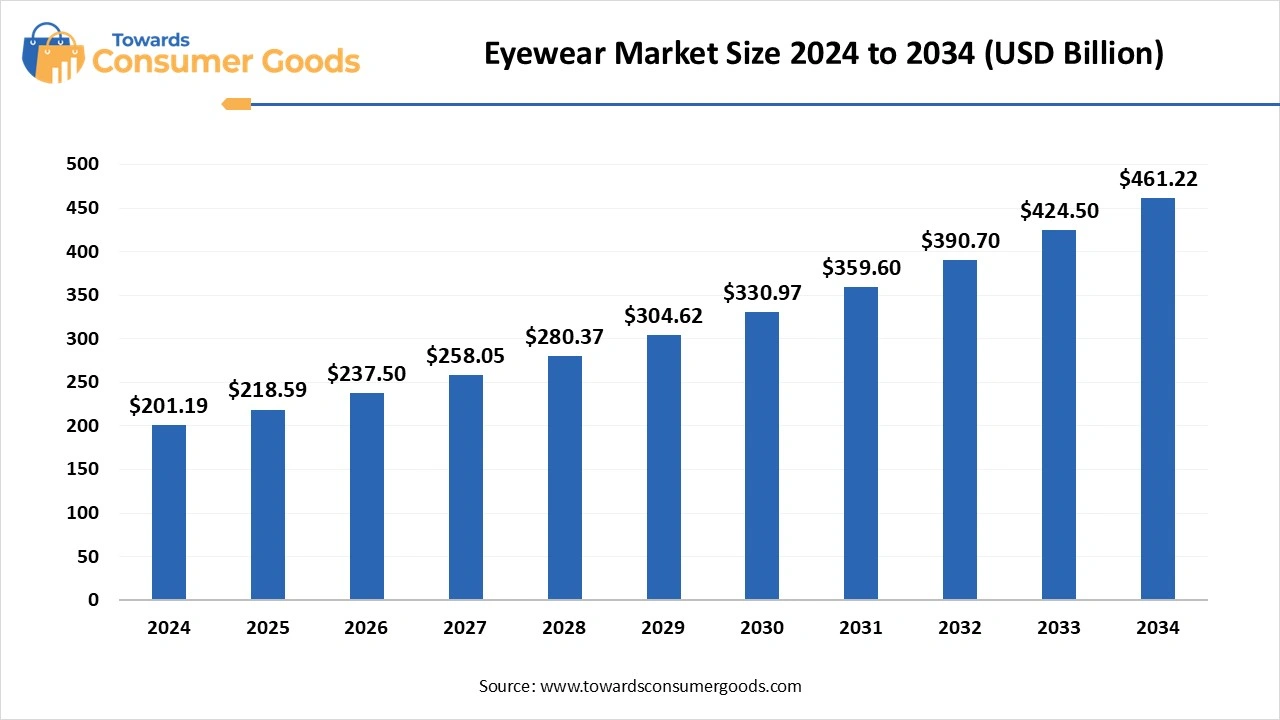

The global eyewear market size accounted for USD 201.19 billion in 2024, grew to USD 218.59 billion in 2025, and is expected to be worth around USD 461.22 billion by 2034, poised to grow at a CAGR of 8.65% between 2025 and 2034. The demand for eyewear is increasing due to the growing popularity of fashion and health factors, which are being combined through technologies in eyewear products like sunglasses, RX glasses, contact lenses and many more.

Eyewear is an accessory worn over or in front of the eyes for various purposes, including protecting vision, correcting vision, or for fashion. It is produced using lenses and frames made from materials such as plastic (CR-39, TR-90), metal, bamboo, and others.

The rising prevalence of vision disorders is one of the major drivers that has attracted many consumers in recent years. The World Health Organization (WHO) data also mentions that at least 2.2 billion people globally have a vision impairment or blindness. Conditions like Myopia, hyperopia and many more are affecting the individual's eyesight, which is contributing towards the growth of the eyewear market.

| Market Attributes | Details |

| Market Size in 2025 | USD 218.59 Billion |

| Expected Size by 2034 | USD 461.22 Billion |

| Growth Rate from 2025 to 2034 | CAGR 8.65% |

| Base Year of Estimation | 2024 |

| Forecast Period | 2025 - 2034 |

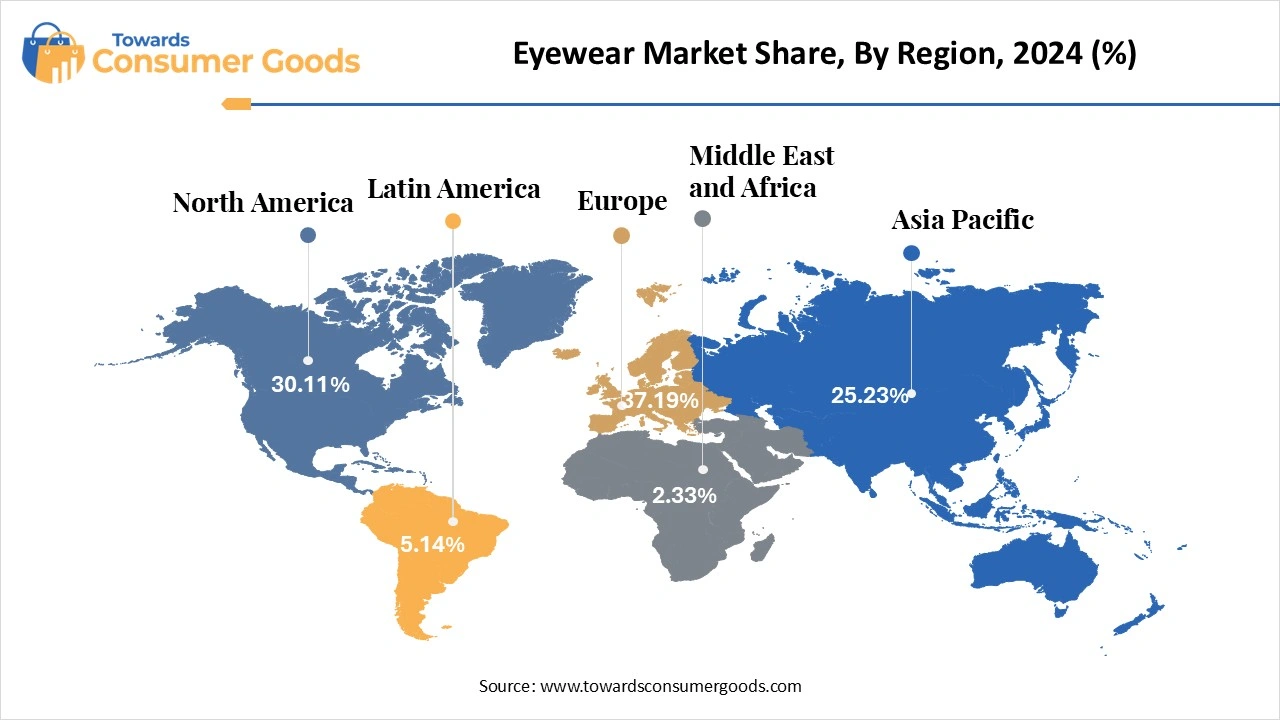

| Dominant Region | Europe |

| Segment Covered | By Product, By Distribution Channel, By End User, By Price, By Region |

| Key Companies Profile | Prada S.p.A, Bausch + Lomb Corporation, Zeiss Group, Rodenstock GmbH, Safilo Group S.p.A, Seiko Optical Products Co. Ltd., Shamir Optical Industry Ltd., Silhouette International Schmied AG, Warby Parker, Zenni Optical Inc., CHARMANT INC., CHEMIGLAS CORPORATION, CooperVision Limited, De Rigo Vision S.p.A., ESSILORLUXOTTICA, Fielmann AG, HOYA Corporation, JINS Inc., Johnson & Johnson Vision Care Inc., Marchon Eyewear Inc., Marcolin S.p.A. |

The rise of technologies like Artificial Intelligence (AI) and Augmented Reality (AR) is playing a transformative role in shaping the eyewear market. AI is gaining popularity as it allows voice commands to the users, which helps in identifying real-time objects, language translation and many more. The rising market competitiveness is influencing companies to innovate advanced products in the market. Moreover, the market is expected to gain massive demand in the future due to the rising interest of tech brands like Google, Apple, Meta, Samsung and Xiaomi. They are expected to make eyewear a broader part of their product lines, like smartphones and smartwatches.

The rural areas have less access to advanced healthcare services as compared to the urban areas, which may witness a dip in the growth. The eyewear market may face certain challenges as the limited healthcare infrastructure has low awareness about vision issues, which often have symptoms like headaches and reading difficulty. This also restrains the companies to invest in these region due to lower consumer awareness and resource limitations.

How did Europe dominate the eyewear market in 2024?

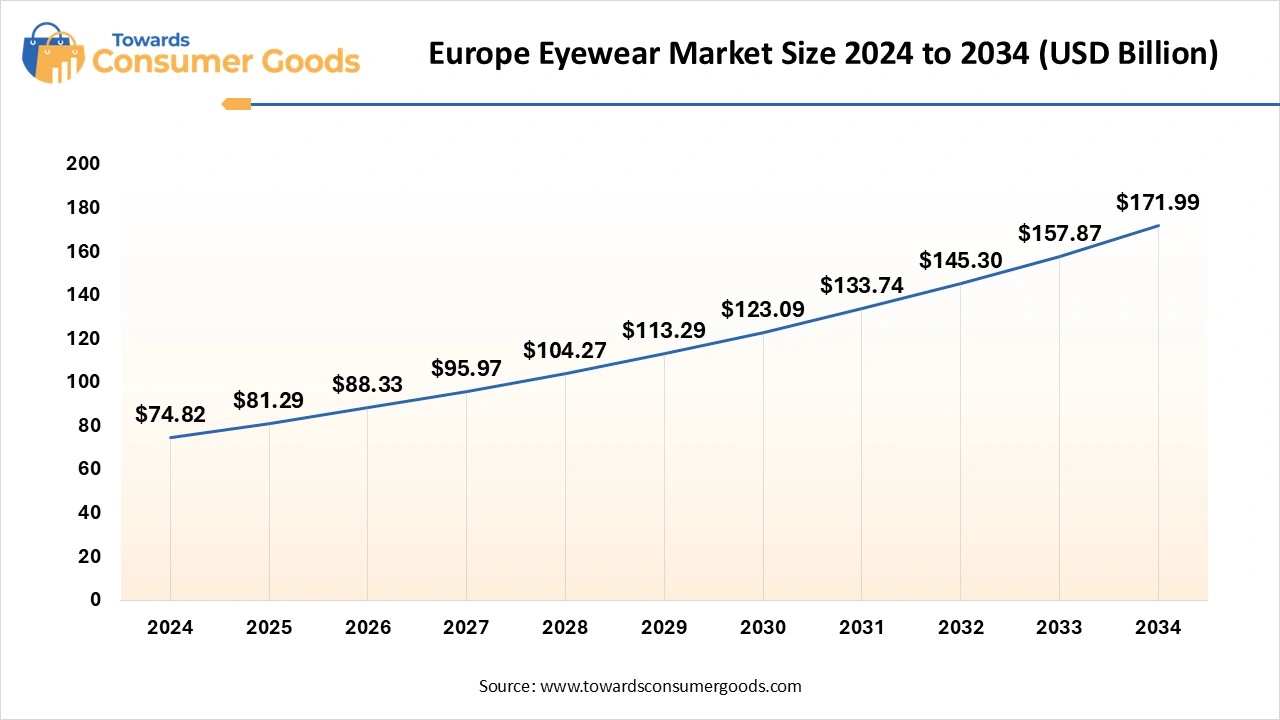

The Europe eyewear market is expected to increase from USD 81.29 billion in 2025 to USD 171.99 billion by 2034, growing at a CAGR of 8.68% throughout the forecast period from 2025 to 2034. Europe marked its dominance by generating the highest revenue share in 2024. The dominance of the region is attributed to the higher prevalence of vision disorders and an aging population. The European Blind Union data shows that an estimated 30,000,000 visually impaired individuals, where a higher number of elderly people, is one of the main reasons. Moreover, the higher influence of fashion from places like Paris, Milan and many more is helping the companies to innovate high-quality branded eyewear products. The bodies like the European Union are also promoting initiatives like EU EYE, which are aiming to improve healthcare outcomes and might also promote the growing demand for advanced eyewear.(Source: euroblind.org)

Germany Eyewear Market Trends

Germany is one of the key European players in eyewear due to its larger population, mainly among aging citizens. Many reports state that the adult population is expected to reach around 24 million by 2030. This population is facing various eye issues, which further creates a wider demand for medical-grade eyewear. Moreover, the country is expected to witness a higher demand for eco-friendly frames in the coming years due to changing consumer preferences, improving its manufacturing capabilities. The World Bank data mentioned that Germany's exports of Frames and mountings for spectacles, goggles or was $116,894.20 in 2023. (Source: aarpinternational.org)

Asia Pacific is expected to grow at the fastest CAGR during the forecast period of 2025 to 2034. The dominance of the country is attributed to the rising youth population in countries like India, China and Singapore, who have a higher screen time. Many environmental factors also influence the growth of eyewear, like sunglasses for eye protection. The eyewear market is expected to grow rapidly as companies are innovating multifunctional glasses, which can be used for fashion and protection. The rising social media presence is also expected to help the market grow, mainly targeting the youth.

China Eyewear Market Trends

China stands as a prominent player in the Asian market due to the higher prevalence of myopia. For instance, in China, myopia (nearsightedness) is a widespread issue, particularly among children and adolescents. In 2024, studies indicate that myopia prevalence among adolescents aged 12-15 in Shandong Province was 71.34%, with rates increasing with age and peaking at 73.12% for 15-year-olds. The country is also prominent due to its manufacturing capabilities for local and global brands. The country is also set to focus on reducing its myopia rates, including a goal to lower the cases among primary school children to below 38% by 2030.(Source: sciencedirect.com)(Source: www.iapb.org)

What made the prescription (RX) segment dominant in eyewear in 2024?

The prescription (RX) segment stood as the dominant one in 2024. The dominance of the segment is attributed to the higher prevalence of refractive errors like myopia, hyperopia, astigmatism and presbyopia, which require these glasses for long-term use. The majority of the segment’s growth is also driven by the rising use of smartphones, laptops, and Televisions among the young population. The eyewear market is experiencing rapid growth as companies are advancing in these glasses by innovating blue-light filtering lenses and customized frames according to consumer demand. Moreover, the medical coverage is also being covered under RX glasses, which will help towards the growth in future.

The sunglasses segment is expected to grow at the fastest CAGR during the forecast period of 2025 to 2034. The growth of the segment is attributed to the rising awareness regarding UV rays, which cause damage to the human eyes. The eyewear market is expanding rapidly, as many companies are investing in social media marketing through influencers and celebrities, which helps in attracting more consumers. This popularity is also gaining demand due to the rising market competitiveness, which helps in targeting multiple audiences. The rising outdoor travel activities like cycling, hiking and beachwear are also expected to help sunglasses gain popularity due to direct sun exposure.

How did the brick-and-mortar dominate the distribution of eyewear in 2024?

The brick-and-mortar segment generated the highest revenue share in 2024. The dominance of the segment is attributed to the higher consumer preference for physical checking of the glasses. Moreover, many brands are investing in physical stores to attract more consumers. The eyewear market is growing significantly as the majority of the players are LensCrafters, Specsavers, Lenskart and many more. Many industry players have adopted their stores near eye clinics, which is helping them to attract a wider consumer base.

The e-commerce segment is expected to grow at the highest CAGR during the forecast period of 2025 to 2034. The growth of the segment is attributed to the changing consumer preferences for convenient shopping. Moreover, these online platforms have also adopted advanced technologies like AI, which are helping consumers make more precise shopping decisions, with digital try-on options. AI is also helping in boosting consumer engagement through data analysis, which helps them in reaching their target audiences. The developing areas are also witnessing a surge in smartphone and internet penetration, which is expected to help them grow more rapidly in future. Additionally, these channels are also providing discounted items to consumers due to the rise of D2C businesses.

How did $0-$150 dominate the price range of eyewear in 2024?

The $0-150 segment accounted for the highest revenue share in 2024. The dominance of the segment is attributed to the higher product demand among the budget-conscious consumers in the developing areas. The Majority of the prescription glasses are being sold widely, where the price range is considered to be ideal. The eyewear segment is expected to grow rapidly as many students, professionals and older adults are being affected by eye-related conditions. The wider business expansion of local players is expected to help the segment grow more rapidly in the future. Many global brands are also investing in these regions, which mainly require lower production costs that will help the price segment more efficiently.

The $300-500 segment is expected to grow at the fastest CAGR during the forecast period of 2025 to 2034. The growth of the segment is attributed to the rising consumer shift towards premium sunglasses. The luxurious brands have managed to portray eyewear as a luxury, where they are also innovating personalized and customized products for the consumers. These brands are also investing in celebrity marketing, which is promoting the growth of these luxurious glasses from brands like Gucci, Prada, Ray-ban and many more. The technological adoption is also expected to develop products like ‘Smart Glasses’ with the functional capability of a built-in camera and audio options.

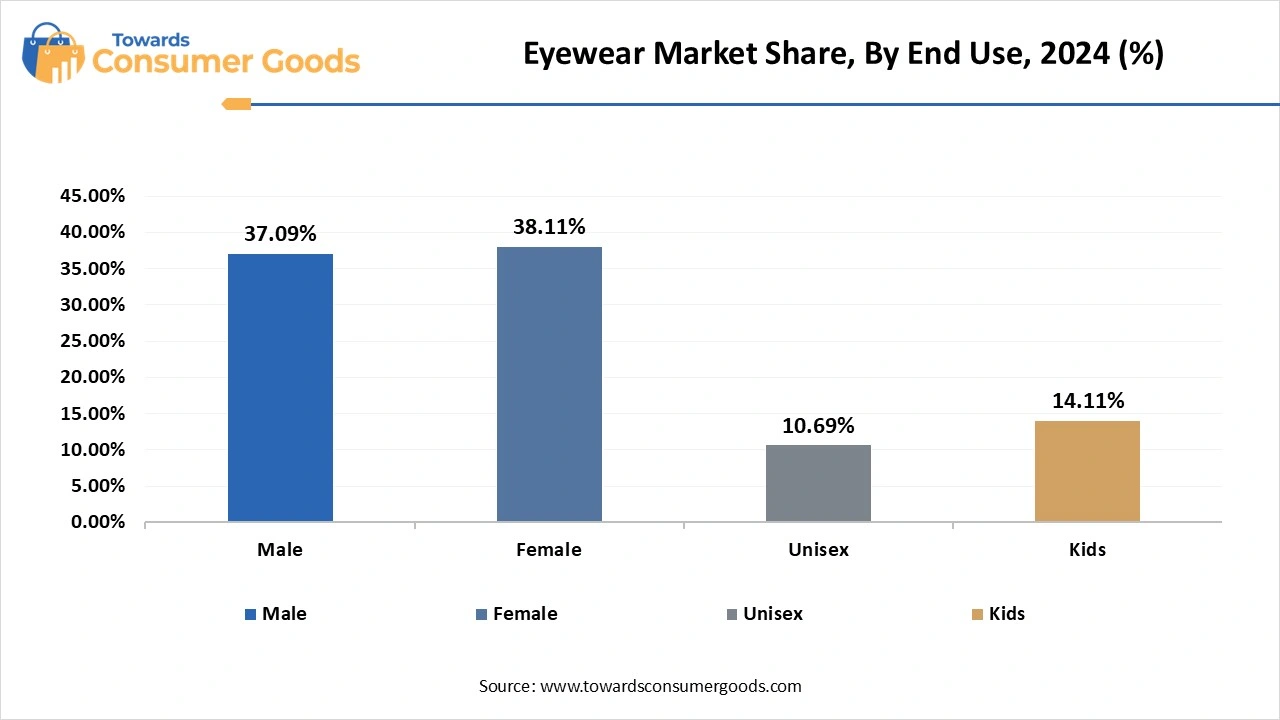

What made the female dominant in the use of eyewear in 2024?

The female segment generated the largest revenue share in the year of 2024. The eyewear market is expanding rapidly as the current fashion trends are more aligned with female interests, which gives an upper hand for companies to promote sunglasses for fashion and lifestyle. The segment is also expanding rapidly due to the increasing eye health awareness among females, who are adopting vision care in their daily routines. The women's user group is often more interested in investing in separate eyewear for various occasions like screen use, sun protection, driving and many more.

The kids segment is anticipated to expand at the fastest CAGR during the forecast period of 2025 to 2034. The growth of the segment is attributed to the rising incidences of visual problems among children, where factors like excessive screen use are influential. Moreover, the families in the urban areas are investing in eyewear as a precaution for their children, which may prevent them from any severe eye conditions. The governments are also investing in eye checkup campaigns in many educational institutions, which will help to create demand for children-oriented products.

Xiaomi

By Product

By Distribution Channel

By End User

By Price Range

By Region

The global handbag market size is calculated at USD 56.85 billion in 2024, grew to USD 60.57 billion in 2025 and is predicted to hit around USD 107.22...

Based on comprehensive market projections, the global connected apparel market size accounted for USD 2,793.79 billion in 2025 and is forecasted to hi...

The U.S. range cooker market size was valued USD 1.95 billion in 2024 and is projected to grow from USD 2.13 billion in 2025 to USD 4.81 billion by 20...

July 2025

July 2025

July 2025

July 2025