July 2025

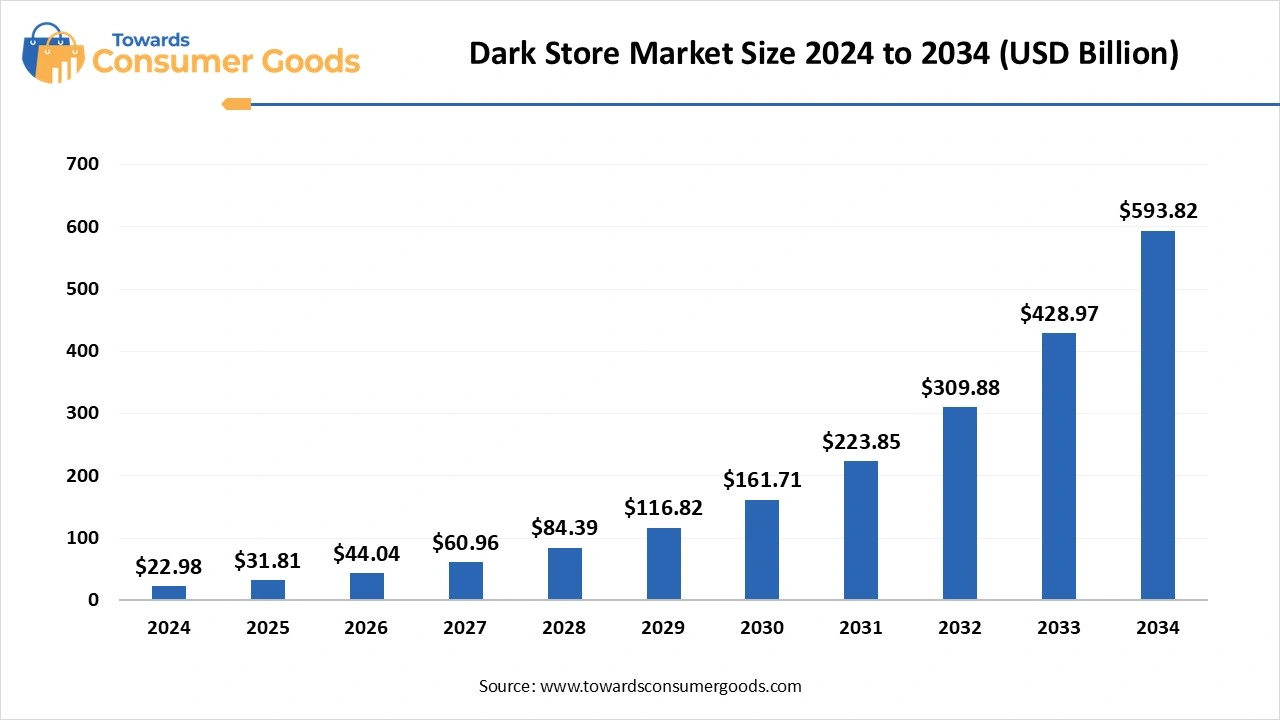

The global dark store market size was calculated at USD 22.98 billion in 2024 and is projected to hit around USD 593.82 billion by 2034 with a CAGR of 38.43%. The rapid growth in e-commerce platforms and consumer shift towards online grocery shopping have driven the market demand.

Why Consumers Prefer Online Platforms: An In-Depth Look at the Dark Store Market

The dark store market is revolutionizing the way online shoppers access fast-moving consumer goods, particularly groceries and perishable items. These specialized facilities, often referred to as micro-warehouses, operate as retail distribution centers that are inaccessible to the public. Instead of traditional retail setups, dark stores are expertly designed for the rapid picking, packing, and shipping of online orders. This model is crucial in facilitating ultra-fast local delivery, which speaks to the increasing demand for convenience and speed in the contemporary online shopping experience.

The core of dark store operations lies in their rigorous focus on expediting order fulfillment. Many employ cutting-edge automation technologies, such as goods-to-person systems, which significantly reduce the time required for order picking. Strategically positioned close to populated areas, dark stores enable retailers to offer rapid delivery options, sometimes even on the same day, or instantaneous pickup services.

The growth trajectory of the dark store market is remarkable, fueled by the surge in online grocery shopping, advancements in e-commerce technology, and an ever-increasing consumer appetite for prompt and efficient online shopping solutions. Innovations in technology, particularly automation and machine learning, play pivotal roles in driving this market's expansion. As consumers continue to lean towards online grocery purchases, the demand for these effective fulfillment centers like dark stores has never been higher.

| Report Attributes | Details |

| Market Size in 2025 | USD 31.81 Billion |

| Expected Size in 2034 | USD 593.82 Billion |

| Growth Rate from 2025 to 2034 | CAGR of 38.43% |

| Base Year of Estimation | 2024 |

| Forecast Period | 2025-2034 |

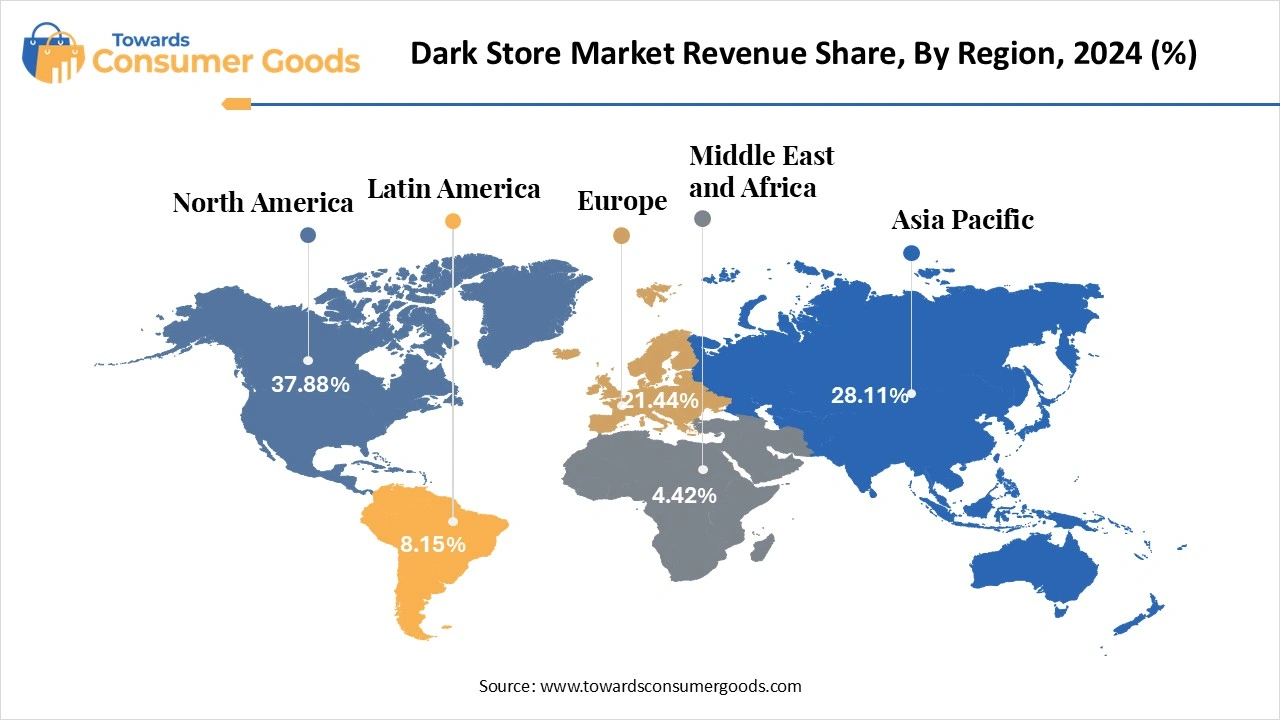

| Dominant Region | North America |

| Segment Covered | By Category, By Age Group, By Distribution Channel, By Region |

| Key Companies Profiled | Amazon.com, Inc., Auchan, Dunzo Digital Private Limited, Flipkart Private Limited, Instacart, Swiggy, Target Corporation, Walmart, Inc., Grab, Zepto |

The dark store market is brimming with opportunities for businesses to capitalize on the increasing consumer preference for rapid fulfillment, minimal delivery times, and streamlined inventory management. The rising trend of quick commerce is significantly propelling market growth, with projections indicating continued expansion in the forthcoming years.

The core advantage of dark stores lies in their ability to efficiently pick and pack orders, thereby optimizing the online fulfillment workflow. By situating these dark stores in high-demand urban areas, businesses can achieve remarkably fast delivery times sometimes within mere minutes catering to consumers’ desires for instant gratification. This model also allows retailers to consolidate their inventory, eliminating the need for multiple stock points across diverse locations, which enhances overall stock management and drives cost efficiencies.

Furthermore, dark stores can capitalize on lower rental costs by being located in areas where real estate is more affordable. This model allows for significant reductions in labor expenses, positioning dark stores as a more financially viable alternative when compared to traditional retail outlets. Moreover, they provide retailers with the flexibility and responsiveness required to adapt quickly to shifting consumer preferences, market dynamics, and seasonal variations. Going beyond groceries, the potential of dark stores extends to offering prepared meals, household necessities, and niche specialty products.

Despite the promising landscape, the dark store market is not without its challenges, primarily concerning logistics, real estate, and labor. High costs associated with real estate and labor can become a significant burden, complicating the establishment and management of dark stores. The complexity of inventory management becomes particularly evident when managing a diverse range of products in dark store facilities. It requires sophisticated coordination and real-time inventory control systems to ensure accurate order fulfillment and minimize delays. Additionally, external disruptions such as transportation strikes, supply shortages, or unforeseen global events can adversely affect the flow of goods, undermining operational efficiency and consumer satisfaction.

Maintaining temperature control for perishable goods like food and pharmaceuticals also presents a notable operational challenge. Setting up a robust network of dark stores, particularly in densely populated urban environments, incurs hefty expenses due to elevated real estate and labor costs, making it critical for businesses to strategically navigate these hurdles to capitalize on the market's potential.

The adult segment holds a dominant position in the dark store market in 2024, influenced by multiple key factors. This age group enjoys a higher disposable income, which allows for greater spending on products and services, including those offered by dark stores. They increasingly seek convenience and rapid shopping experiences, making them more inclined to utilize dark store services for both routine purchases and impulse buys. Additionally, there is a noticeable shift among adults toward health-conscious and eco-friendly products, which many dark stores are strategically catering to. Their comfort and experience with online shopping make adults particularly receptive to the benefits of quick delivery services provided by dark stores.

The elderly segment is emerging as the fastest growing in the dark store market during the forecast period. This growth can be attributed to several compelling factors. Many elderly individuals experience limited mobility, making grocery delivery services an invaluable resource for maintaining their independence and ensuring they have access to essential goods without the need to venture out to busy grocery stores. As grocery retailers continue to invest in enhancing their omnichannel capabilities, they’re refining their storage and distribution processes to effectively meet this demographic's growing demand for dark store services. The increasing prominence of e-commerce in this sector positions dark stores as a practical solution for delivering groceries directly to elderly individuals.

The grocery segment led the dark store market in 2024, largely propelled by a robust consumer appetite for convenient grocery delivery and the accelerating trend of online grocery shopping. In today's fast-paced world, the allure of having groceries delivered straight to one's doorstep is compelling. Dark stores streamline the process of fulfilling online grocery orders, significantly reducing the time and effort required compared to navigating traditional brick-and-mortar establishments.

The dairy segment expects the significant growth in the market during the forecast period, driven by heightened consumer interest in dairy products especially value-added offerings such as yogurt, flavored milk, and fortified items. Health-conscious shoppers are actively seeking dairy products that provide additional benefits, including probiotics, further fueling this surge in demand. The convenience offered by dark stores for handling online grocery orders, particularly for items like dairy, is well-suited to the trend of frequent, smaller shopping trips focused on speed and ease of purchasing.

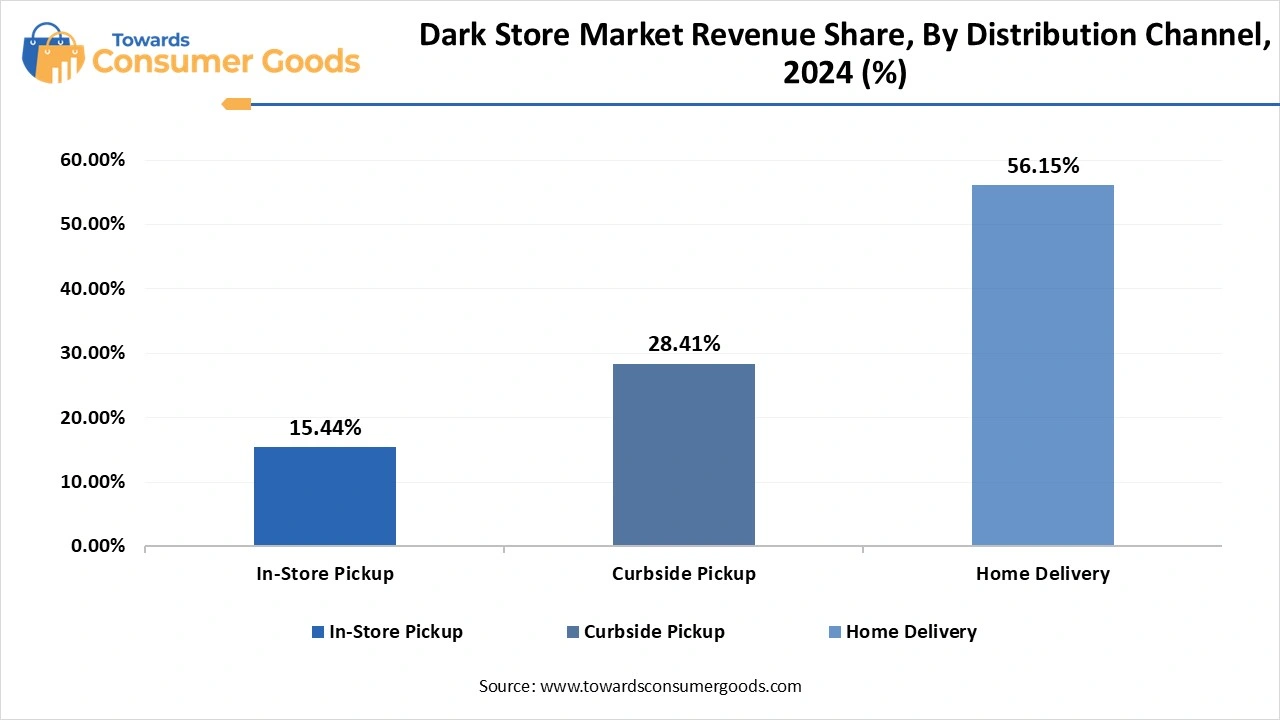

The home delivery segment led the dark store market in 2024. The COVID-19 pandemic has also contributed to an increased preference for contactless shopping options, further propelling the growth of home delivery. As modern consumers lead increasingly busy lives, the ability to shop from home and receive prompt deliveries has gained immense popularity, encouraging a broader range of products to become available through delivery options.

The curbside pickup segment has rapidly ascended to become the fastest-growing avenue within the dark store market during the forecast period. Its appeal lies in the seamless, quick, and contactless shopping experience it offers consumers, which has become particularly coveted in today’s shopping landscape. This convenient collection method provides a safe alternative for order retrieval, particularly appealing in the post-pandemic era when consumers are increasingly prioritizing safety and efficiency.

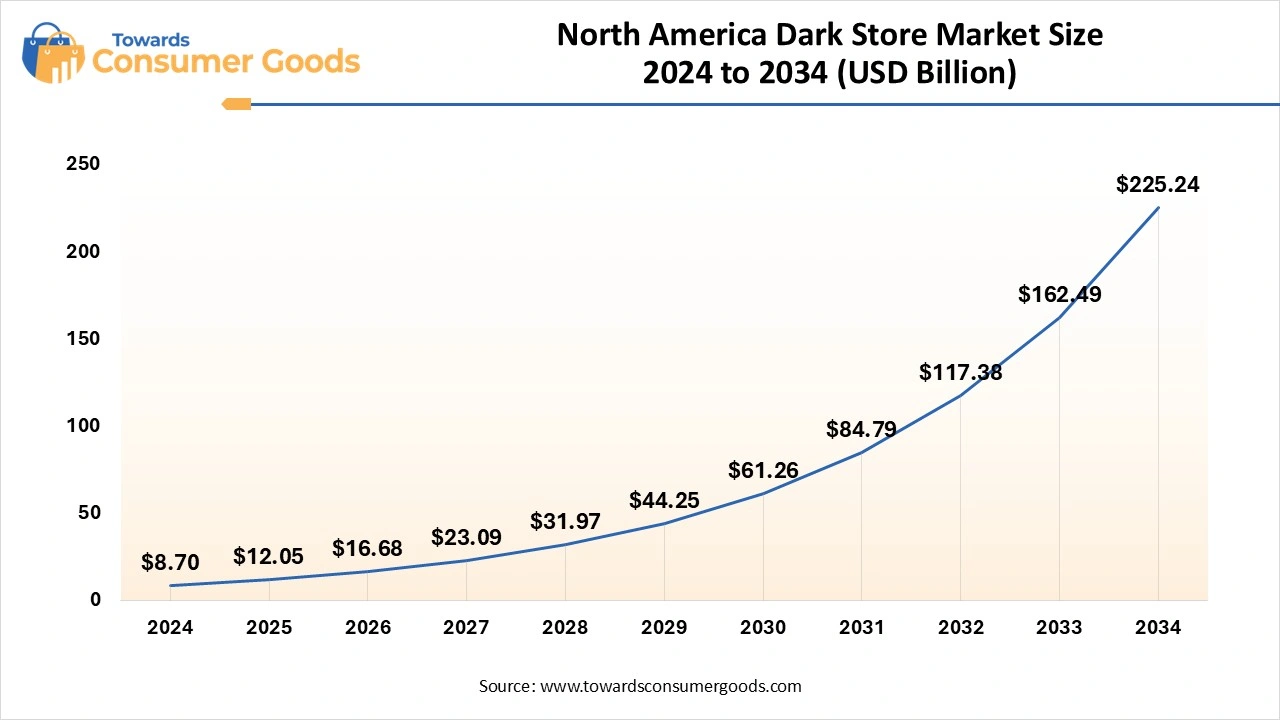

The North America dark store market size was valued at USD 8.70 billion in 2024 and is expected to be worth around USD 225.24 billion by 2034, growing at a compound annual growth rate (CAGR) of 38.46% over the forecast period 2025 to 2034. North America has established itself as a leader in the dark store market in 2024, a position that can be largely attributed to its sophisticated e-commerce infrastructure and the growing consumer demand for expedited deliveries. With a keen focus on both technology and advanced logistics, North American businesses are effectively streamlining their operations to adapt to the evolving preferences of consumers.

The e-commerce landscape in North America is not only well-developed but also characterized by a diverse array of online retailers and an expansive consumer base. As consumer expectations for rapid delivery intensify, dark stores, known for their strategically located facilities and efficient operational frameworks, are uniquely equipped to satisfy this urgent demand. Industry giants such as Amazon, Walmart, and Target have successfully embraced the dark store model, setting benchmarks within the retail space that encourage other businesses to follow suit and thus reinforcing North America's position as a frontrunner.

Asia-Pacific expects the significant growth in the market during the forecast period, especially in rapidly developing nations such as India and China. This growth can be attributed to multiple factors. The surge in e-commerce adoption, coupled with widespread smartphone and internet penetration, has made a significant impact on consumer behavior, particularly among the younger demographic. This tech-savvy population exhibits a pronounced preference for convenience, fueling a notable expansion in online shopping.

As urbanization accelerates across the Asia-Pacific, especially in Indian cities, there is an increasing demand for logistical efficiency and innovative delivery solutions, including dark stores that cater to this need. The e-commerce sector in this region is booming, supported by factors such as the rising number of internet users, the proliferation of mobile technology, and a growing inclination toward online retail.

Innovation- In February 2025, DTDC announced the launch of its first dark store in Bengaluru, marking its entry into the rapid commerce sector. This initiative aims to enhance the urgency of delivery services, targeting delivery windows of 2-4 hours as well as same-day options. (Source: businesstoday)

Innovation- In January 2025, Zepto made headlines by launching a women-only dark store in the Madambakkam area of Chennai, an innovative concept designed to cater specifically to the shopping preferences and needs of female consumers. (Source: business standard)

Innovation- In August 2024, Ola Cabs, having rebranded itself as Ola Consumer, revealed plans to introduce a fully automated dark store. This initiative illustrates the company’s commitment to leveraging technology to enhance efficiency and meet consumer demands in the rapidly evolving retail landscape. (Source: ndtvprofit)

Based on comprehensive market projections, the global knife market size was valued at USD 4.88 billion in 2024. The market is projected to grow from U...

The U.S rum market size was estimated at USD 3.19 billion in 2024 and is predicted to increase from USD 3.35 billion in 2025 to approximately USD 5.17...

July 2025

July 2025

July 2025

July 2025