July 2025

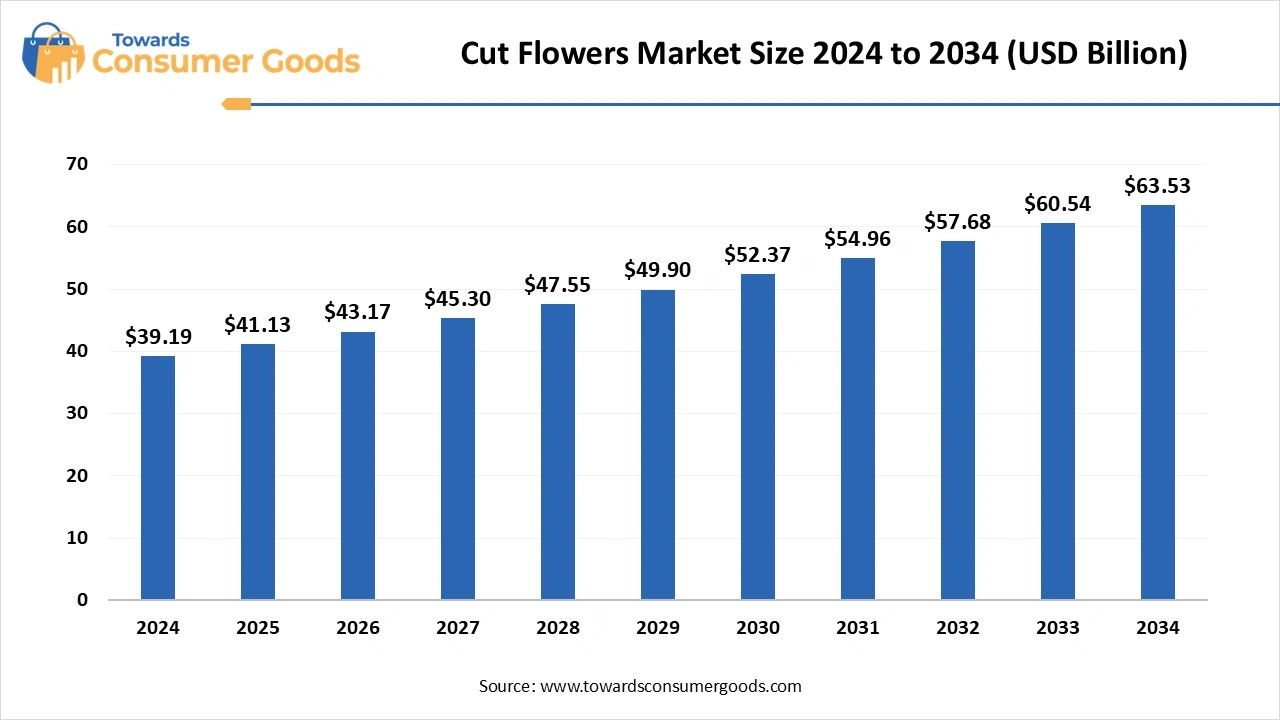

The global cut flower market size was valued at USD 39.19 billion in 2024 and is estimated to hit around USD 35.12 billion by 2034, growing at a compound annual growth rate (CAGR) of 4.95% during the forecast period 2025 to 2034. This market is growing due to the increasing use of flowers in personal gifting, event decoration, and the hospitality industry, along with rising consumer preference for aesthetic lifestyle products.

The global cut flower market is expanding rapidly, driven by cultural customs, rising urbanization, and consumers' preference for natural and ornamental accents in events and homes. These days flowers are a must for social gatherings, weddings, and business gifts. Additionally, floral aesthetics are now popular in interior design, influencing both retail and hospitality settings. Social media-on-demand delivery services and e-commerce platforms have completely changed how people buy and view flowers.

The use of pesticides and water is being reduced, and industry participants are moving toward environmentally friendly farming practices. Growing consumer awareness of environmental issues is reflected in the popularity of carbon labeling, biodegradable packaging, and local sourcing. Furthermore, florists are using digital interfaces and subscription models to customize arrangements which increase client retention and engagement.

| Report Attributes | Details |

| Market Size in 2025 | USD 41.13 Billion |

| Expected Size by 2034 | USD 63.53 Billion |

| Growth Rate from 2025 to 2034 | CAGR 4.95% |

| Base Year of Estimation | 2024 |

| Forecast Period | 2025 - 2034 |

| High Impact Region | Europe |

| Segment Covered | By Product, By Application, By Distribution Channel |

| Key Companies Profiled | The Queen’s Flowers Corp, Selecta Cut, Flowers SAU, Sher Holland BV, Multiflora Corp, Rosebud Ltd, Karen Roses Ltd, Washington Bulb Co Inc ,Dummen ,Orange Holding BV ,Esmeralda Farms LLC Marginpar BV |

Is Urban floriculture the next big opportunity?

In crowded cities rooftop greenhouses, vertical farming, and community floriculture initiatives are becoming more common. These programs give people year-round access to fresh flowers, lower transportation costs, and boost local jobs. Urban floriculture has the potential to transform retail supply chains and lower carbon footprints due to the high demand in cities and the growing inclination for hyperlocal products.

Restraint

Climate variability and perishability challenge supply stability

The cut flower industry is vulnerable to erratic weather patterns, pest outbreaks, and logistic delays, which affect bloom quality and availability. Consistent product delivery in emerging economies is hampered by cold chain inefficiencies, short shelf lives, and a lack of standardization. For stakeholders to overcome these obstacles, they must make investments in automated post-harvest handling predictive analytics and climate-resilient crops.

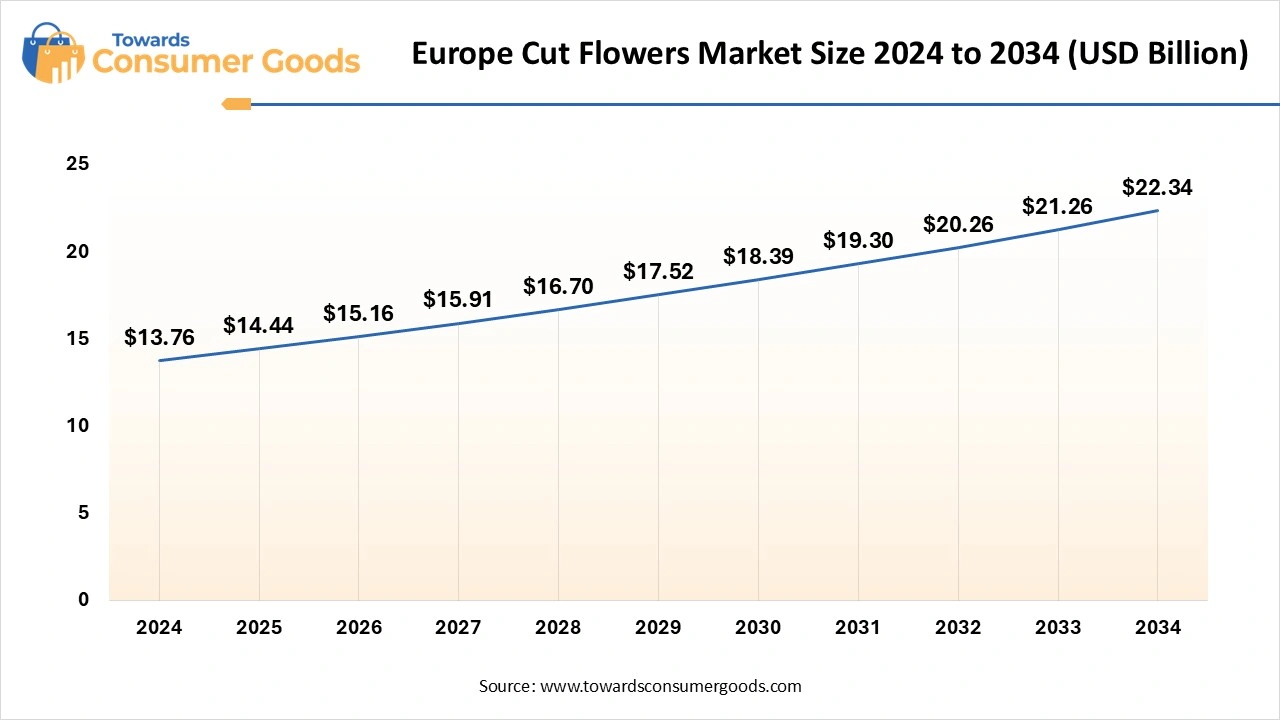

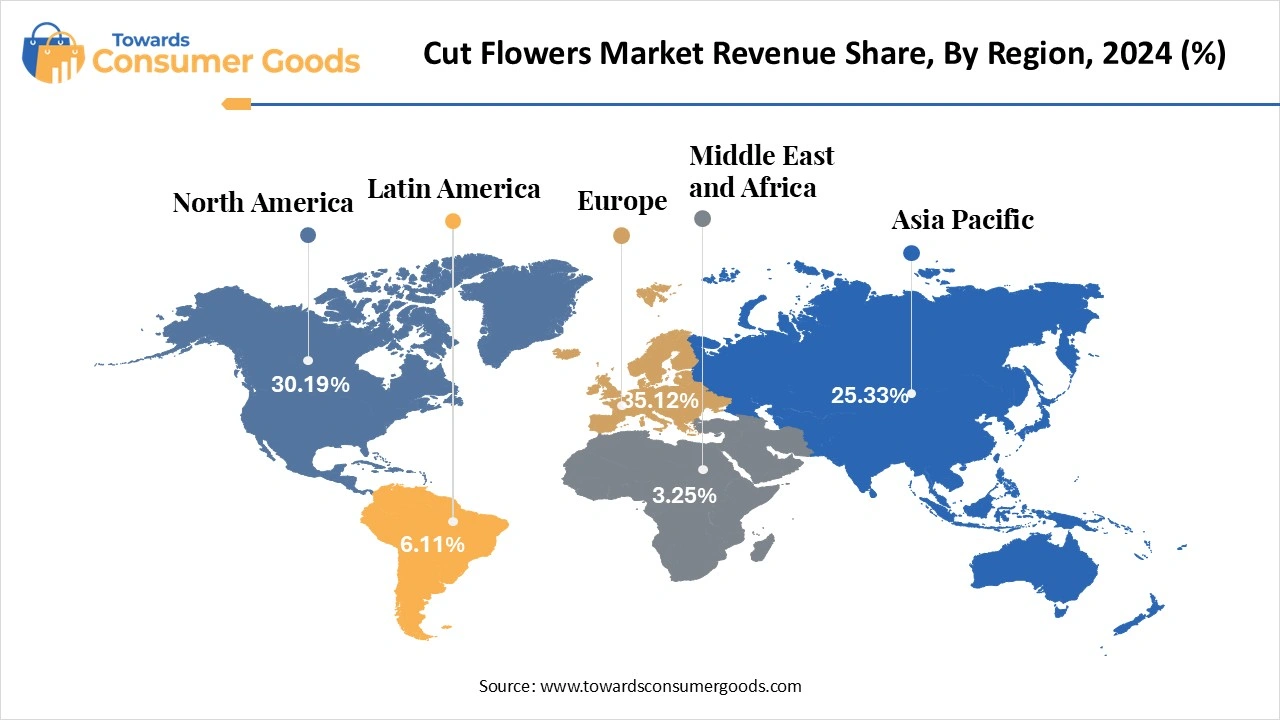

Europe dominated the global cut flowers market in 2024, The Europe cut flowers market size was valued at USD 13.76 billion in 2024 and is expected to be worth around USD 22.34 billion by 2034, exhibiting a compound annual growth rate (CAGR) of 4.97% over the forecast period 2025 to 2034. driven by a floriculture sector and a robust demand for ceremonial and decorative purposes. Customers' preference for fresh cut flowers for a variety of occasions as well as sophisticated logistics and effective distribution channels benefit the area its dominant position is further supported by its retail presence and long-standing cultural customs. Europe's competitive advantage in quality and variety is also being maintained by investments in innovative breeding methods and sustainable farming practices.

Asia Pacific was the fastest-growing region in the cut flower market in 2024, fueled by the expansion of the middle-class growing urbanization and growing appreciation for the beauty of flowers. Cut flowers became increasingly popular in both the personal and business markets as a result of shifting lifestyle trends and a rise in gift-giving customers. This quick expansion was aided by growing online and retail distribution. Infrastructure and production investments are also being fueled by government programs that support floriculture and its export potential.

North America held a significant share of the cut flowers market in 2024, thanks to steady demand across residential, hospitality, and event segments. The market has become even more robust due to the growth of online flower delivery services and advancements in preservation and packaging. All year long there was a steady consumer interest in both imported and domestically grown flowers. Furthermore, eco-friendly product lines and sustainability trends are influencing supplier strategies and customer preferences.

Rose cut flowers segment dominated the market in 2024 owing to their enduring appeal, particularly during festive and romantic settings. Roses are a popular choice for bouquets for weddings and events because they are widely accessible and come in a variety of colors. They are the most popular flower type in the world due to their symbolic significance and are frequently used as gifts. In addition, a lot of brands are catering to premium and sustainable tastes by providing eco-friendly rose varieties and preserved roses. Sales at high-profit margins on Valentine's Day anniversaries and holidays bolster the performance of this segment even more.

Lilium cut flowers segment is anticipated to witness the fastest growth over the forecast period. Lilies are becoming more and more popular because of their exquisite look, lengthy vase life, and culturally significant symbolic meanings. The segment's growth is being aided by their growing demand for exquisite floral arrangements and settings for memorials or spiritual events. To appeal to younger consumers hybrid varieties with fragrance enhancements and vivid colors are being developed. Additionally, they are a favorite among both online and physical florists due to their durability in both transportation and display.

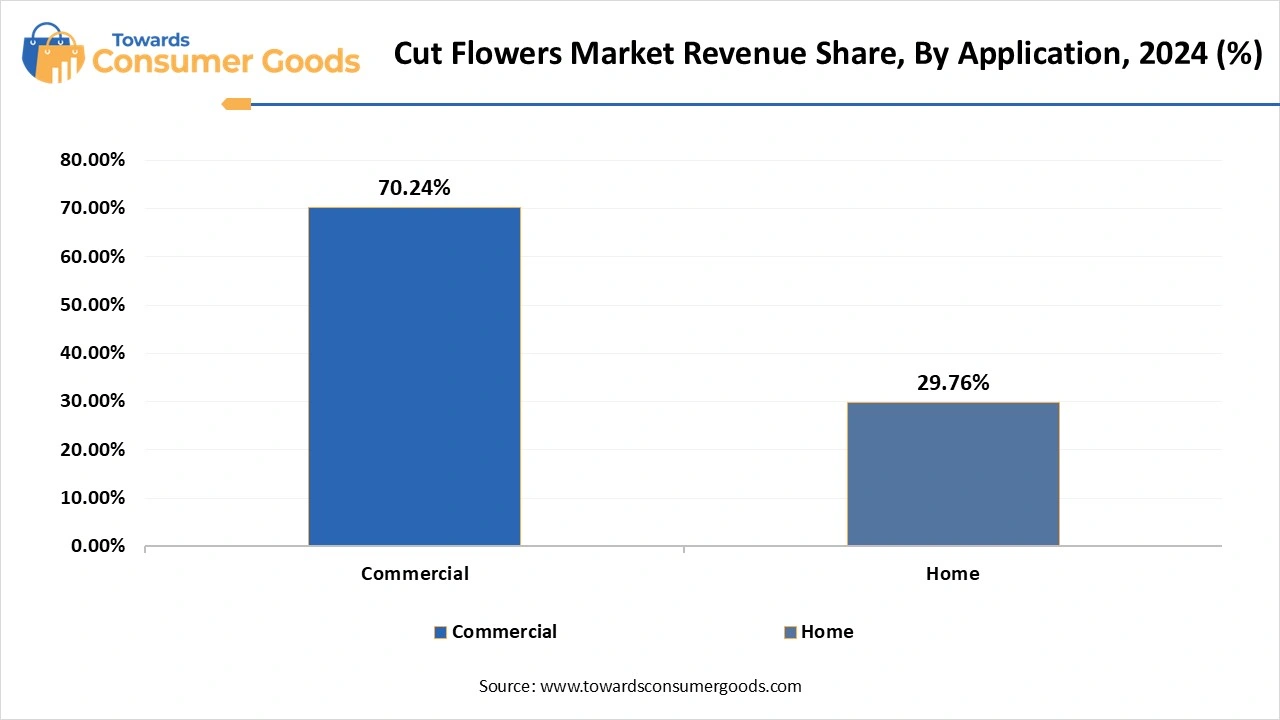

Commercial applications segment dominated the market in 2024. Cut flowers are brought in bulk by florist's event coordinators and hospitality companies for ambiance and decoration. Strong commercial sales are ensured throughout the year by the bulk demand generated by weddings' corporate events, hotels, and restaurants. This market segment is further supported by expanding events management companies and rising luxury travel expenditures. Business gifting trends and international flower expos are also important factors.

Home applications segment is anticipated to witness the fastest growth over the forecast period as more and more customers purchase flowers for wellness and home decor. This trend is largely driven by changes in post-pandemic lifestyles and the growing popularity of using fresh flowers to beautify interior spaces. DIY floral decor influences marketing and subscription flower services are growing in this market. The calming effects of floral arrangements and growing awareness of mental health issues are driving daily demand from homes.

Supermarkets and hypermarket segment dominated the market in 2024. These stores are a popular choice for both regular and impulsive floral purchases because they provide convenience, affordable prices, and premade bouquets. Freshness and daily restocking are guaranteed by their robust supply chain partnerships and wide accessibility. Prominent merchants are also incorporating seasonal gift arrangements and flower kiosks to increase foot traffic. In-store promotions and solid vendor relationships maintain high levels of customer engagement.

Online sales segment is anticipated to witness the fastest growth over the forecast period. E-commerce platforms provide last-minute gifting options, doorstep delivery, and personalized options. Digital bouquet previews and AI-powered recommendations are examples of tech-driven innovations that increase the allure of online flower shopping. Increased customer satisfaction and retention are fueled by subscription boxes, real-time order tracking, and mobile app interaction.

By Product

By Application

By Distribution channel

By Geography

The global electric toothbrush market size was estimated at USD 3.51 billion in 2024 and is predicted to increase from USD 3.67 billion in 2025 to app...

The global premium cosmetics market size was grew at USD 165.2 billion in 2024, grow to USD 175.77 billion in 2025 and is anticipated to hit around US...

Anticipated market trends show that, the global outdoor lighting market size accounted for USD 19.11 billion in 2025 and is forecasted to hit around U...

According to market forecast, the U.S. oven market size was estimated at USD 1.95 billion in 2024 and is predicted to increase from USD 2.00 billion i...

July 2025

July 2025

July 2025

July 2025