July 2025

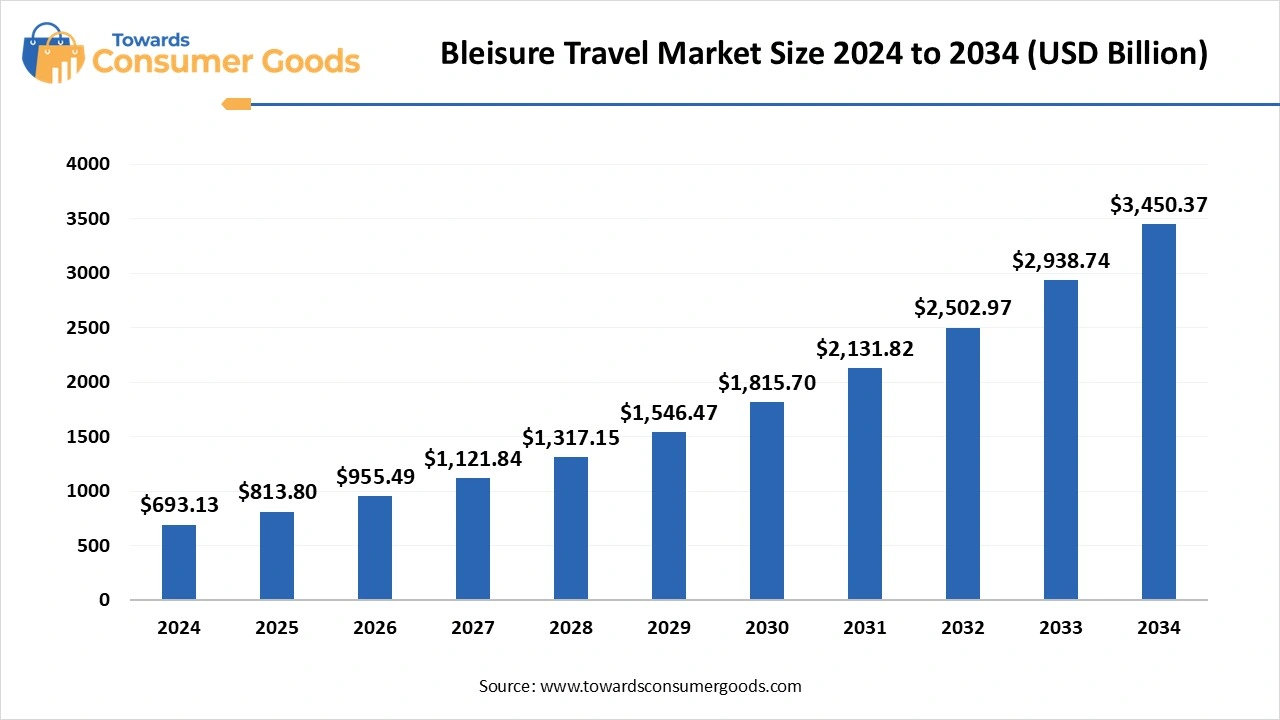

The global bleisure travel market size accounted for USD 693.13 billion in 2024 and is predicted to increase from USD 813.8 billion in 2025 to approximately USD 3450.37 billion by 2034, expanding at a CAGR of 17.41% from 2025 to 2034. A significant rise in remote and hybrid working models, increasing corporate travel budgets post-COVID recovery, and a growing millennial and Gen Z workforce are leading the market towards development.

The bleisure travel market is undergoing a significant transformation, reflecting changing workforce expectations and a global lifestyle shift. With corporate culture becoming more flexible and human-centric, business travel is no longer confined to boardrooms and briefcases; it now extends to beaches, museums, and cultural landmarks.

Corporations are increasingly encouraging bleisure as a part of employee engagement and retention strategies. Meanwhile, travel and hospitality providers are reshaping their offerings to serve this hybrid traveler, offering packages that combine corporate perks with leisure experiences, seamless itinerary extensions, co-working hotels, and destination-based wellness programs.

Airlines are offering discounted return trips for extended stays.

The market is also expanding to second-tier cities and emerging destinations that combine business viability with rich leisure offerings, opening new regional growth corridors. As organizations rethink mobility and travelers seek deeper experiences, the bleisure model is becoming not just a trend but a strategic shift in global travel dynamics.

| Report Attributes | Details |

| Market Size in 2025 | USD 813.8 Billion |

| Expected Size by 2034 | USD 3450.37 Billion |

| Growth Rate from 2025 to 2034 | CAGR 17.41% |

| Base Year of Estimation | 2024 |

| Forecast Period | 2025 - 2034 |

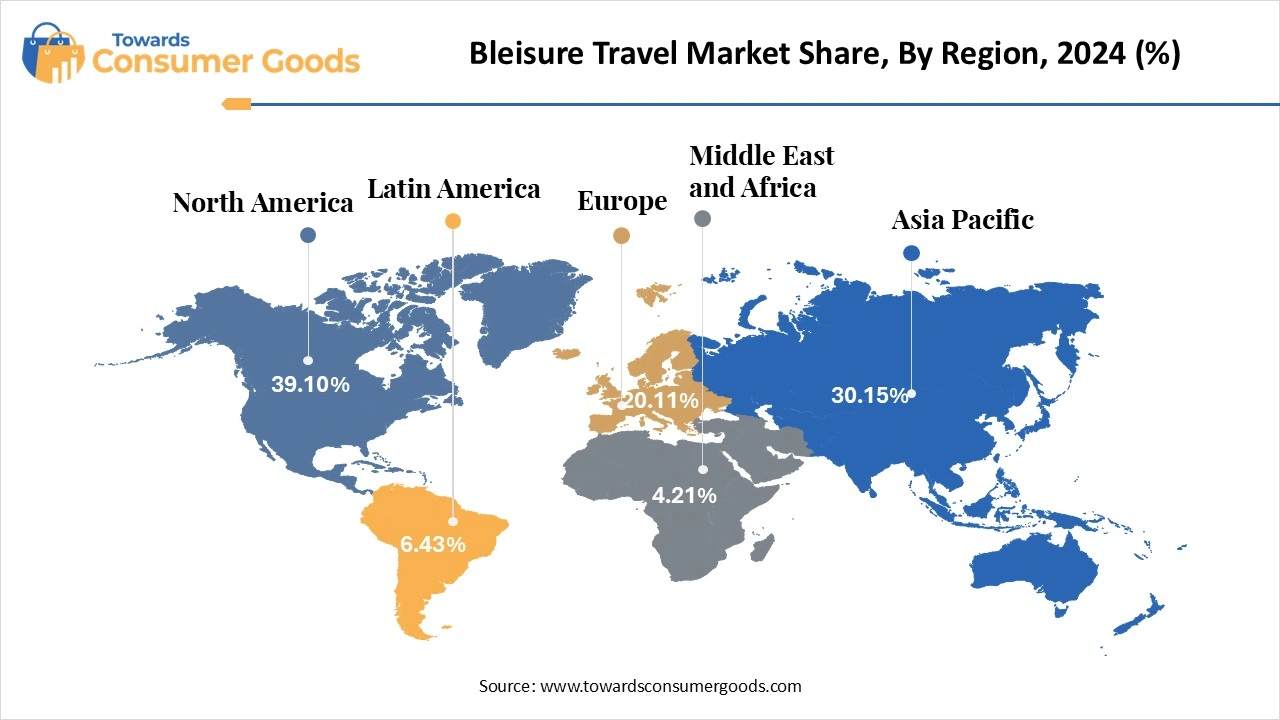

| Dominant Region | North America |

| Segment Covered | By Tour Type, By Travel Type, By Travel Duration, By geographical region |

| Key Companies Profiled | American Express Travel, Expedia, Inc., BCD Travel, Travel Leaders, JTB Business Travel, CT Business Travel, IMC International, AVIAREPS AG, Carlson Wagonlit Travel, World Travel Holding Inc. |

| (Mid-Career Executives) 36-50 age | (Senior Professionals) 51+ |

| Often travel frequently for business and are loyal to premium hotel chains and airline brands. More likely to combine family travel with business commitments. Prioritize comfort, seamless logistics, and wellness over adventure. Look for extended stay options, high-speed internet, meeting facilities and leisure services for kids and spouses. | This segment includes senior executives, business owners, and post-retirement professionals who often travel for high-level meetings, conferences, or frequent bleisure travelers, but when they do, they prefer luxury, heritage stays, and wellness retreats. Emphasis on personalized services, safety, and premium experiences may involve spouse or extended family in the leisure part of travel. |

As the global workforce evolves, the bleisure travel market finds itself at the heart of a transformative opportunity, the shift from material consumption to experience-driven living. This behavioral evolution, amplified by the pandemic, has opened a golden gateway for the travel and hospitality industry to reinvent how business travel is perceived and sold. Remote and hybrid work flexibility. Employees can now travel beyond fixed workdays, extending trips or working from scenic locations, merging productivity with pleasure. These cohorts value and are far more likely to take a business trip as an opportunity to explore, unwind, and connect with local culture. Organizations are incorporating bleisure into their travel policies to promote work-life balance, reduce burnout, and increase employee satisfaction. Apps and platforms now curate AI-based recommendations for leisure extensions around business itineraries, making bleisure planning seamless and scalable. As travelers seek unique, less crowded destinations, countries are investing in tourism infrastructure beyond metros, unlocking vast, untapped bleisure potential.

Corporate Caution in a Connected World

Despite its rising popularity, the bleisure travel market faces a set of restraining forces that could slow its widespread adoption, particularly in structured or highly regulated corporate environments. Policy ambiguity and liability concerns: Many organizations are reluctant to formalize bleisure in their corporate travel policies due to insurance, security, and tax implications associated with combining personal time with business duties. Data security and compliance risks. Travelling with sensitive corporate data to unsecured or public environments poses a cybersecurity threat, especially for sectors like finance, law, and defence. Budget constraints and approval complexities.

Employers may hesitate to fund trips that blend work with leisure, especially in cost-sensitive industries. Approval workflows for such trips are often unclear or restrictive. Workforce disparity Not all employees can benefit equally. Roles that require physical presence (e.g., manufacturing or healthcare) may not enjoy the same flexibility, raising questions of equity and fairness. Cultural and regional limitations.

In conservative or formal business cultures, combining leisure with work may still be viewed as unprofessional or inappropriate, particularly in parts of Asia, the Middle East, and Eastern Europe. While bleisure is gaining momentum, its long-term success hinges on resolving structural barriers, establishing clear governance, and ensuring that digital and ethical safeguards are embedded within the travel policies of tomorrow’s corporations.

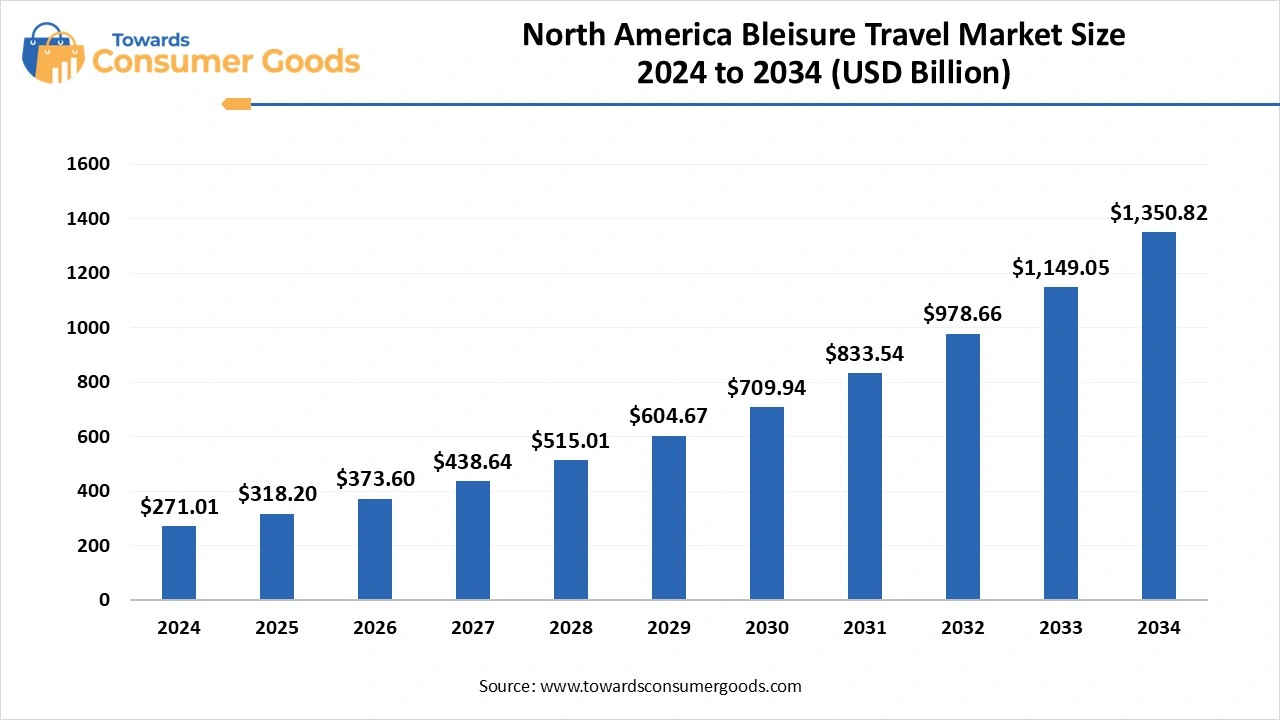

Why Is North America Leading the Bleisure Charge?

The North America bleisure travel market is expected to increase from USD 318.20 billion in 2025 to USD 1,350.82 billion by 2034, growing at a CAGR of 17.43% throughout the forecast period from 2025 to 2034.

North America, particularly the United States, continues to dominate the bleisure travel market due to its mature corporate culture, flexible work arrangements, and well-established travel infrastructure. Businesses in this region especially tech, finance, and consultancy firms have been early adopters of progressive travel policies that support the blending of business and leisure. Employees are often encouraged to extend business trips for personal enjoyment, with some companies even offering subsidized leisure components as part of corporate wellness and retention programs.

The diversity of destinations from the vibrant cultural hubs of New York and Chicago to the scenic getaways of Colorado and California provides endless opportunities for leisure around work commitments. Moreover, North America’s advanced digital infrastructure, extensive airline connectivity, and thriving hospitality sector make it easy to plan, manage, and enjoy bleisure trips efficiently.

With the rebound of corporate events, conferences, and exhibitions post-COVID, cities like Las Vegas, San Francisco, and Toronto have witnessed a surge in extended-stay bookings, reinforcing the region’s position as the global frontrunner in bleisure travel.

Why is Europe Emerging as the Fastest-Growing Bleisure Hub?

Europe is rapidly emerging as the fastest-growing region in the bleisure travel market, owing to a unique combination of cultural, geographical, and infrastructural advantages. The region’s strong emphasis on work-life balance aligns naturally with the bleisure concept, encouraging professionals to extend their business trips for personal rejuvenation. The Schengen agreement and Europe’s compact geography allow easy cross-border travel, enabling a business trip to Paris to seamlessly transition into a weekend getaway in Amsterdam, Vienna, or Barcelona.

With the revival of the MICE (Meetings, Incentives, Conferences, and Exhibitions) sector, European cities are witnessing an influx of corporate travelers, many of whom are opting to stay longer and explore more. Hospitality providers across the region have responded with curated bleisure packages, integrating co-working amenities, cultural experiences, and wellness options.

Furthermore, many European governments are embracing remote work trends through the introduction of digital nomad visas and tax-friendly policies. Sustainability also plays a key role in Europe’s bleisure growth, as eco-conscious travelers favor train travel and slow tourism, aligning leisure with responsibility. Together, these factors are transforming Europe into a dynamic and fast-expanding hub for bleisure travel.

Why Is Solo Travel Dominated the Bleisure Space?

Solo travel leads the bleisure market primarily because most business travelers embark on work-related journeys alone. These individuals often use the flexibility and autonomy of solo travel to tailor leisure experiences around their professional agendas. With greater control over schedules and preferences, solo bleisure travelers can easily extend trips, explore local cultures, visit historical sites, or unwind in peace.

This segment is particularly strong among millennials and Gen Z professionals, who value self-exploration and independence. Additionally, solo travelers tend to be more agile, making last-minute decisions and leveraging digital tools for bookings and personalized itineraries. The rise of solo workations and digital nomadism has further solidified this segment’s dominance in the bleisure landscape.

Moreover, the group travel is emerging as the fastest-growing segment in the bleisure market, driven by evolving corporate cultures that encourage team-building and collective experiences. Whether it is departments attending off-site meetings or conferences, or professionals extending trips with friends, family, or colleagues, group bleisure travel is becoming increasingly attractive.

This growth is also supported by the rise of incentive-based travel programs offered by companies as rewards for performance. Group travel often leads to higher per-trip expenditure, benefiting hotels, restaurants, and local tour operators. As businesses recognize the value of shared leisure in enhancing morale and productivity, this segment is expected to accelerate further.

Why Is Domestic Travel the Bleisure Favorite?

Domestic travel continues to dominate the bleisure travel market due to its cost-effectiveness, convenience, and familiarity. Employees are more likely to extend work-related travel when within their home country, as it requires less logistical preparation, fewer formalities, and often shorter travel time. With strong internal connectivity and supportive corporate policies, domestic destinations become easy additions to business itineraries.

Moreover, domestic travel allows travelers to revisit or explore lesser-known locales, blending comfort with novelty. This trend is particularly prominent in larger nations such as the United States, India, or China, where business hubs and leisure destinations often lie within a few hours of each other.

On the other hand, international travel is the fastest-growing segment in the bleisure market, especially among mid-level and senior professionals who attend global conferences, cross-expanding global roles, business travelers are increasingly seizing the opportunity to explore a new country once work concludes.

The allure of experiencing a different culture, cuisine, and landscape drives many to extend their international business trips into immersive leisure escapes. While cost and visa logistics are considerations, international bleisure is gaining traction due to its uniqueness and the prestige associated with overseas travel.

Why is 2-4 days preferred for bleisure trip?

The 2–4-day travel window remains the most popular and practical duration for bleisure trips. It allows professionals to strike a perfect balance between their business objectives and personal relaxation without causing extended absence from work. Typically, a short leisure extension of one- or two-days post-business meetings or events fits neatly into weekends or flexible work-from-anywhere policies. This duration is ideal for short domestic getaways, city breaks, spa retreats, or cultural immersions. Its popularity also stems from affordability and ease of planning, making it the go-to option for most bleisure travelers.

Moreover, one-week bleisure trips are gaining popularity, especially among remote and hybrid workers who have the liberty to combine work with travel over extended periods. A longer duration allows for deeper exploration of destinations, participation in local experiences, and better recovery from business fatigue. These trips often blend several leisure activities with intermittent work hours, creating a more balanced and restorative experience. The increase in flexible work policies, digital work tools, and supportive employers is fueling the demand for week-long bleisure escapes, particularly in scenic or culturally rich destinations.

By Tour Type

By Travel Type

By Travel Duration

By Geographical region

July 2025

July 2025

July 2025

July 2025