July 2025

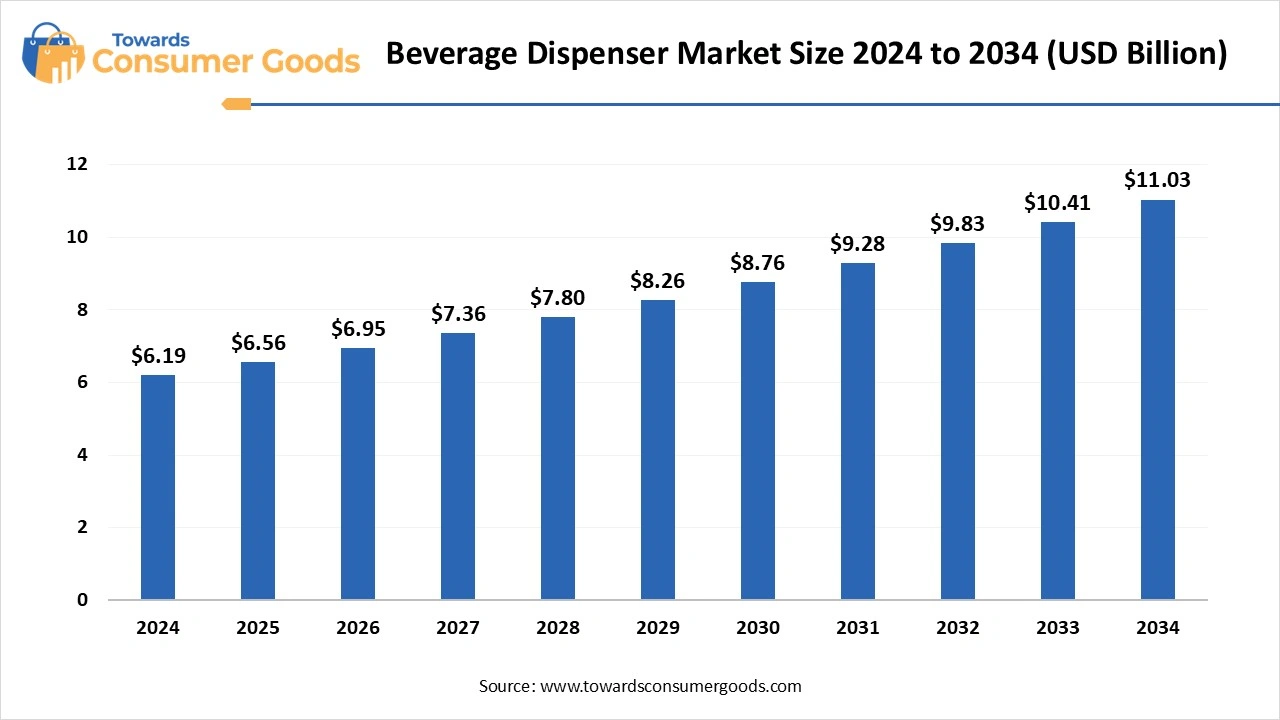

The beverage dispenser market accounted for USD 6.19 billion in 2024 and is expected to reach around USD 6.56 billion by 2034, with a CAGR of 5.95% from 2025 to 2034. The demand for convenience, hygiene, quick, and self-service solutions has increased, especially in the foodservice industry, driving the global beverage dispenser market. The growing shift toward sustainable practices, driving manufacturers to develop eco-friendly and energy-efficient beverage dispensers, is expected to boost the market in the upcoming period.

The global beverage dispenser market has witnessed significant growth in recent years due to increased demand for convenient and customized beverage solutions. The market has seen various demands, including customized dispensers, self-service solutions, automated, and sustainable solutions. The increased demand for eco-friendly and energy-efficient beverage dispensers has shaped opportunities for key manufacturers. The implementation of automated technologies like Artificial Intelligence (AI) and IoT devices gives an innovative and advanced touch to the beverage dispensers. Institutes are examining various dispenser models to understand current areas and essential parts to be advanced in the future, to satisfy consumer needs.

The rising surge for convenient and on-the-go consumption is the major driver for the global beverage disperser market. Consumers have increased demand for premium and on-the-go beverages. The increased availability of disposable income enables the adoption of quick and easy access to beverage solutions. The popularity of self-service dispensers is on the rise; The changing consumer lifestyle is significantly driving this popularity. The expanding foodservice industry has also increased the adoption of on-the-go dispensers. Innovations in technologies like touchless dispensers and digital payment are making the adoption of this dispenser easier.

| Report Attributes | Details |

| Market Size in 2025 | USD 6.56 Billion |

| Expected Size by 2034 | USD 11.03 Billion |

| Growth Rate | CAGR of 5.95% |

| Base Year in Estimation | 2024 |

| Forecast Period | 2025-2034 |

| Dominant Region | America |

| Segment Covered | By Type, By Capacity, By Material Type, By End-user, By Region |

| Key Companies Profiled | Bras Internazionale, Wunderbar Dispensing, Cornelius Inc., Wunder-Bar, Lancer Worldwide, Bevrad, Bunn-O, Matic Corporation, Avantco Equipment, Franke Coffee Systems, Berries by Astrid, Grindmaster-Cecilware, Bevi |

Development of Smart Beverage Dispensers

The development of smart beverage dispensers is creating significant opportunities for beverage dispenser manufacturers. Manufacturers are focusing on creating dispensers with leverage advanced technologies like Internet of Things (IoT) connections, AI, and automation to improve operational efficiency, customization, and user experiences.

Consumers are seeking smart dispensers, drive-by surges for sustainable demands, and customizations. Smart dispensers with remote monitoring and maintenance have gained major popularity. Smart homes are the major adopters of smart beverage dispensers.

High Initial and Maintenance Cost

High upfront investment and maintenance & repair cost is the major hindrance for the beverage dispenser market. The advanced and high-capacity system is a beverage dispenser that requires a high cost for purchasing and installation. Additionally, the dispenser requires regular maintenance and repair, causing a further cost burden. A beverage disperser also often requires replacement of parts, such as valves, electric components, and pumps. The replacement parts cost can also be high. The cost can hamper the adoption range in the individual consumer base.

North America dominated the global market, growth driven by factors including technological advancements, a strong culture of out-of-home dining, strong food service industries, the presence of key vendors, and the adoption of AI technology in the industry. The well-established food service industry of North America drives high demand for beverage dispensers in hotels, cafes, and restaurants. In regions, the high availability of disposable income enables consumers to spend on premium and luxurious beverage dispenser solutions. The rising demand for sustainable nearest dispensaries is contributing to and creating opportunities for novel innovation and developments.

The U.S is leading the regional market due to increased consumer spending and expanded e-commerce platforms. The demand for convenience and self-service is on the rise in the country. U.S. consumers have high disposable income, enabling them to spend on premium and convenient solutions. The existence of key players further contributes to the market growth. Companies are investing heavily in self-service and automated dispensers to meet consumer preferences, supporting the market growth.

Asia Pacific is anticipated to grow at the fastest rate over the forecast period due to rapid changes in consumer preference for ready-to-drink beverages and the adoption of premium and convenient solutions. Consumers in the Asia Pacific region are seeking drinks like smoothies and frozen coffees, driving demand for frozen beverage dispensers. The expanding food service industry and growth in quick service restaurants, cafes, and food counters are on the rise in the region, driving high demand for beverage dispensers.

India is a significant player in the Asian beverage dispenser market, growth driven by increased demand for frozen beverages and expanding and expanding food service industries. The large population base and rapid growth of food services industries are supporting demand for cost-effective and high-quality frozen dispensers in the country. Major key vendors of the Indian market are contributing heavily to the innovation and development of automated dispenser solutions to comply with a large volume of quick services and improve customer service satisfaction.

In 2024, the non-electric segment dominated the market, growth driven by its cost-effectiveness, simplicity, reliability, and wide applicability. Non-electric beverage disperser requires minimal maintenance, without complex electrical components. The lack of electric components makes non-electric dispensers ideal for remote use. Non-electric beverage dispensers like manual and gravity-fed systems are popular in the market due to their easy use and simplicity. Manufacturers are developing smart non-electric beverage dispensers for both hot and cold beverages.

The electric segment is anticipated to grow at the fastest rate over the forecast period, due to increased adoption of convenient and automated beverage dispensers. Electric dispensers provide temperature control management to ensure optimal serving temperature according to beverage types. Technological advancements like the integration of touchless and automated designs help to improve hygiene. The demand for electric beverage dispensers is increasing among hygienic-conscious consumers. The growing demand for self-service systems and smart dispensers is shaping segment growth.

The plastic beverage dispensers segment accounted largest market share in 2024. Plastic average dispersers are cost-effective compared to other materials. These dispensers come with lightweight, high durability, flexibility, and affordability features. Individual consumers are the major adopters of plastic beverage dispensers. These dispensers are often used for single-use and disposable applications, making them ideal for on-the-go services. Ongoing advancements in technologies are enabling durable and visually appealing designs for plastic beverage dispensers. Additionally, the development of sustainable plastic materials is fostering segment growth even among sustainability-conscious consumers.

The Stainless-Steel Beverage Dispensers segment is expected to account for significant growth in the market. Stainless steel beverage dispensers are gaining popularity due to their durability, hygiene, and low-maintenance nature. Commercial consumers are seeking highly durable and hygienic beverage dispensers that can withstand heavy use and cleaning and are highly corrosion-resistant. Stainless steel beverage dispensers are mainly ideal for high-end establishments, where durability and hygiene are fundamental principles.

The 5 to 10 Liters segment holds a significant market share due to consumer preference. The 5 to 10 Liters capacity enables beverage dispensers to be convenient and customizable options. Technological advancements like touchless dispensing systems and automated solutions are improving user experiences. The segment offers a balance between capacity and portability. The 5 to 10-liter capacity-based dispensers are cost-effective and widely accessible. Both residential and commercial end-users are adopting a wide range of beverage dispensers with 5 to 10-liter capacity.

In 2024, the commercial segment generated the largest market share, growth driven by High demand for efficient services in commercial establishments, including restaurants, cafes, and hotels. Commercial establishments have increased adoption of battery dispenser solutions to meet consumer demands for efficient, quick, and self-service applications. The adoption of advanced dispensers is high due to their touchless dispensing, IoT-enabled tracking, and AI integration, helping to improve operational efficiency.

Expanding into the service industry, the demand for commercial beverage dispensers is emerging. The need for Blu-ray dispensers to ensure consistency and quality in beverage services is on the rise among businesses, drive significant adoption drive significant adoption of advanced beverage advanced beverage dispensers to maintain customer satisfaction and experiences.

The residential segment is the second-largest segment, leading the market, due to increased demand for convenient and personalized beverage sponsors. The growth in smart kitchens and IoT-enabled devices at driving the adoption of advanced and smart beverage dispensers at home. Growing awareness of health and Wellness further contributes to consumer preference for beverage dispensers using a home basis. The trend for self-serve systems is fostering the segment's growth.

July 2025

July 2025

July 2025

July 2025