July 2025

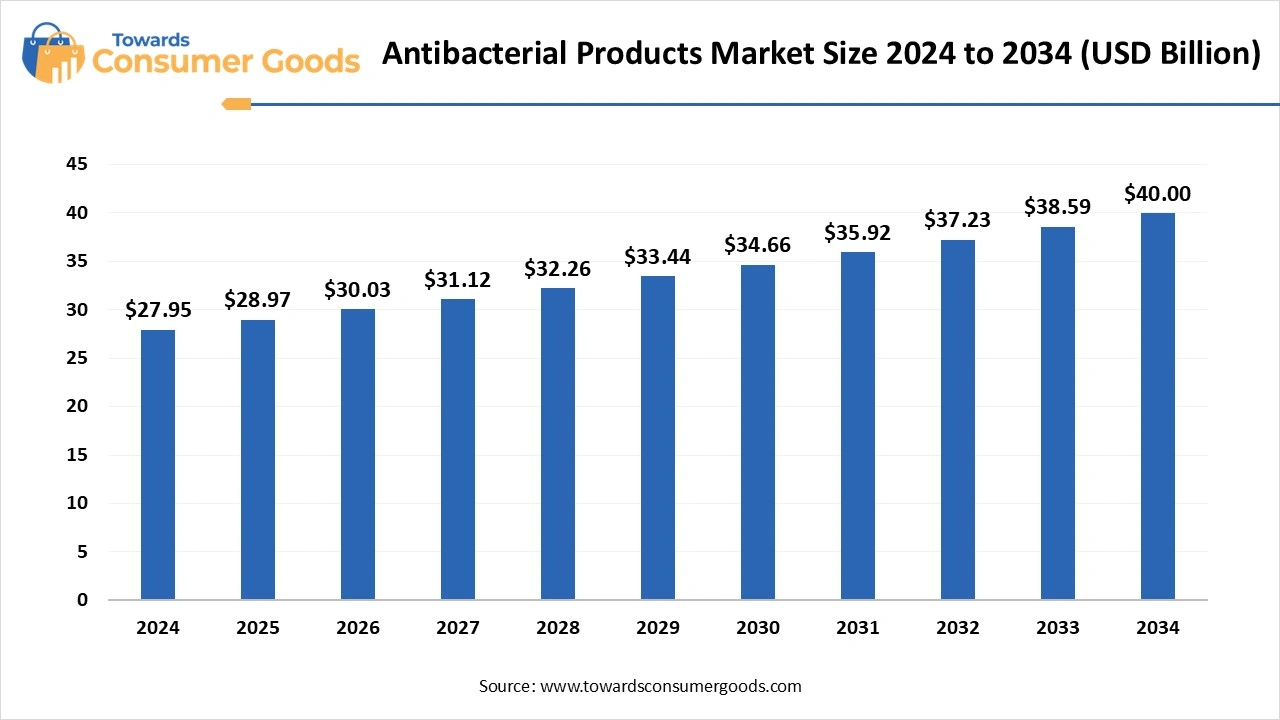

The antibacterial products market size was estimated at USD 27.95 billion in 2024, and it is expected to hit around USD 40.00 billion by 2034, expanding at a CAGR of 3.65% during the forecast period from 2025 to 2034. The rise in infectious diseases and the resistance factor of antibacterial products towards antibiotics have driven the market growth.

Prevention of Infectious Diseases and Awareness of Hygiene Drives the Market

The antibacterial products market is experiencing significant growth, propelled by an increasing global consciousness regarding hygiene, a surge in the prevalence of infections, and an escalating demand for products that offer effective germ protection. A pivotal aspect driving this market includes the heightened consumption of antibacterial soaps, hand sanitizers, and disinfectants, especially within the healthcare sector and personal care industries. Moreover, consumer preferences have evolved to prioritize not only antibacterial efficacy but also the inclusion of additional benefits such as moisturizing agents and skin care properties.

As consumers become more health-conscious, their emphasis on hygiene practices has led to an increased desire for antibacterial products. The alarming rise in bacterial and viral infections has further catalyzed this demand, compelling individuals to seek effective antibacterial solutions. In healthcare environments, the need for such products is critical to prevent nosocomial infections, thus safeguarding both patients and healthcare personnel. Additionally, the market is influenced by a trend where consumers are seeking multifunctional products that provide both antibacterial protection and enhanced skin care benefits.

Several factors contribute to the ongoing expansion of the antibacterial products market. Among these are the growing incidence of infectious diseases, the escalation of antimicrobial resistance, and significant advancements in research and development within the industry. Regulatory initiatives and government backing are also pivotal in promoting healthcare measures that bolster the market.

The global heavy burden of infectious diseases, particularly those caused by resistant bacterial strains, continuously fuels demand for innovative antibacterial products. This growing concern is underscored by the emergence of pandemics and endemic infections, highlighting the urgent necessity for new antibacterial solutions.

| Report Attributes | Details |

| Market Size in 2025 | USD 28.97 Billion |

| Expected Size by 2034 | USD 40.00 Billion |

| Growth Rate | CAGR of 3.65% |

| Base Year in Estimation | 2024 |

| Forecast Period | 2025-2034 |

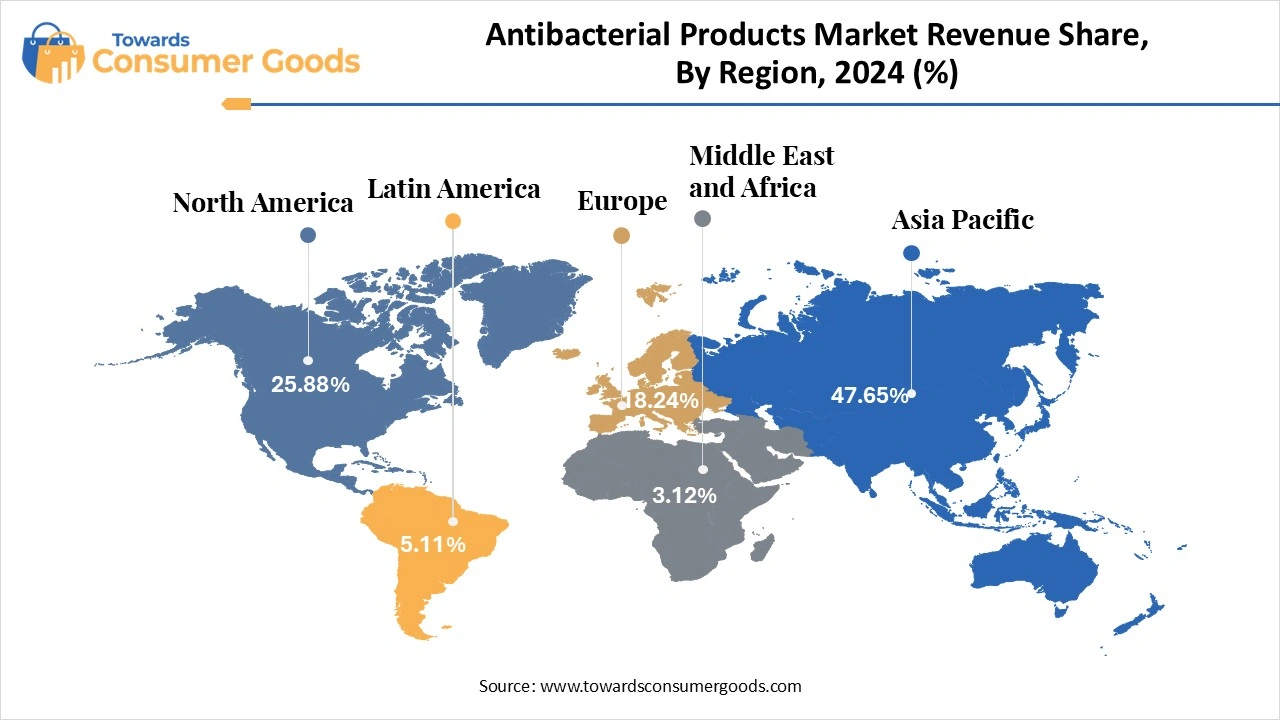

| Dominant Region | Asia Pacific |

| Segment Covered | By Product, By Distribution Channel, By Region |

| Key Companies Profiled | Reckitt Benckiser Group PLC, Unilever, GOJO, Industries, Inc., The Himalaya Drug Company, Sebapharma, Bielenda, Colgate-Palmolive Company, Henkel AG & Co. KGaA, Johnson & Johnson Services, Inc., Farouk Systems International |

The antibacterial products sector harbors substantial opportunities for growth, driven by increasing health awareness, urgent infection control needs, and stringent government regulations. Innovative approaches in developing eco-friendly, personalized products are creating substantial new avenues for market expansion. Regions such as Asia-Pacific and Africa present noteworthy opportunities due to a rising trend in healthcare expenditures and improvements in health literacy among consumers. The enforcement of hygiene regulations and heightened awareness of antimicrobial resistance will further catalyze the demand for effective antibacterial solutions.

Despite the promising growth trajectory, the antibacterial products market faces several constraints. The rise of antibacterial resistance poses a significant challenge, as bacteria evolve and become less responsive to existing agents. This resistance can result in more severe infections, extended treatment durations, and escalating healthcare costs. Additionally, fluctuations in the prices of raw materials, such as silver, copper, and zinc integral components in antimicrobial additives pose risks to production costs and may hinder innovation within the sector. Furthermore, regulatory hurdles can stifle the development of new products and delay market entry for potentially revolutionary antibacterial solutions.

The hand soap dominated the antibacterial products market in 2024. Hand soap is the leading product in the antibacterial sector, owing to several critical factors. The COVID-19 pandemic has significantly heightened health consciousness among consumers, prompting an increased demand for hygiene products. Hand soaps, renowned for their potent antibacterial properties, have transformed into essential items in both households and communal environments, resulting in a robust market presence. Public health authorities have consistently advocated for regular handwashing, further catalysing this demand. Additionally, hand soaps are available in a myriad of formulations, including foaming, liquid, and bar varieties, each designed for ease of use, making them highly accessible for everyday application.

The body wash segment has emerged as the fastest growing in the antibacterial products market during the forecast period. This surge can be attributed to a heightened focus on personal hygiene and wellness among consumers, coupled with frequent launches of innovative products tailored to various demographics such as travellers, health professionals, and active individuals. Health concerns related to infections and diseases are prompting individuals to prioritize hygiene, making body wash a practical option for maintaining cleanliness in daily routines. The convenience of body wash resonates particularly well with frequent flyers, travellers, health workers, and athletes, all of whom prioritize not just cleanliness but also the portable hygiene benefits of antibacterial products.

The supermarkets and hypermarkets segment dominated the antibacterial products market in 2024. The supermarkets and hypermarkets hold a prominent position as the primary distribution channels. Their extensive reach, combined with the convenience of offering a wide array of products at competitive prices, makes these retail formats exceptionally appealing to consumers. Supermarkets and hypermarkets maintain a strong physical presence, ensuring easy access for consumers. Their shelves boast a diverse assortment of antibacterial offerings from multiple brands, enabling shoppers to select from various formulations tailored to their needs. Additionally, these retail giants frequently run promotions and discounts on bulk purchases, enhancing their attractiveness for cost-conscious consumers. Brands strive to establish effective distribution through these retail channels to maximize visibility and accessibility to potential buyers.

The online segment expects the significant growth in the antibacterial products market during the forecast period. The online distribution channel is rapidly emerging as the most dynamic growth area within the market. Online shopping experiences range from quick commerce services that promise rapid delivery to broader e-retail platforms offering a vast assortment of products ranging from hand soaps and sanitizers to disinfectant wipes all available at the click of a button. For consumers with busy lifestyles or those residing in areas with limited access to physical retail locations, this digital convenience is a significant draw. The growth of e-commerce in the antibacterial sector is bolstered by attractive pricing, promotional offers, and flexible payment options available through online retailers. As hygiene awareness continues to rise, digital platforms play a vital role in not only providing access to products but also disseminating crucial information regarding the importance of antibacterial measures.

Asia-Pacific led the antibacterial products market in 2024. The region currently leads the market, driven by a synergy of factors, including a vast and rapidly expanding population, heightened awareness of hygiene practices, and substantial growth in key sectors such as packaging, healthcare, and food & beverages. This trend is particularly pronounced in high-population-density countries like China and India, where the demand for antibacterial products is intensified by a growing prevalence of infectious diseases and an increase in public consciousness regarding personal hygiene. Additionally, government initiatives aimed at bolstering healthcare facilities and promoting hygiene awareness are positively impacting market growth in Asia-Pacific.

North America expects the significant growth in the market during the forecast period. The region is witnessing the fastest growth trajectory in the antibacterial products market owing to a combination of factors, including a rising understanding of bacterial diseases and an escalation in personal hygiene practices. Enhanced accessibility through online shopping platforms, combined with the establishment of major hypermarkets and supermarkets in urban areas, is facilitating greater access to these essential products. There is a growing movement among individuals in the North America towards adopting better hygiene practices, driven by an awareness of health risks associated with insufficient cleanliness, thus propelling the demand for antibacterial solutions.

Innovation- In March 2025, Avenacy is set to introduce five new injectable antibiotic products Ampicillin and Sulbactam, Ampicillin, Tazobactam, Penicillin G Potassium, and Piperacillin into the U.S. market, expanding treatment options in the therapeutic landscape.

Initiative- In April 2025, Singapore is poised to implement a national standard for the validation of antimicrobial disinfectant products, setting a benchmark for product efficacy and safety.

Innovation- In November 2024, In a more consumer-oriented innovation, Xiaomi is launching a whimsical soap dispenser in November 2024 that boasts a 180-day battery life and an impressive antibacterial effectiveness rate of 99.9%.

According to market projection, the global household appliances market size is calculated at USD 503.19 billion in 2024, grew to USD 529.61 billi...

The global surfing tourism market size is calculated at USD 64.1 billion in 2025 and is forecasted to reach around USD 109.31 billion by 2034, acceler...

The global travel retail market size is calculated at USD 75.46 billion in 2024, grew to USD 82.67 billion in 2025 and is predicted to hit a...

July 2025

July 2025

July 2025

July 2025