June 2025

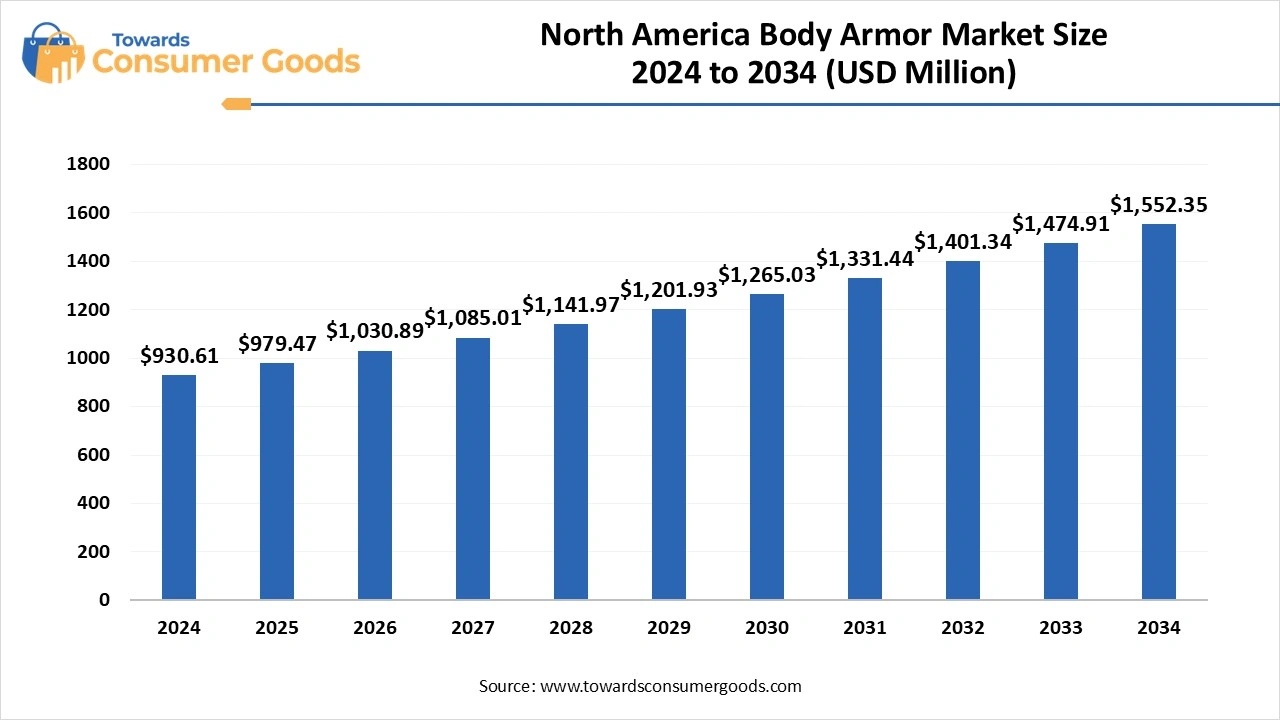

The global North America body armor market size is estimated at USD 979.47 million in 2025 and it is predicted to reach around USD 1,552.35 million by 2034. The market is expected to grow at a CAGR of 5.25% from 2025 to 2034. The rising military and defense budget is a major factor driving the North American body armor market. The U.S. focus on military modernization is playing a crucial role in market growth.

The North American body armor market has witnessed significant growth due to major factors like robust military & defense and civil & law enforcement settings of the region. The region has a major focus on law enforcement and the defense budget. The increased threats like urban terrorism, mass shootings, violent crime, and war situations are driving the need for advanced protection solutions, including body armor. Countries like the United States and Canada empowering their defense agencies and law enforcement departments, drive the need for protective equipment.

Additionally, the regional surge in the development of next-generation body armor systems, fulfilling its position in the global body armor market. Government investments in research & development foster market growth. Additionally, regulations for process and safety settings contribute to fostering market expansion.

The increasing security concerns, especially due to civil unrest, military conflicts, and various threats, have increased demand for the advanced body armor market, leading to market growth.

The global terrorism threat has increased, increasing risks of heightened risks for military soldiers, security workforces, and law enforcement. The military and law enforcement agencies are seeking advanced body solutions for their soldiers for better protection in hazardous situations. The rising spending for high protection solutions in the military, defense, and law enforcement sectors enables manufacturers to offer cutting-edge solutions with technological advancements like improvements in materials science and engineering.

Avient Corporation is the major body armor company in North America, which is involved in protective materials. The company had bought the Dyneema® division from DSM, and improved a protection, energy-absorbing, lightweight solution. Avient Corporation has a capital stock market of approximately 3,87 billion USD in February 2025.

Cadre Holdings Inc. owns various body armor manufacturers like Safariland, GH Armor, Protect Armor Systems, and Pacific Safety Products. The company held stock at $36.43 per share in February 2025, with a capital market for around $1.47 billion. The company has risen its stock price by around 239%, form past three years.

| Report Attributes | Details |

| Market Size in 2025 | USD 979.47 Million |

| Expected Size in 2034 | USD 1,552.35 Million |

| Growth Rate from 2025 to 2034 | CAGR of 5.25% |

| Base Year of Estimation | 2024 |

| Forecast Period | 2025-2034 |

| Dominant Region | North America |

| Segment Covered | By Product Type, By End User, By Region |

| Key Companies Profiled |

Craig International Ballistics, Armored Republic LLC, Point Blank Enterprises, Hellweg, Premier Body Armor, Honeywell International Inc., Pacific Safety Products, The Safariland Group, Elmon, U.S. Armor Corporation |

Advances in Materials, Design, and Engineering

Ongoing technological advancements in material, design, and engineering, holding significant growth opportunities for the North America body armor market. The increased demand for high-protection solutions in military, civil & law enforcement, and other various threats is driving the need for advanced body armor solutions. Advances in body armor material, design, and engineering enable lightweight, ballistic protection and modular designs of the products. Advanced materials like polymers, ceramics, and composites are providing lighter, comfortable, and stronger solutions. The recent developments of technologically integrated body armor are trending in the market. Additionally, the rising focus on eco-friendly and biodegradable materials is expected to provide major growth initiatives in the future.

Stringent Regulations

Stringent regulations regarding the approval process and cost compliance are the major restraints of the North American body armor market. The government has implemented strict regulations, like the National Institute of Justice (NIJ), Underwriters Laboratories (UL), and the US Department of Defense (DoD), for production, testing, and supply chain for body armor. The complex approval process of novel products and technologies slows down the market competition. Regulatory restrictions on sales and use for the law enforcement and military sector hamper the availability of the products. Additionally, the federal and state laws for the sale, use, and processing of body armor solutions generate a complex environment for the manufacturers.

The United States dominated the North American body armor market in 2024, mainly due to the robust military & defense industry and government investment in military modernization. The increased concern over safety and protection for military officers is fuddling the adoption of advanced solutions, including body armor.

Ongoing innovations in material, design, and engineering are enabling advanced protection, with the lightweight nature of body armor shaping market growth. The United States has major manufacturers of body armor, including Point Blank Enterprises, BAE Systems, Safariland, Honeywell, Mordor Intelligence, U.S. Armor, and Central Lake Armor Express.

Canada is anticipated to witness significant growth over the forecast period, due to the country's strong focus on the development of next-generation body armor systems. Canadian companies are investing in modernization and upgrading their protective equipment. The rising concern of safety and government initiatives in providing suitable protection improvements has surge in rising adoption of body armor solutions. The strong focus on defense modernization and law enforcement safety contributes to the market growth.

Pacific Safety Products (PSP) is a major manufacturer of soft body armor products in Canada. The company offes advanced body armor for law enforcement and the Department of National Defence, with high durability, comfort, and high-quality solutions. Companies' sales. rise by 7% to $8.24 million in 2024. (Source: bodyarmornews)

The soft and hard armor segment dominated the market in 2024, due to the increased need for advanced and ballistic protective body armor. Soft armor is flexible and comfortable, whereas hard armor provides high-velocity rifle rounds and armor-piercing threats. The increased focus of manufacturing companies to develop multi-threat protective capabilities in soft and hard armor, fulfilling a significant opportunity for segment expansion.

The helmets is the second largest segment, leading the market. The segment growth is attributed to increased demand for head protection in the military and law enforcement. Modern warfare has increased focus on head protection. Technological advancements like the integration of cutting-edge features with helmets, fueling segment growth. Manufacturers are developing advanced helmets with the integration of AI technology to provide cutting-edge experiences, reduce risk, and improve ventilation systems. Adoption of modular helmet systems is training the market.

The military segment dominated the market in 2024, growth driven by high adoption of body armor in the military sector. The military sector has a high demand for protection solutions. Using body armor and combat helmet protection in the military suit gives 72% survival chances for all threats. Ongoing programs of military modernization, defense budget, and focus on soldier survivability rate are driving demand for advanced body armor solutions in the military. Ballistic helmets, tactical vests with higher flexibility and protection, and soft and hard armor have a high adoption range in the military sector.

The civil and law enforcement segment is the fastest-growing segment of the market. The innovation and development of advanced body armor products for civil and law enforcement settings has increased, driven by a rising focus on safety and the need for improved protection during civil unrest situations. Body Armor Solutions offers enhanced protection and helps to maintain mobility and comfort. The increased incidence of firearms and civil unrest has increased the need for better protection solutions, including body armor.

Based on comprehensive market projections, the global baby car seat market size is calculated at USD 33.05 billion in 2025 and is forecasted to reach ...

According to market projections, the global baby care products market, valued at USD 107.88 billion in 2024, is anticipated to reach USD 165.15 billio...

June 2025

May 2025

April 2025