June 2025

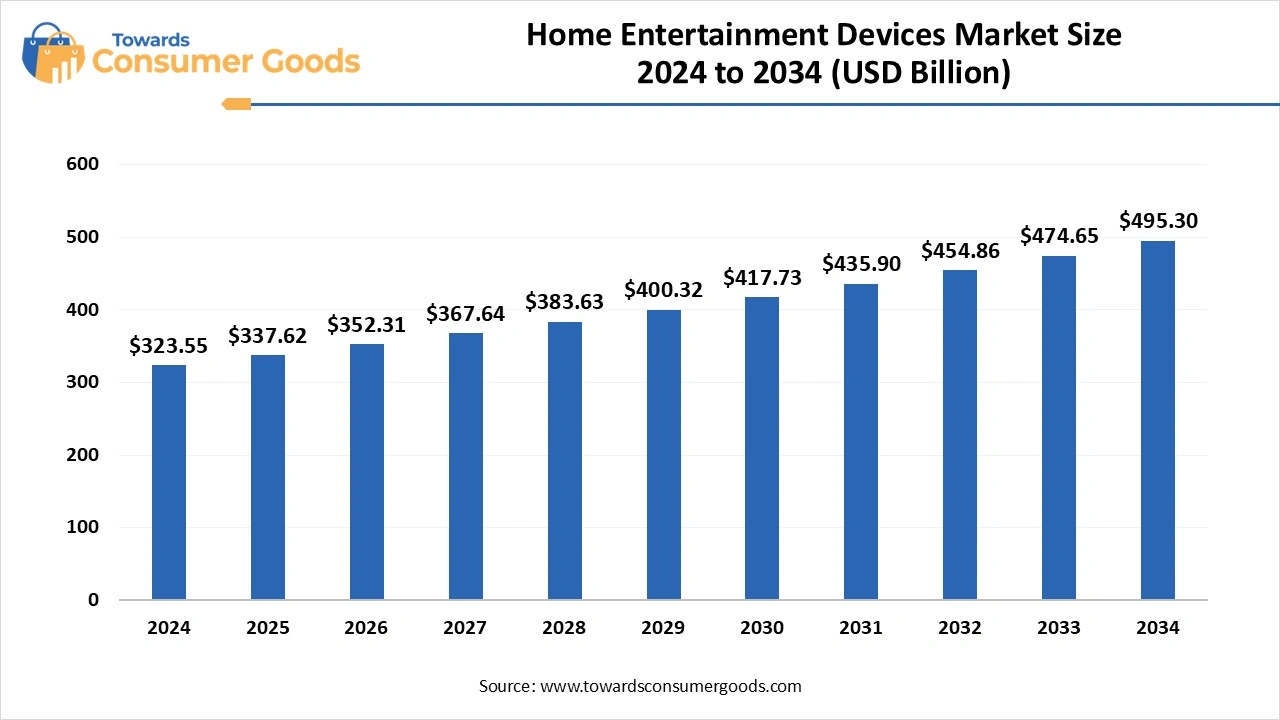

The global home entertainment devices market size was calculated at USD 323.55 billion in 2024 and is projected to hit around USD 495.30 billion by 2034 with a CAGR of 4.35%. The consumer shift towards OTT platforms and the high-quality audio-visual experience has driven the market growth.

The home entertainment devices market is increasingly shaped by consumers’ desire for enhanced audio and video experiences, which are driven by rapid technological advancements. Notably, the advent of ultra-high-definition 8K displays and sophisticated immersive audio systems is at the forefront of this evolution. Alongside these advancements, the integration of streaming services and smart home technology is transforming how consumers engage with content, resulting in a higher demand for devices such as smart TVs, streamlined streaming devices, and gadgets equipped with voice assistant capabilities.

The shift from traditional cable television to streaming services reflects profound changes in consumer viewing habits, raising the attractiveness of products like smart TVs and streaming sticks. As consumers increasingly prioritize high-quality audio and visual output, there is a growing demand for higher resolution displays, cutting-edge audio systems, and immersively engaging technologies such as virtual reality (VR) headsets.

Devices designed for seamless integration into smart home ecosystems are becoming more desirable, granting users enhanced control and convenience over their entertainment experiences. The gaming industry is also witnessing remarkable growth, as video game consoles and peripherals emerge as vital components of the home entertainment landscape. Moreover, consumers are expressing a preference for localized and tailored content, which is propelling the demand for smart TVs and streaming devices that provide broad selections of streaming services along with personalized content recommendations.

| Report Attributes | Details |

| Market Size in 2025 | USD 337.62 Billion |

| Expected Size in 2034 | USD 495.30 Billion |

| Growth Rate from 2025 to 2034 | CAGR of 4.35% |

| Base Year of Estimation | 2024 |

| Forecast Period | 2025-2034 |

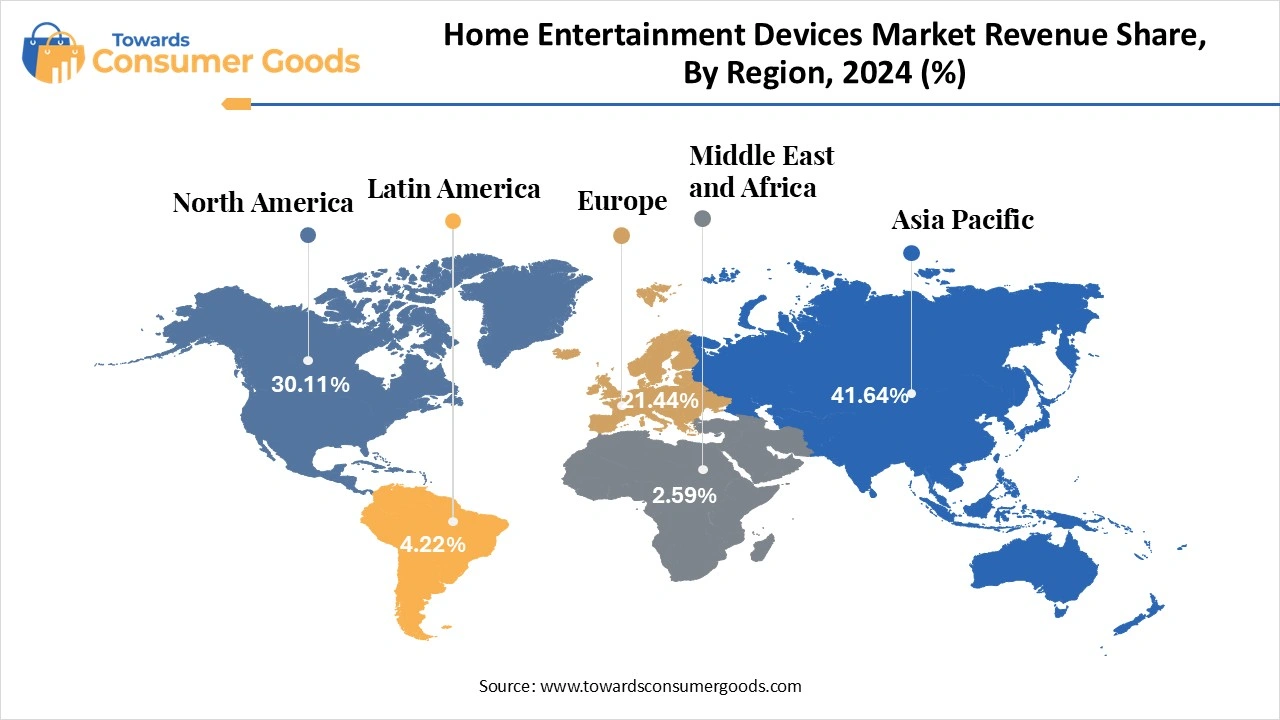

| Dominant Region | Asia Pacific |

| Segment Covered | By Device Type, By Distribution Channel, By Region |

| Key Companies Profiled | Samsung Electronics Co. Ltd., Panasonic Corporation, Sony Corporation, LG Electronics Inc., Mitsubishi Electric Corporation, Sennheiser electronic GmbH & Co. KG, Bose Corporation, Koninklijke Philips N.V., Haier Inc., Microsoft Corporatio |

Why Smart Features and 8K Quality is in Demand?

The global home entertainment devices market stands on the brink of significant growth opportunities, propelled by a rising appetite for high-quality audiovisual experiences, ongoing technological innovation, and shifting consumer preferences. Key areas identified for expansion include smart TVs, soundbars, sophisticated home audio systems, and both VR and AR technologies. The expected growth of this market will be further driven by the increasing number of streaming services available and the incorporation of smart features into entertainment devices. The surge in popularity of 4K and 8K technologies has stimulated demand for compatible televisions and displays that can deliver unmatched picture clarity and quality.

Competition Across the Industry

The home entertainment devices market is currently navigating a landscape filled with significant challenges. Chief among these are fierce competition from mobile devices and alternative platforms, the high upfront costs associated with premium products, and the pressing requirement for continuous innovation to meet the shifting preferences of consumers. With users increasingly prioritizing cost considerations, manufacturers face pressure to provide reasonably priced options despite the potential for supply chain disruptions. Additionally, the demand for sustainable and energy-efficient products is becoming more pronounced.

As entertainment consumption habits evolve, many consumers are turning to smartphones and tablets for their viewing needs. This trend signifies a substantial pivot away from traditional home entertainment systems, as the convenience of accessing content via numerous streaming applications and cloud services on mobile devices diminishes reliance on conventional devices.

Furthermore, the rise in gaming across PCs, mobile platforms, and other channels is influencing the demand for dedicated gaming consoles. To remain relevant, the market must evolve alongside changing consumer inclinations, particularly in terms of integrated smart home technologies and immersive entertainment experiences. Companies must prioritize innovation by incorporating cutting-edge features such as 8K resolution, artificial intelligence enhancements, and eco-friendly materials to distinguish their offerings. As price sensitivity grows among consumers, it is essential for manufacturers to establish competitive pricing strategies to attract and retain customers.

The video device segment is the foremost leader in the home entertainment marketplace, driven by several interrelated factors. As a result, consumers increasingly lean towards visual entertainment, solidifying video devices as integral components in contemporary home setups. The quest for superior resolution and display quality has sparked a notable upswing in the demand for Ultra High Definition (UHD) and 4K TV, as well as projectors that enhance viewing pleasure.

Moreover, the harmonization of high-fidelity audio devices, such as soundbars and comprehensive home theater systems, significantly enriches the overall viewing experience, propelling further demand for advanced video devices. Smart TVs, equipped with built-in streaming capabilities, internet connectivity, and an expansive range of features, have surged in popularity, often becoming the preferred choice for home entertainment enthusiasts.

This segment is experiencing vigorous growth, primarily driven by the meteoric rise of streaming services and the increasing consumer appetite for high-caliber viewing experiences. Streaming giants like Netflix, Amazon Prime, and Hulu have rewired consumer expectations, driving users to upgrade their devices for enhanced viewing satisfaction. Additionally, consumers are gravitating toward more immersive home theater setups, which include options featuring 4K and 8K resolutions, expansive screen sizes, and sophisticated audio systems.

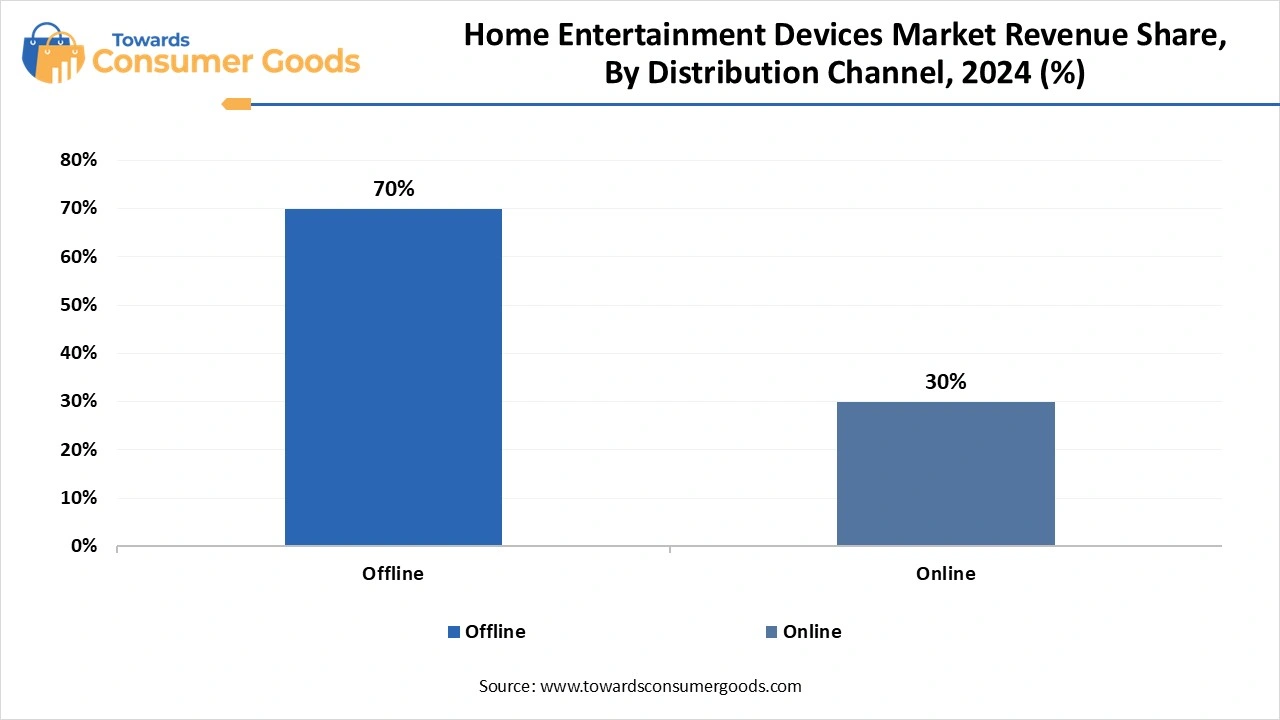

In the realm of distribution channels, the offline segment continues to hold a commanding position within the home entertainment industry. Many consumers appreciate the opportunity to see, touch, and evaluate products in person, allowing them to compare different models and assess sound quality directly before making purchasing decisions. The accessibility of expert guidance and support from sales representatives, who can provide advice on installation and setup, further enhances the appeal of offline shopping.

Buying in-store also offers consumers the chance to physically inspect and experience home entertainment devices like televisions, audio systems, and projectors, which is crucial for products where factors such as sound clarity and image quality are paramount. Offline retailers are often staffed with knowledgeable personnel who offer personalized recommendations, helping customers choose the right products to meet their unique requirements and ensuring compatibility with their existing setups.

Conversely, the online segment represents the fastest-growing area within home entertainment, fueled by the burgeoning popularity of streaming services and a growing inclination towards digital content consumption. Consumers increasingly favor on-demand access to a diverse array of content over traditional cable or satellite television, generating an accelerating demand for devices and platforms that facilitate this lifestyle.

Platforms like Netflix, Amazon Prime Video, and Disney+ have fundamentally altered how audiences consume entertainment, providing an extensive library of content at their fingertips. Devices such as smart TVs, media streaming players (like Roku and Fire TV), and gaming consoles equipped for streaming have surged in popularity, empowering users to access their favorite streaming services directly through their home entertainment setups.

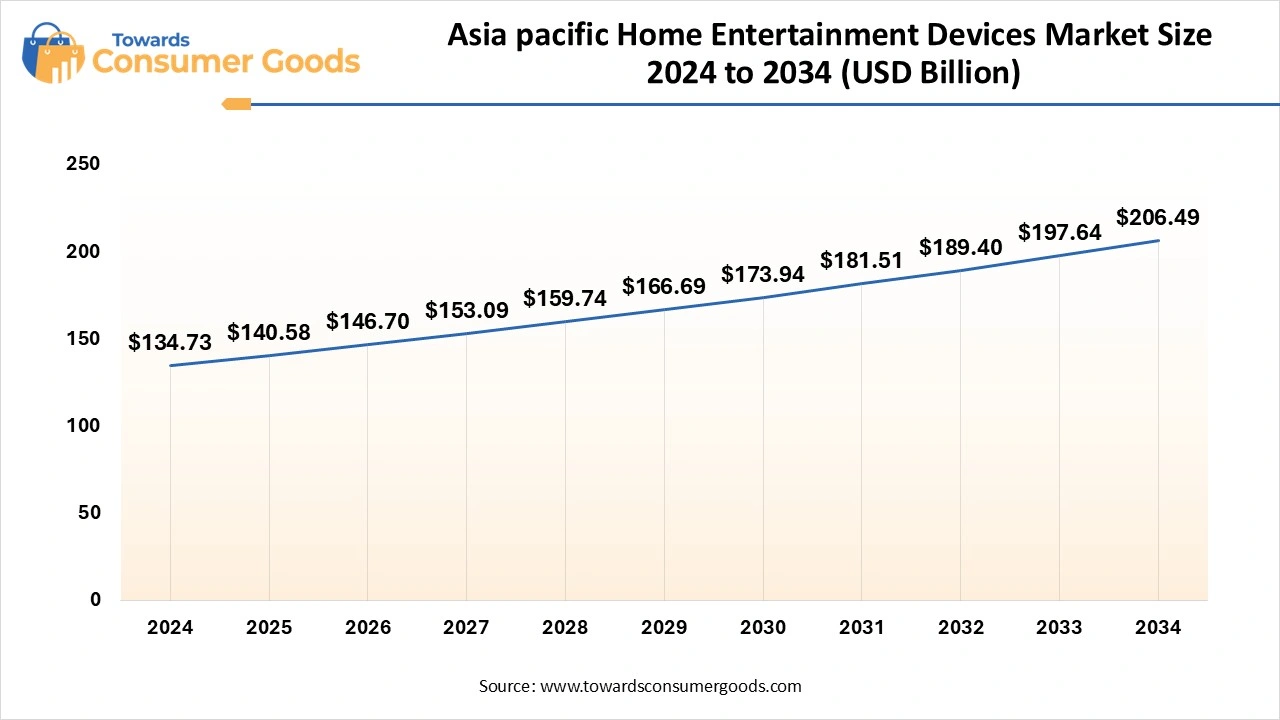

The Asia Pacific home entertainment device market size was valued at USD 134.73 billion in 2024 and is expected to be worth around USD 206.49 billion by 2034, growing at a compound annual growth rate (CAGR) of 4.36% over the forecast period 2025 to 2034.

The Asia-Pacific region stands as a powerhouse in the home entertainment market, driven by several compelling factors. As urban lifestyles evolve, consumers are more inclined to allocate their earnings toward leisure activities, with home entertainment being a significant focus. Moreover, this region boasts some of the highest internet penetration rates globally, which, along with the widespread adoption of smart home technologies, has revolutionized how individuals engage with entertainment. The expansion of digital broadcasting initiatives across various nations is further enhancing the demand for set-top boxes, enabling seamless access to a plethora of viewing options.

In Europe, the home entertainment market is experiencing exponential growth, fueled by similar trends. The rise of smart home technology has transformed the landscape, with consumers embracing the benefits of connectivity. As modernization takes root, coupled with increasing disposable incomes, particularly evident in nations like the UK and Germany, there’s a surging demand for streaming services.

The influential presence of over-the-top (OTT) services, such as Netflix and Disney+, has significantly intensified the appetite for devices capable of accessing on-demand content. Many consumers are opting for smart TVs, attracted by the enhanced viewing experience they offer. Additionally, the growing interest in high-resolution and 4K content, alongside the technological advancements of virtual reality (VR) and augmented reality (AR), is propelling the demand for cutting-edge home entertainment devices.

Innovation: In terms of recent developments within the industry, in May 2025, TCL, a prominent player in the consumer electronics market, unveiled its exciting new collection of QD Mini-LED TVs, namely the C6K and C6KS models. These televisions promise to deliver stunning picture quality and vibrant colors, enhancing the home viewing experience. (Source: tribuneindia)

Innovation: In the same month, Haier expanded its presence in India by launching two innovative series of smart OLED televisions. The Haier C90 series is available in multiple screen sizes—55-inch, 65-inch, and an impressive 77-inch variant while the C95 series offers 55-inch and 65-inch models, catering to diverse consumer preferences. (Source: thehindu)

Innovation: Additionally, in April 2025, Xiaomi debuted its X Pro QLED series in India, featuring televisions with QLED displays boasting 4K resolution. This new lineup exemplifies Xiaomi’s commitment to delivering high-quality visual experiences, catering to the increasing consumer demand for premium home entertainment options. (Source: gadgets360)

June 2025

June 2025