June 2025

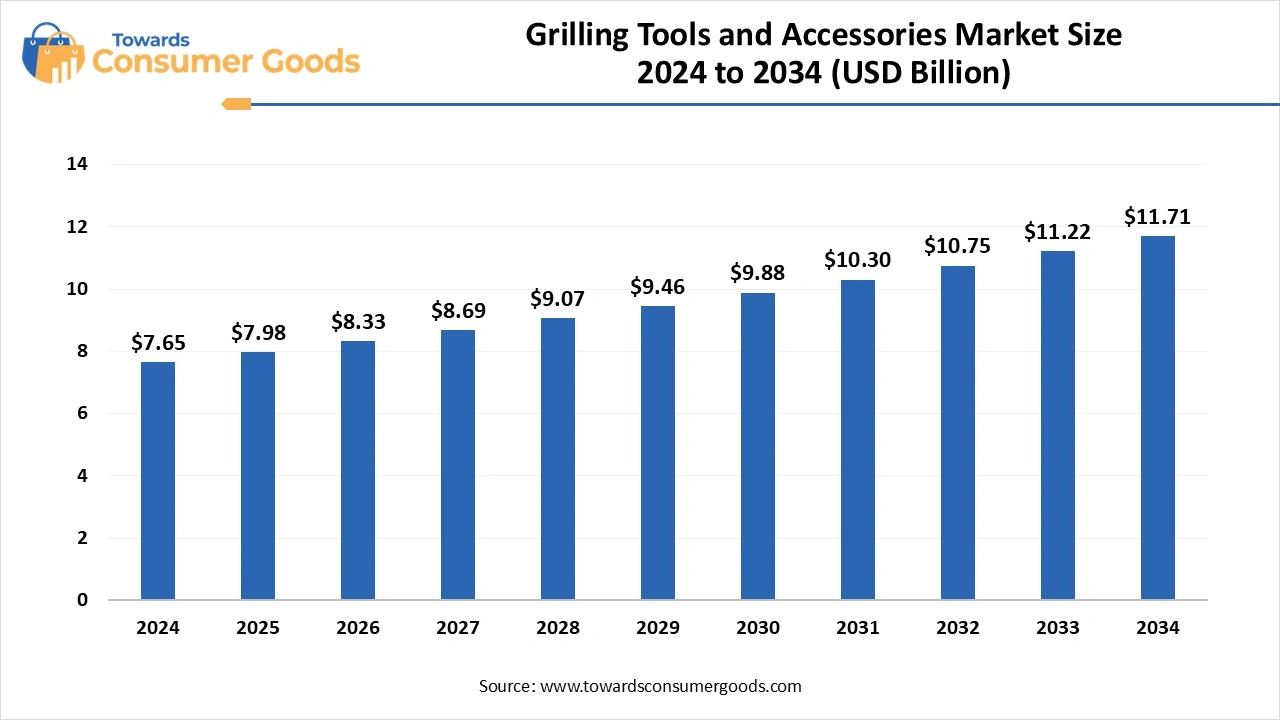

The global grilling tools and accessories market size is calculated at USD 7.65 billion in 2024, grew to USD 7.98 billion in 2025 and is predicted to hit around USD 11.71 billion by 2034, expanding at healthy CAGR of 4.35% between 2025 and 2034. This market is growing due to rising consumer interest in outdoor cooking, increasing demand for premium kitchen experiences, and the expansion of home improvement projects.

The global grilling tools and accessories market is experiencing steady growth, driven by growing consumer interest in outdoor cooking and barbecuing as a recreational process. Because of its robust outdoor culinary culture and growing use of smart grilling technologies. High-end long-lasting and environmentally friendly products like bamboo accessories, reusable mats, and stainless-steel tools are becoming more and more popular.

Market growth is still supported by the popularity of outdoor kitchens and communal grilling gatherings. However, seasonality fluctuations in the cost of raw materials competition from low-cost imports to electric indoor alternatives, and other factors pose challenges to the industry.

Yes, grilling tools and accessories are transforming traditional barbeque experiences into sophisticated culinary events. Cooking has become more convenient, safe, and controlled by consumers thanks to the use of intelligent and ergonomic tools. Access to outdoor grilling for camping picnics and travel is also facilitated by the growth of portable multipurpose accessories.

Instead of being a seasonal pastime, grilling is becoming a year-round lifestyle due to improved user experience, cleaner cooking, and time-saving features. This trend is becoming more noticeable among families looking for deeper mealtime interactions and health-conscious millennials.

| Report Attributes | Details |

| Market Size in 2025 | USD 7.98 Billion |

| Expected Size by 2034 | USD 11.71 Billion |

| Growth Rate from 2025 to 2034 | CAGR 4.35% |

| Base Year of Estimation | 2024 |

| Forecast Period | 2025 - 2034 |

| Dominant Region | North America |

| Segment Covered | By Type, By End User, By Distribution Channel, By Geographic |

| Key Companies Profiled | Weber, LANDMANN, Traeger, Lodge Cast Iron, Le Creuset, Trmontina USA Inc, CAMPCHEF.COM, Char-Broil, Napoleon, Cuisinart, Other Key Players |

Yes, sustainability-driven innovation holds substantial potential for expanding the grilling tools and accessories market. Manufacturers are responding by launching product lines made from sustainable materials like bamboo recycled steel and compostable plastics as environmentally conscious consumers look for durable reusable and low-waste tools. Innovations like solar-powered lighters, biodegradable packaging, and reusable grill mats are changing what consumers expect.

Furthermore, collaborations with environmental groups and involvement in certification initiatives (e.g. A. USDA Bio Preferred FSC) increase brand legitimacy and expand appeal. These developments promote long-term product value, customer retention, and environmental objectives.

One of the key restraints in the grilling tools and accessories market is the lack of product standardization, which leads to inconsistent performance and potential safety issues. Counterfeit products, particularly those sold via online platforms, compromise quality and customer trust. This problem is especially prevalent with unbranded or imported tools that may not adhere to food safety or material durability standards. In response, many reputable brands are investing in anti-counterfeit packaging and certifications, but the lack of regulation in some markets continues to hamper industry reputation and customer satisfaction.

North America dominated the grilling tools and accessories market in 2024, motivated by a strong tradition of backyard BBQ, a high level of disposable income, and an established outdoor cooking culture. The demand in the area is still being driven by the existence of high-end brands, advancements in smart grilling equipment, and the appeal of seasonal grilling events. Revenue is also greatly increased by increasing product launches during summer sales. Particularly in suburban homes, there is a high demand for multipurpose weatherproof tools. Influencer-led campaigns and vibrant grilling communities also help the market here.

Asia Pacific is the fastest growing market, owing to growing middle-class income, growing urbanization, and growing interest in Western foods. Due to the expansion of e-commerce and greater awareness of international culinary trends, outdoor cooking is becoming more and more popular in this region. Compact reasonably priced and multipurpose grilling accessories are in high demand. Urban consumers are favoring portable and electric grills that are suitable for apartments as well as accessories that can be stacked. Young consumers' interest is fueled by social media, food trends, and online recipe platforms. The customer base is also growing as a result of the rise in outdoor recreation parks and weekend grilling activities.

Europe remains a notable region in the grilling tools market, where summer grilling and garden gatherings are becoming mainstream. The region shows a preference for eco-friendly and design-forward grilling accessories, aligning with its sustainability focus and premium outdoor lifestyle habits. Health-conscious consumers are opting for lean meat grilling with accessories like skewers, grilling baskets, and smoking planks. Many brands are now offering FSC-certified wooden tools and recyclable packaging. Seasonal open-air events and community cookouts are creating consistent demand for reusable and easy-to-clean grilling items.

Grilling tools dominated the market in 2024 due to their being a necessary component of any barbecue setup. These include essential tools for every grilling occasion such as tongs, spatulas, forks, and grill brushes. Their large selection in both high-end and low-cost categories helps them maintain a dominant market share. Additionally contributing to this segment's dominance is ongoing innovation in the multipurpose use of ergonomic designs and heat-resistant materials. Customers are searching more and more for heavy-duty rust-proof dishwasher-safe tools that can withstand high temperatures. Additionally, limited-edition and themed grilling sets related to important sporting events or holidays are being released by brands. In this market, product bundling with cleaning supplies aprons and tools is improving value perception.

Preparation & servicing accessories is the fastest growing segment, with an increase in the need for products like food thermometers, skewers, basting tools, meat injectors, and marinating trays. This market is being driven by consumers' growing desire to replicate restaurant-quality results at home as well as the growing popularity of meal planning and gourmet-style presentations. Add-ons that speed up adoption include prep kits with digital timers and smart thermometers.

Raising awareness is also being aided by celebrity chefs and influencers promoting prep tools on social media sites like YouTube and Instagram. The use of accessories that facilitate marinating skewering and presentation is growing as more customers try out flavors from around the world. Customers who care about the environment are increasingly purchasing bamboo skewers and eco-friendly serving trays.

Residential users dominated the market, as since home-based grilling and backyard barbecuing are becoming more and more commonplace lifestyle choices to improve their home cooking experience consumers are purchasing complete grilling toolkits for everything from weekend family get-togethers to festive grilling during national holidays.

An increasing number of households are upgrading their grilling setups as a result of the rise of DIY meals and cooking trends inspired by social media. Patio grilling tool sets are becoming more and more popular as housewarming and Father's Day gifts. More and more people are choosing family-sized grilling kits that combine functionality and style.

Commercial users is the fastest-growing segment, particularly given the resurgence of outdoor dining at eateries, caterers, and resorts following the pandemic. Commercial customers are looking for high-performance long-lasting equipment that promotes efficiency, hygienic standards, and continuous use. Demand for catering services from food trucks, cafes, and events is also being driven by customization branding and bulk purchasing in this market. Professional-grade stainless steel tools with long warranties and simple maintenance are available from numerous suppliers. In the business sector, grilling contests and culinary festivals also increase demand for tools. Toolkits for professional-grade outdoor kitchens are also packaged with rolling prep tables and modular storage options.

Specialty stores dominated the distribution channel segment as consumers prefer to test products with their hands when purchasing grilling tools, particularly when selecting high-end or durable models. Strong brand loyalty is fostered by these locations' individualized help product demonstrations and exclusive grilling product lines. To draw devoted fans, a lot of physical stores also run seasonal grilling promotions. BBQ demos and in-store seminars promote brand experiences and impulsive purchases. Additionally, during national grilling holidays retailers provide bundle discounts. Partnerships with nearby chef's culinary schools also boost foot traffic and trust in specialty shops.

Online retail is the fastest-growing channel, driven by the ease of doorstep delivery through product reviews and a large section of product bundles. Sales are high on e-commerce sites like Amazon, Walmart, and brand-owned websites, particularly during campaigns with a BBQ theme and seasonal discounts. Virtual demos and how-to videos are becoming more widely available, which facilitates online purchases. Top-rated seller lists and algorithm-based recommendations have an impact on online buyers. Influencer unboxing videos and live shopping sessions improve product discovery even more. Loyalty discounts and subscription-based accessory boxes are also becoming popular growth tactics in this market.

By Type

By End User

By Distribution Channel

By Geographic

June 2025

June 2025

June 2025

June 2025