June 2025

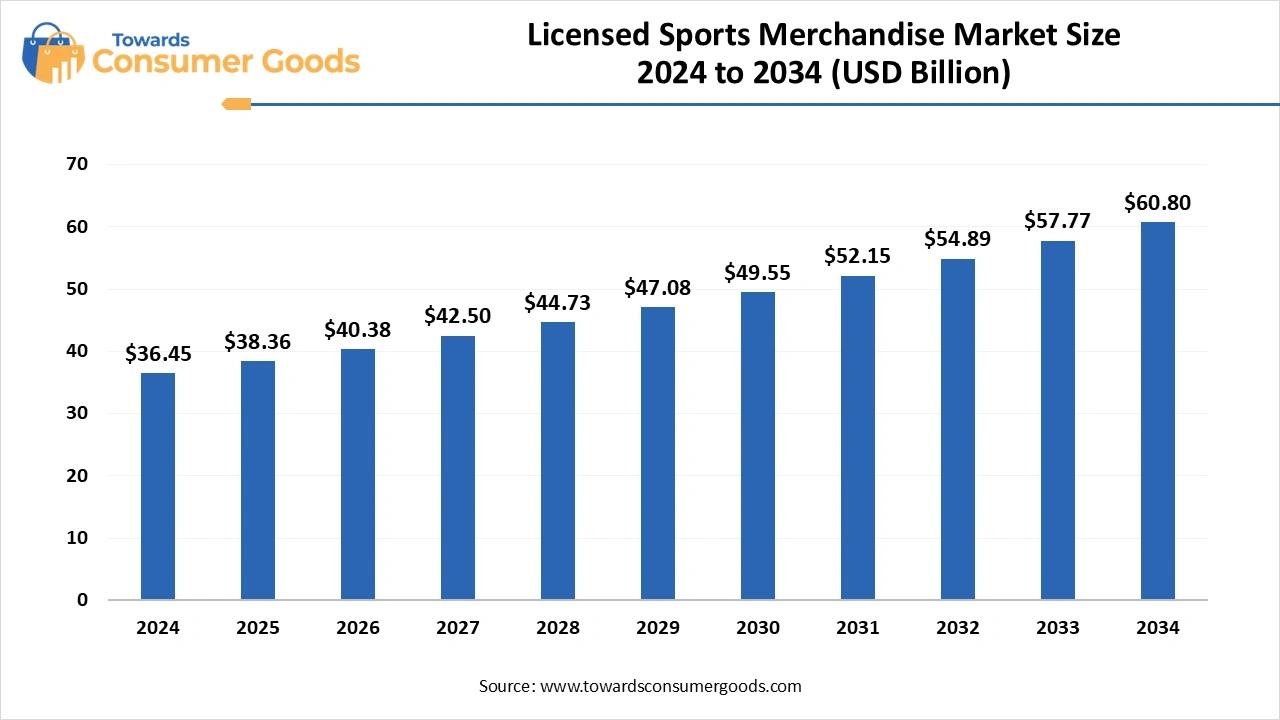

The global licensed sports merchandise market was valued at approximately USD 36.45 billion in 2024 and is projected to grow at a CAGR of 5.25% from 2025 to 2034, reaching a value of USD 60.80 billion by 2034.

The licensed sports merchandise market is experiencing robust growth, fueled by the passionate fan base of global sporting events, rising disposable income, and a growing culture of brand and team loyalty. From apparel and accessories to collectables and memorabilia, fans are increasingly investing in officially licensed products that reflect their support for their favorite teams, players, and sports leagues.

The licensed sports merchandise market is thriving as fans increasingly seek to connect with their favorite teams, athletes, and sporting moments through tangible, officially endorsed products. This growing demand is being driven by heightened sports viewership, expanding global fan bases, and the emotional value attached to memorabilia and branded apparel. From football jerseys and cricket caps to NBA sneakers and Olympic-themed collectibles, consumers are not just purchasing products, they are investing in identity, community, and nostalgia.

Brands and sports leagues are capitalizing on these sentiments by forming strategic licensing partnerships, launching limited-edition merchandise, and embracing e-commerce platforms to enhance reach and engagement. Additionally, the fusion of fashion, pop culture, and athletics has expanded the appeal of sports merchandise beyond just match days, transforming it into an everyday lifestyle choice. With digital transformation and fan engagement at the forefront, the market is set to scale new heights in both volume and value.

| Report Attributes | Details |

| Market Size in 2025 | USD 38.36 Billion |

| Expected Size by 2034 | USD 60.80 Billion |

| Growth Rate from 2025 to 2034 | CAGR 5.25% |

| Base Year of Estimation | 2024 |

| Forecast Period | 2025 - 2034 |

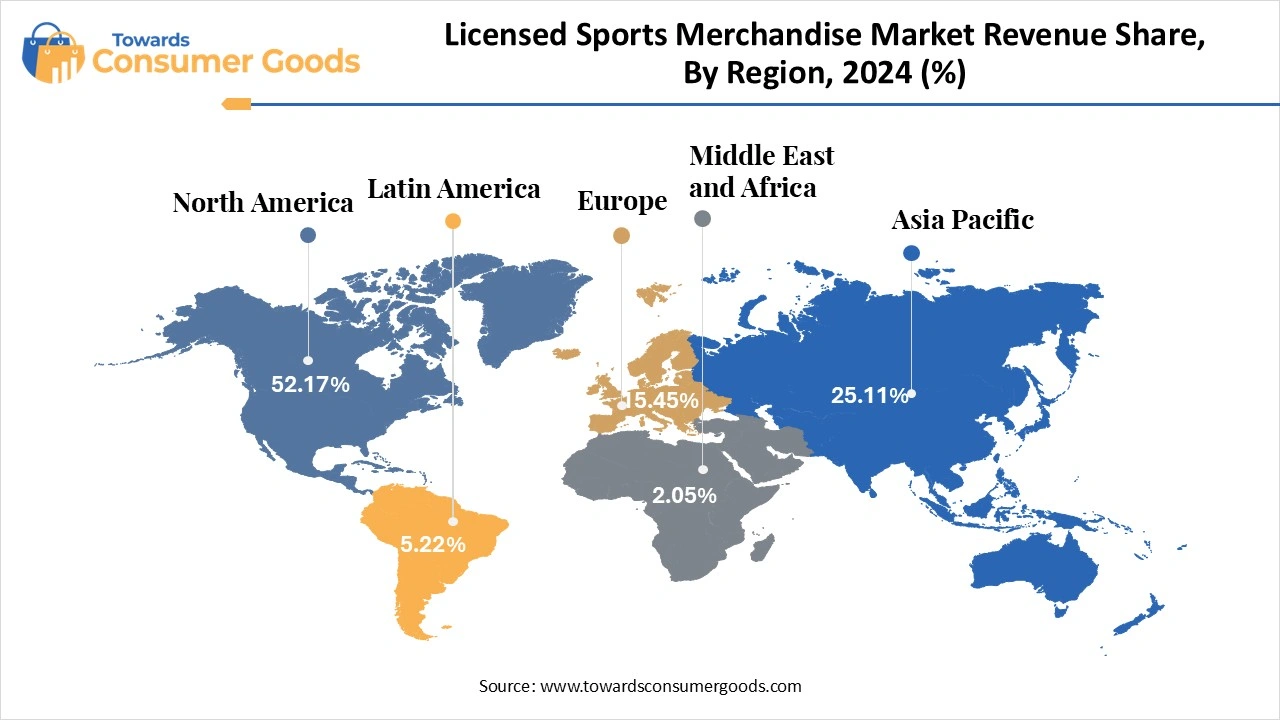

| High Impact Region | North America |

| Segment Covered | Product Type Insight, Distribution Channel Outlook |

| Key Companies Profiled | VF Corporation, Nike, Inc., Adidas AG, Puma SE, Under Armour, Inc., Hanesbrands Inc., DICK’S Sporting Goods Inc., Sports Direct International plc, G-III Apparel Group, Ltd., Fanatics Inc. |

As digital media reshapes fan engagement, the rise of e-commerce, mobile applications, and virtual sports events presents a golden opportunity for brands to expand their licensed merchandise offerings beyond traditional retail. Fans now expect seamless access to their favorite team apparel and memorabilia from anywhere in the world. The growing popularity of fantasy leagues, esports tie-ins, and influencer-led promotions has opened fresh avenues for product placement and customization. Emerging markets in Asia-Pacific, Latin America, and Africa, where sports viewership is rapidly expanding, are also ripe for brand licensing deals. This digital transformation enables brands to hyper-personalize offerings and build year-round loyalty, turning every fan into a walking ambassador.

Despite its promising growth, the licensed sports merchandise market is heavily challenged by the rampant production and sale of counterfeit goods. Illegally replicated jerseys, hats, and memorabilia not only eat into genuine brand revenues but also erode consumer trust and product value. The digital marketplace, particularly on unregulated platforms and third-party sites, makes it increasingly difficult to trace or control the spread of fake merchandise. Additionally, high price points for official products can drive budget-conscious consumers toward unlicensed alternatives, especially in developing economies. To maintain integrity and consumer loyalty, the industry must invest in advanced authentication technologies, legal enforcement, and global awareness campaigns to combat this ever-evolving threat.

Is North America Still the Powerhouse of Licensed Sports Merchandising?

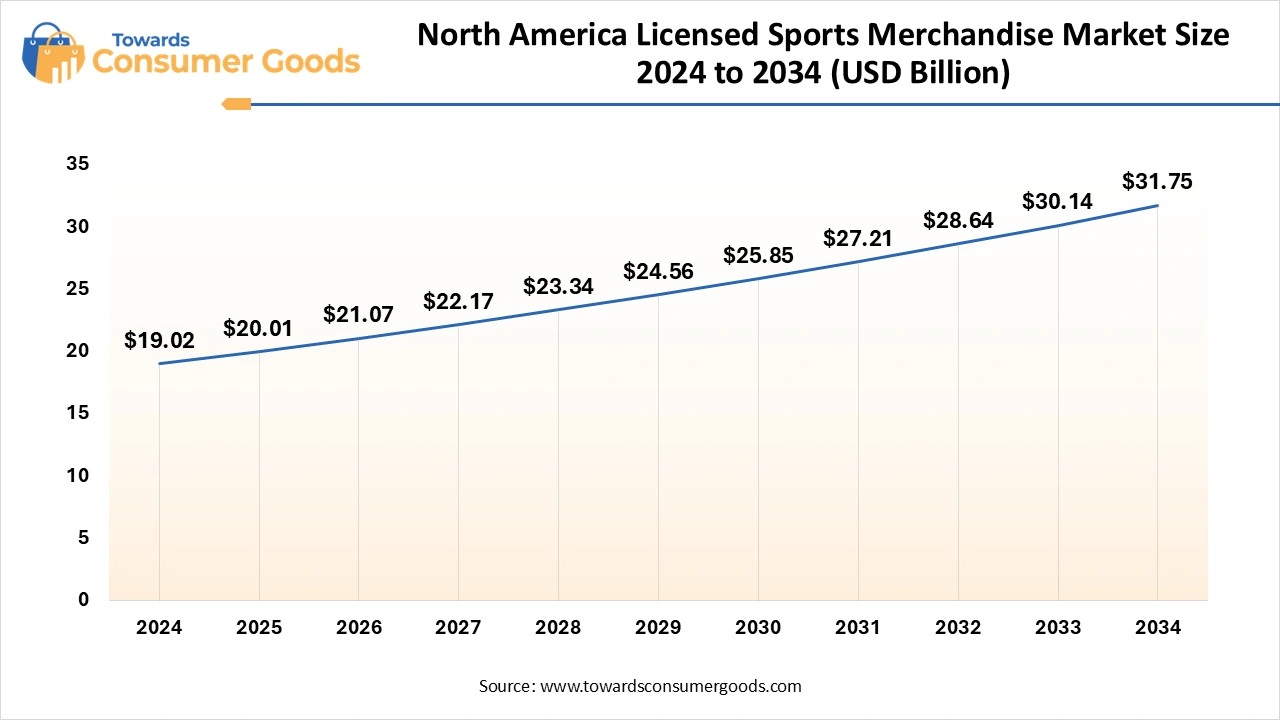

The North America licensed sports merchandise market size was valued at USD 19.02 billion in 2024 and is expected to be worth around USD 31.75 billion by 2034, exhibiting a compound annual growth rate (CAGR) of 5.26% over the forecast period 2025 to 2034.

North America continues to dominate the global licensed sports merchandise market, thanks to its deep-rooted sports culture and massive fan bases across leagues like the NFL, NBA, MLB, and NHL. The region’s robust retail infrastructure, combined with strong digital presence through e-commerce platforms and mobile apps, has allowed merchandise sales to flourish. Partnerships between major sports franchises and lifestyle brands like Nike, Adidas, and Fanatics further drive innovation and demand. Moreover, events such as the Super Bowl, NBA Finals, and World Series fuel seasonal spikes in consumer spending.

Is Europe Catching Up Fast in Sports Merchandising?

Europe is emerging as the fastest-growing region in the licensed sports merchandise space, driven by football (soccer) fandom and increasing cross-border merchandise demand. Clubs like Manchester United, FC Barcelona, and Bayern Munich have created powerful brand identities with global appeal. The rising popularity of American sports, such as the NBA and NFL, in major European cities is also contributing to new market opportunities. Expansion of official online stores, strategic tie-ups with sports retailers, and international shipping capabilities are accelerating growth across this region.

Could Asia-Pacific Become the Next Giant in Sports Licensing?

Asia-Pacific is witnessing notable growth, driven by rising disposable incomes, increasing internet penetration, and a booming youth population that is passionate about global sports. Countries like India, China, Japan, and Australia are seeing surges in demand for merchandise related to both international and regional sports leagues. Cricket, basketball, and football are among the leading sports driving sales, while e-commerce platforms and social media influencers are enhancing brand visibility. International sporting events like the Olympics and ICC tournaments further fuel fan enthusiasm and spending.

What is driving the domination of toys and games in today’s market?

The toys and games segment is dominating the market, due to its mass appeal across all age groups. From action figures and board games featuring popular sports teams to collectibles like Funko Pop and LEGO kits representing athletes and teams, this segment taps into both the nostalgia of adult fans and the excitement of a younger audience. The continued association of major sports leagues with toy manufacturers has only boosted this segment’s visibility and profitability. Seasonal promotions, league-specific editions, and global sporting events significantly contribute to its sustained demand.

On the other hand, the sportswear segment is the fastest-growing category, driven by the surge in health consciousness, the athleisure trend, and increasing fan engagement. Jerseys, tracksuits, and footwear featuring official team logos or athlete branding are not only worn for games but also integrated into everyday fashion. Collaborations between major sports clubs and apparel giants like Nike, Adidas, and Puma continue to drive this segment forward. With the limited-edition drops and influence-led marketing, sportswear has transformed into a statement of both fandom and style.

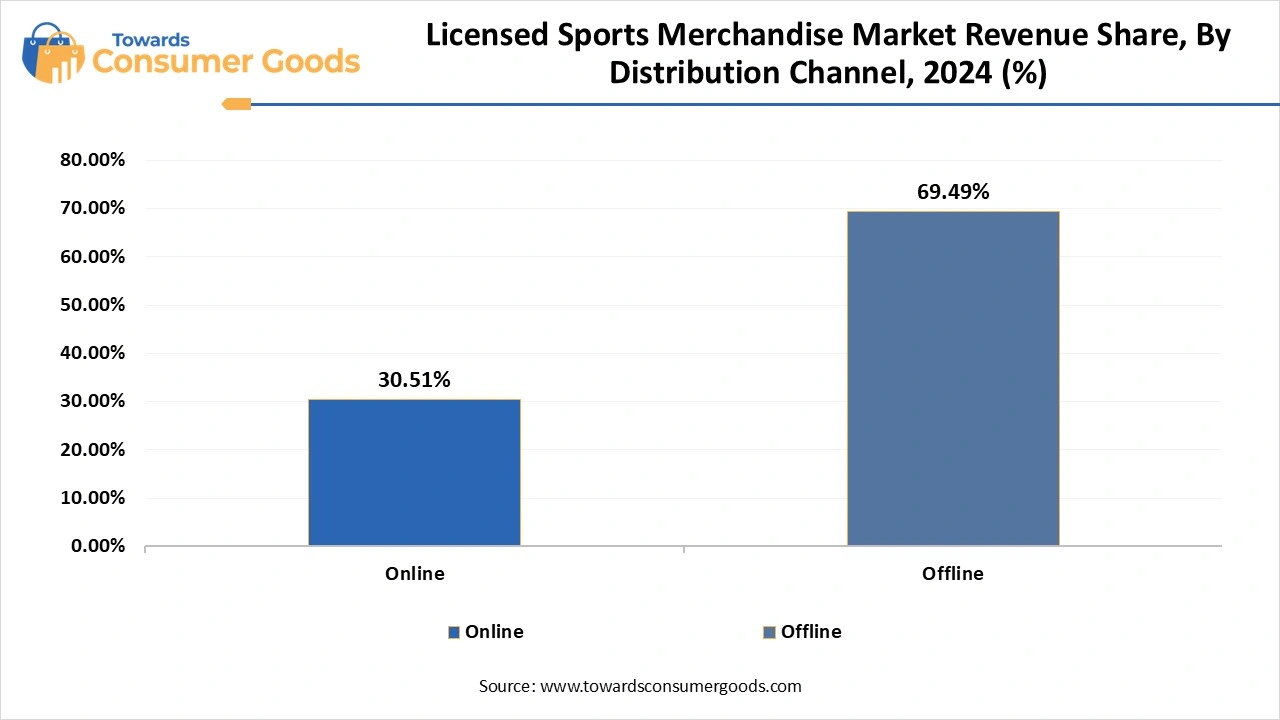

The offline distribution channel remains the leading force in the market, especially through flagship stores, stadium shops, sports events, kiosks, and licensed retail chains. These outlets offer an immersive experience, letting fans physically interact with merchandise, customize jerseys, and participate in loyalty programs. The tangible retail experience is particularly crucial during tournaments, fan festivals, or team meet-and-greets, where emotional purchases dominate.

On the other hand, the online distribution channel is witnessing the fastest growth, fueled by convenience, digital transformation, and global accessibility. E-commerce platforms, official team websites, and sports merchandise aggregators offer extensive product ranges, real-time stock updates, and customization options. Integration of AR (Augmented Reality) for virtual try-ons, exclusive web-only collections, and influencer endorsements on platforms like Instagram and TikTok is enhancing online customer engagement, particularly among Gen Z and millennial consumers.

By Product type

By Distribution Channel

By Region

June 2025

April 2025